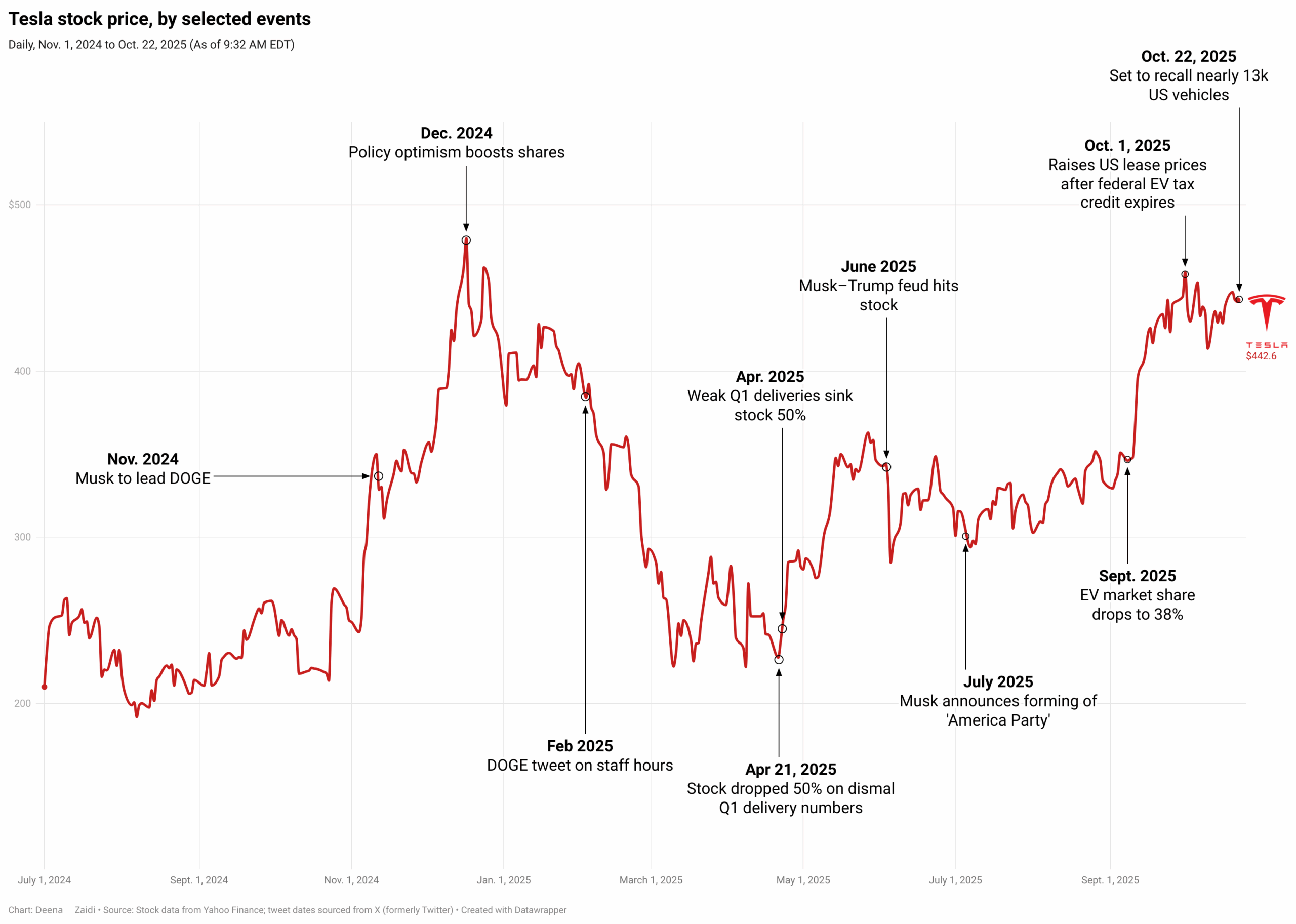

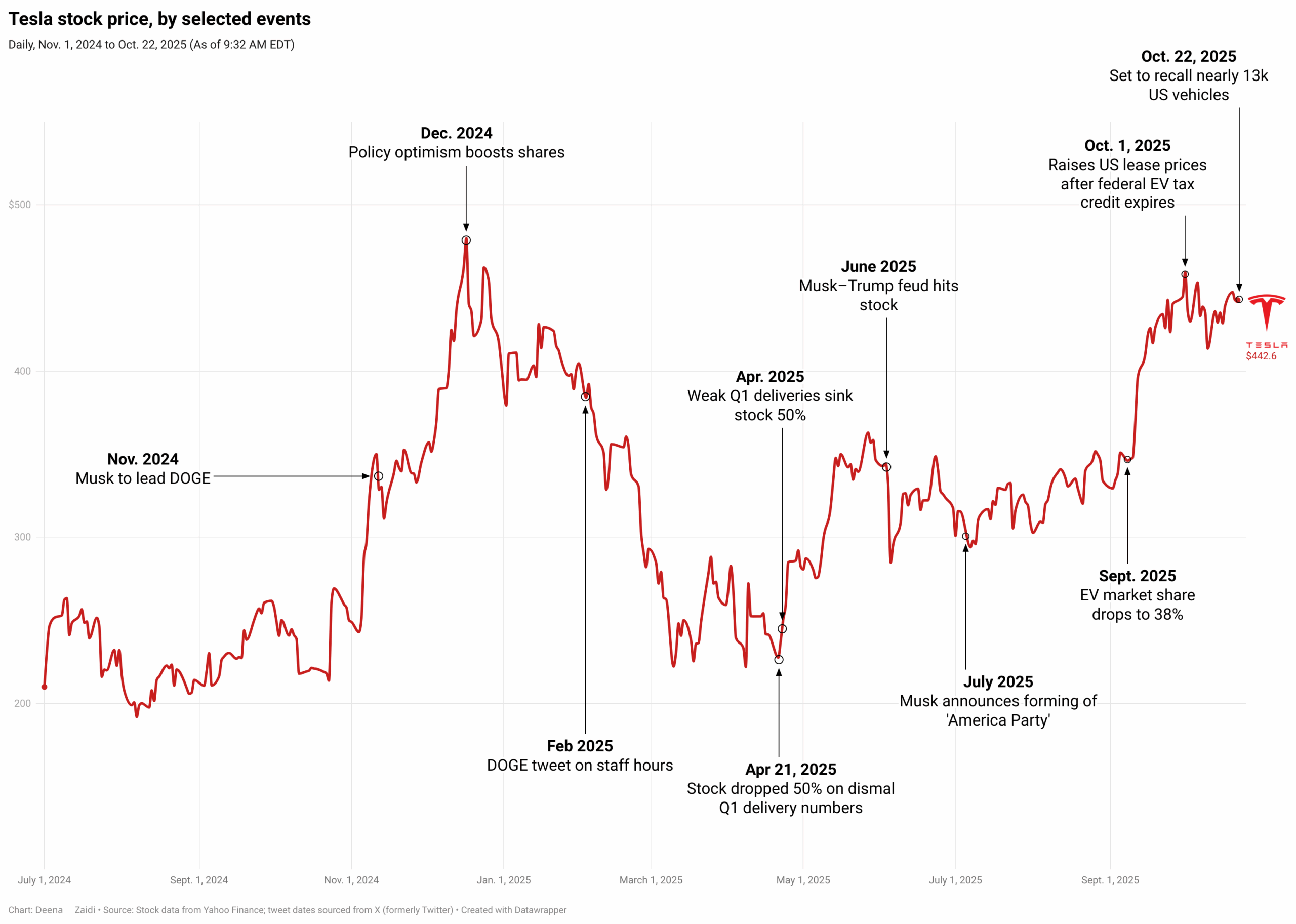

Tesla’s stock is a fascinating case study—one that not only reflects traditional market forces but also captures the increasingly powerful influence of the CEO’s political leanings on investor’s confidence.

Data and Financial Journalist

Tesla’s stock is a fascinating case study—one that not only reflects traditional market forces but also captures the increasingly powerful influence of the CEO’s political leanings on investor’s confidence.

Right investments in 2014 are important to an Indian investor or NRIs looking to invest in India. With inflation, volatile markets and political instability, as portfolio should have enough room for savings and a long term return. This article focuses on the different areas to invest in.Having said that, it should be kept in mind that all investments are subject to market risks.

2014 is definitely a year to watch out for especially for those who have a kept a keen eye on Indian markets and have wondered the fate of the Indian Rupee.Well, amidst all the economic mayhem, 2014 is also important politically.Reason: it’s the election year. 2014 is a bit different than any other election year held before. This is because India is going through an economic reform process.

Recurring Deposits (RD) are a great way to deposit bit by bit and yield a high amount on maturity. A very popular tool for those who cannot use the entire savings but a few thousands in order to get a high amount back on maturity. The interest charged on these deposits is similar to the…