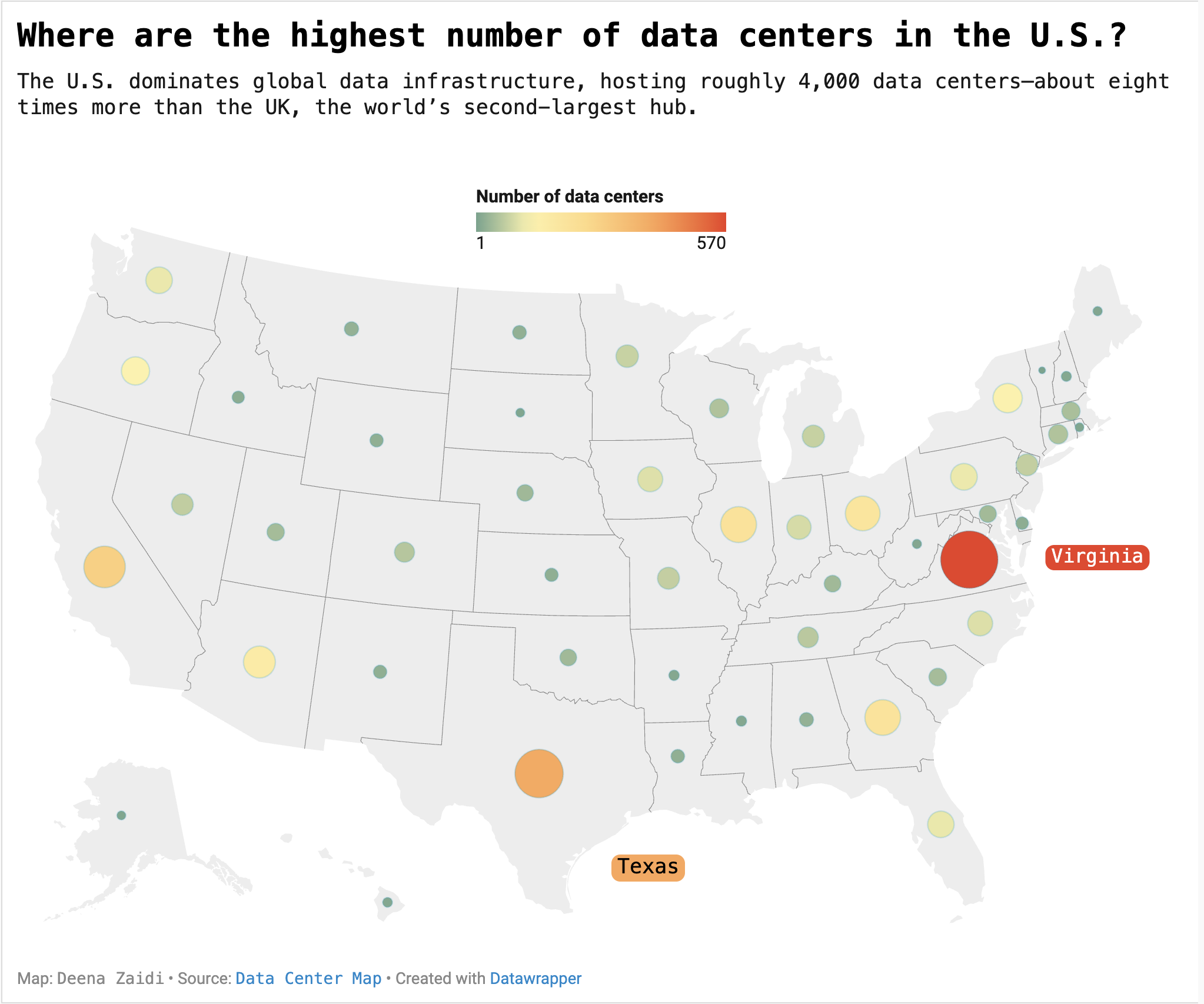

Northern Virginia and Texas have emerged as the core hubs of America’s data center boom. As demand for artificial intelligence and cloud services accelerates, data centers are becoming critical infrastructure — and a major new source of energy demand.