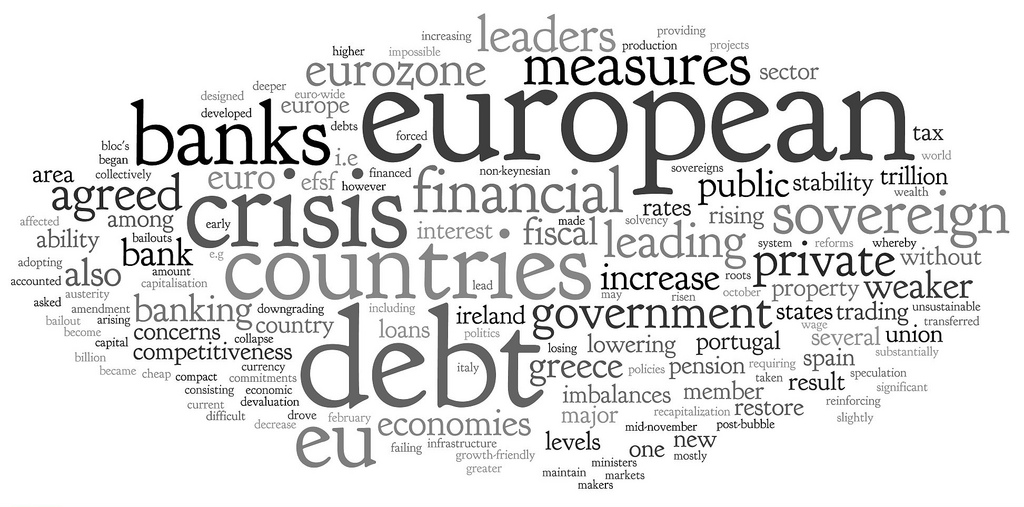

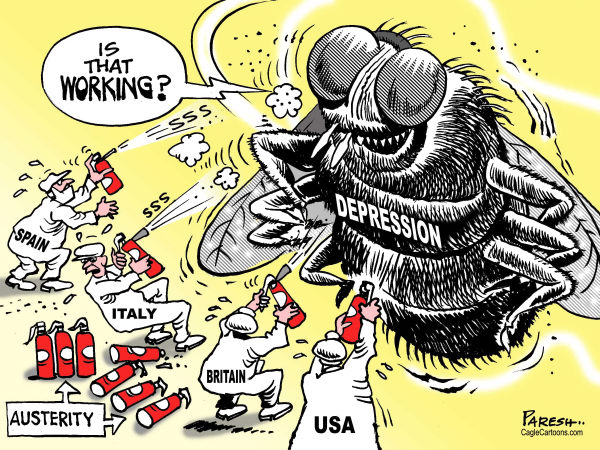

The year 2008 marked the advent of a financial crisis that began with a subprime scandal and mistakes made by credit rating agencies followed by the excesses of a financial capitalism that got seriously off track. This included the dissimulation of risks, unverified and highly complicated financial instruments, legal loopholes and the persistence of tax havens attracting a share of world savings that would be more justly used to finance investments and growth.In 2008, IMF had reported that these terrible lapses will cost the international banking system about a trillion dollars in the long-term.