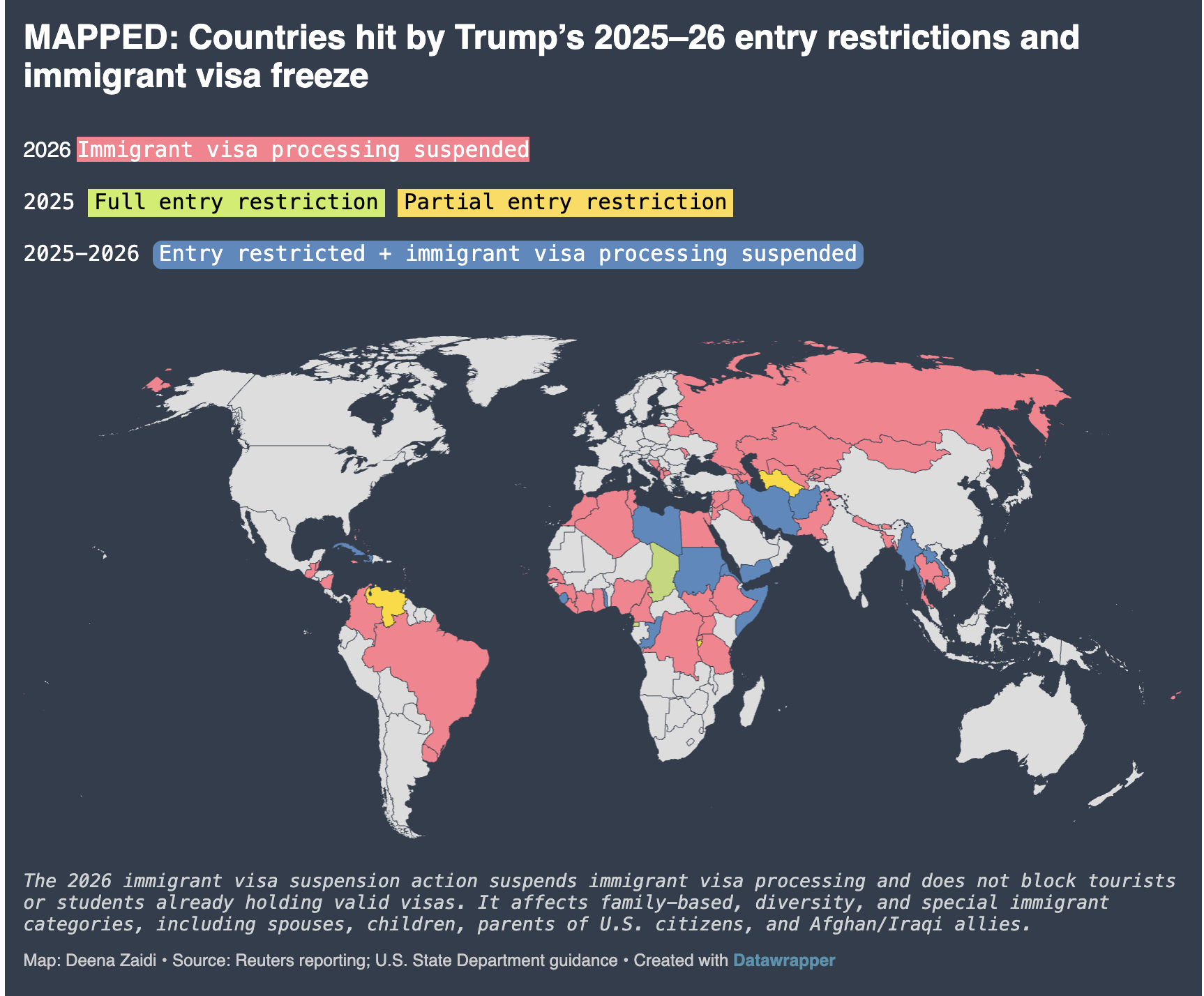

On January 14, 2026, the U.S. State Department announced that it will indefinitely suspend immigrant visa processing for citizens of 75 countries beginning January 21. The move is a part of a broad immigration policy shift under the Trump administration.