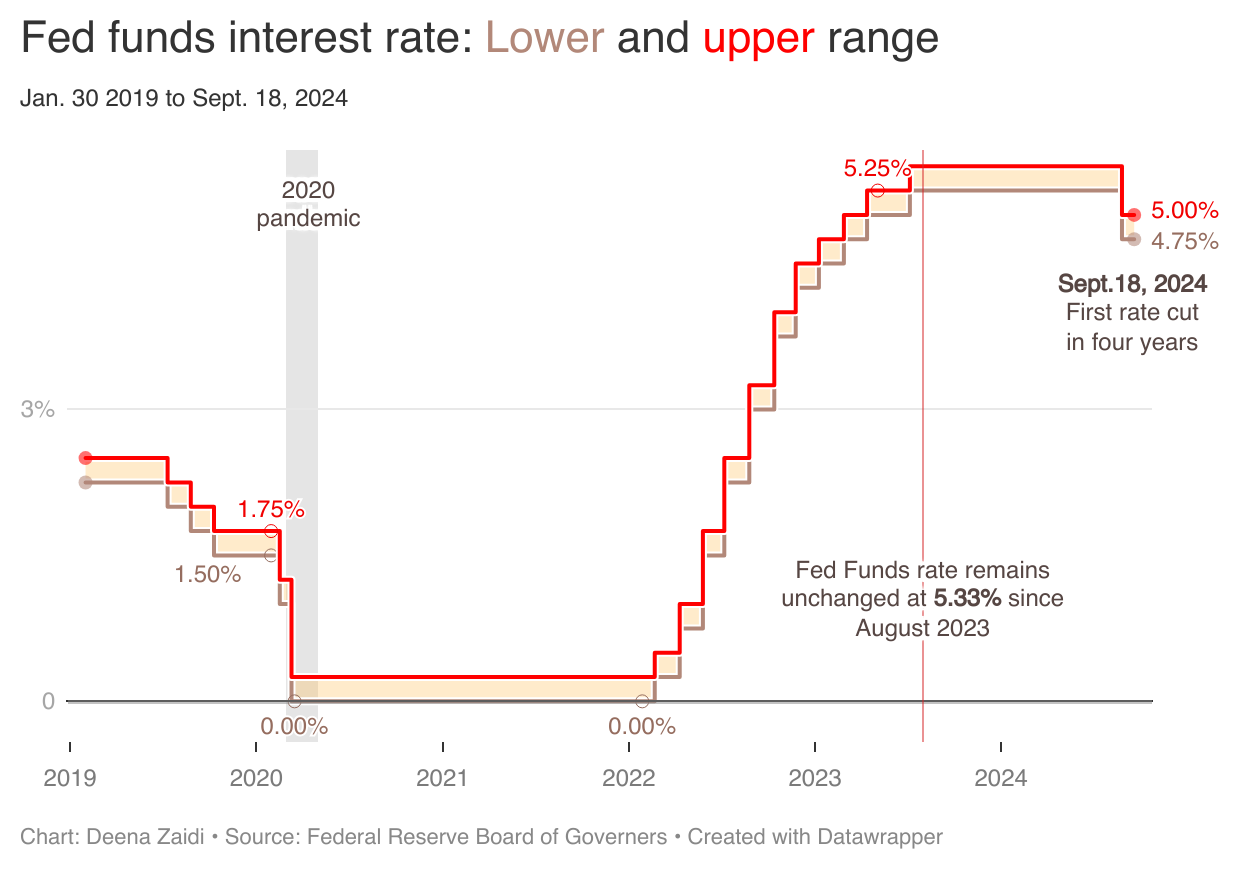

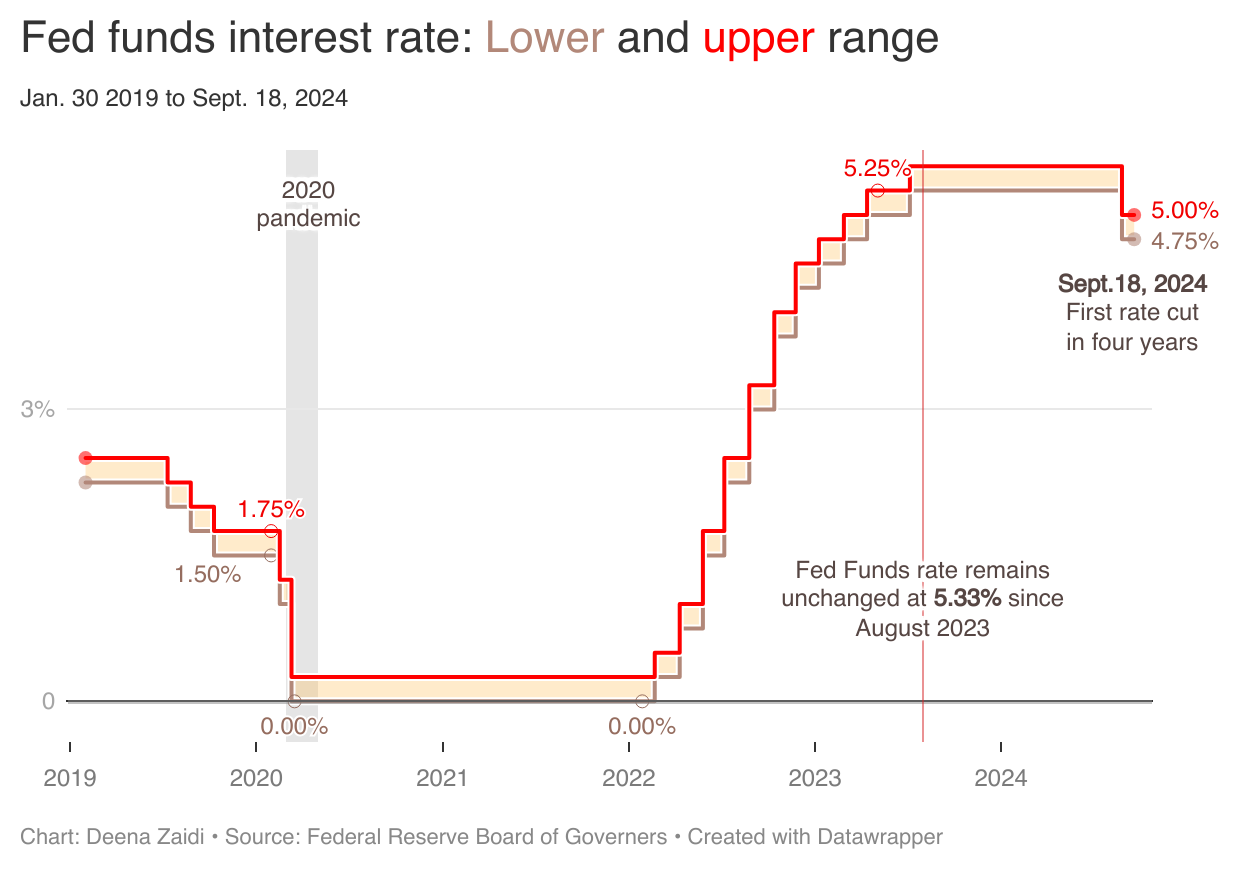

The Federal Reserve lowered interest rates for the first time since 2020.

Data and Financial Journalist

The Federal Reserve lowered interest rates for the first time since 2020.

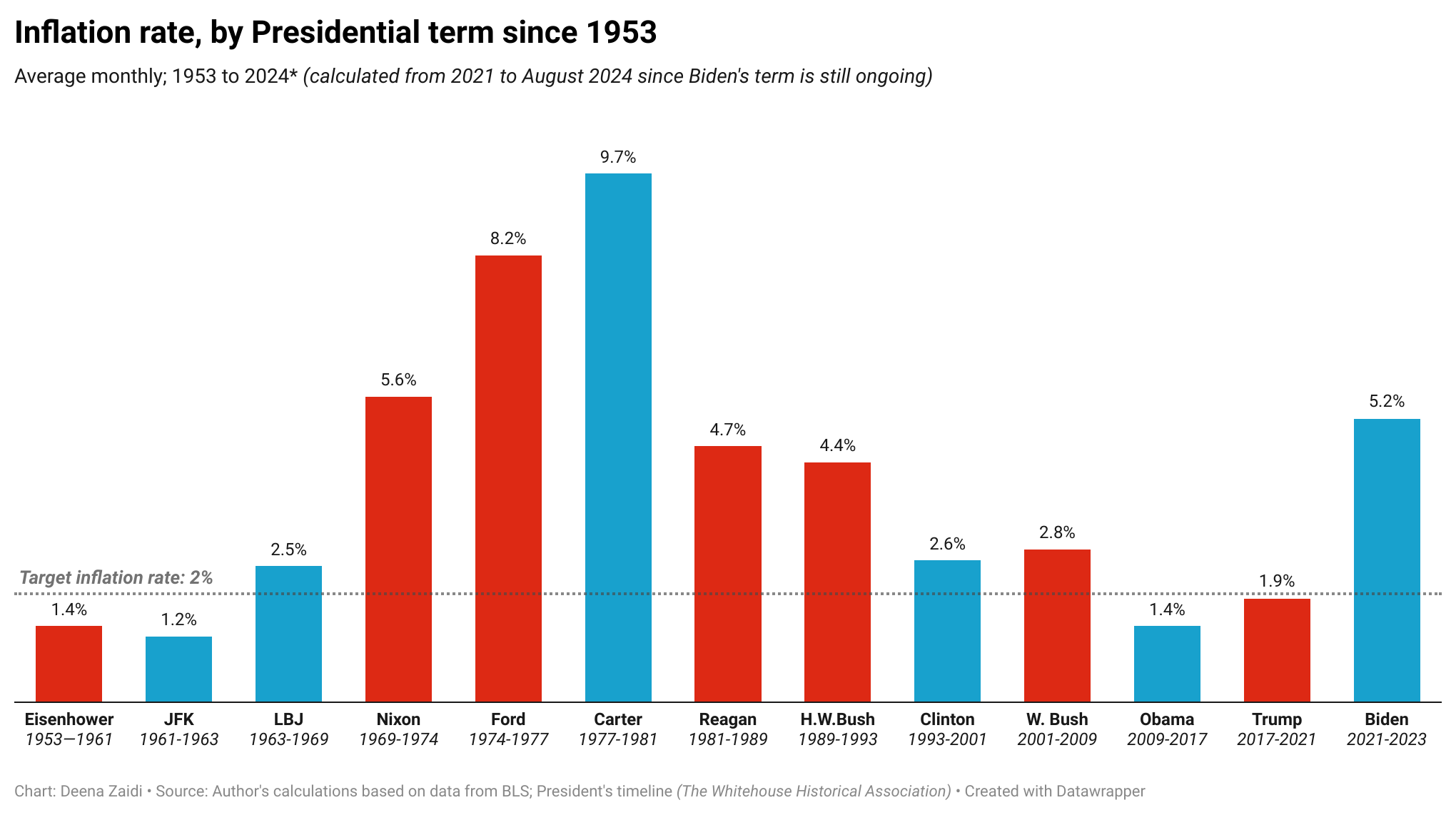

Inflation drivers are often complex and it’s essential to understand that new presidents often inherit economies, shaped by their predecessors.

Both party nominees, Donald Trump and Kamala Harris made some interesting claims about the U.S. economy in their first televised Presidential debate. The U.S. economy remains a heated topic during presidential debates and a top concern for American voters. Eight in ten registered voters say it will be important to their vote in the 2024…

The Federal Reserve uses interest rates as one of the many monetary policy tools to keep inflation at 2% and ensure full employment. Here’s how the terms in this relationship typically work: The relationship between the two can be summarized as follows: Lag Effect: Changes in the federal funds rate don’t immediately impact inflation. There’s…