Trump’s second presidency has come with a series of executive actions—most with the focus to make the country more self-reliant, reducing dependence on foreign economies. I delve into the data to uncover how these tariffs might impact the U.S.

Data and Financial Journalist

Trump’s second presidency has come with a series of executive actions—most with the focus to make the country more self-reliant, reducing dependence on foreign economies. I delve into the data to uncover how these tariffs might impact the U.S.

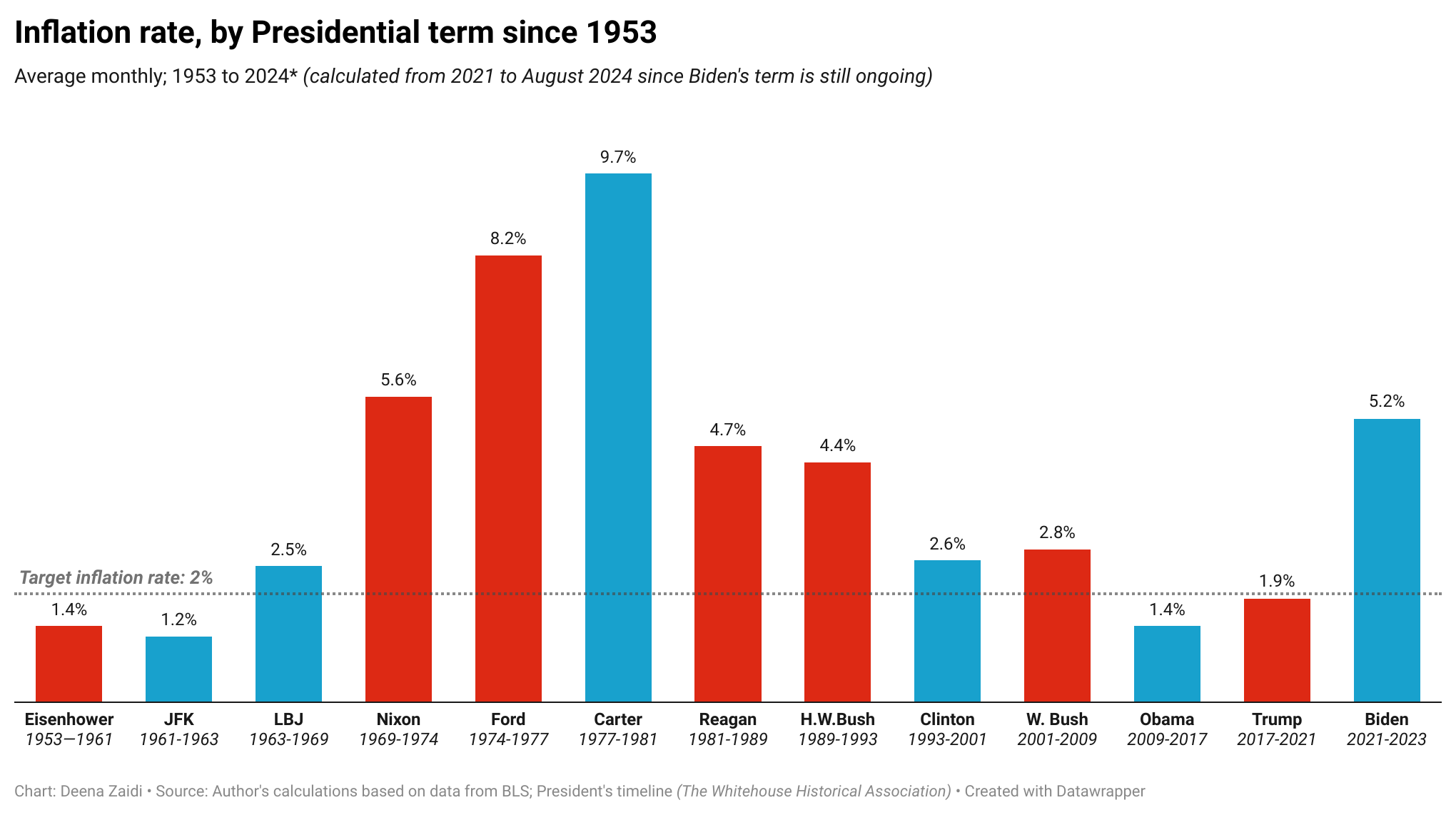

The Fed’s interest rate decision on Thursday coincides with the electoral victory of Donald Trump, who won both the popular and Electoral College votes in a strong political comeback in U.S. history, with promises of lowering inflation.

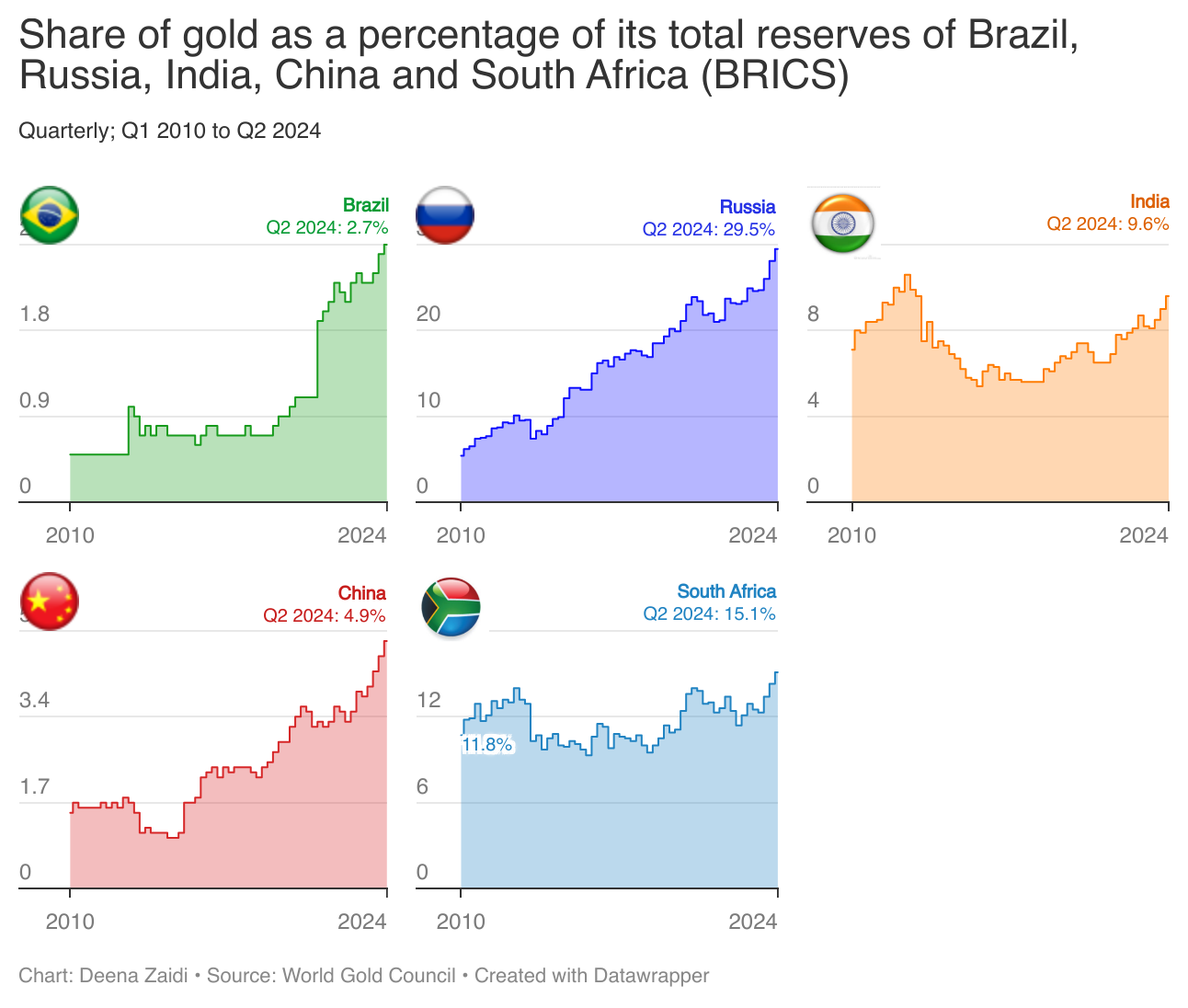

Central bank purchases have been key in driving up gold, often considered a haven in times of uncertainty and turmoil. Global uncertainties and the Federal Reserve slashing interest rates this year giving bullion a lift.

Inflation drivers are often complex and it’s essential to understand that new presidents often inherit economies, shaped by their predecessors.