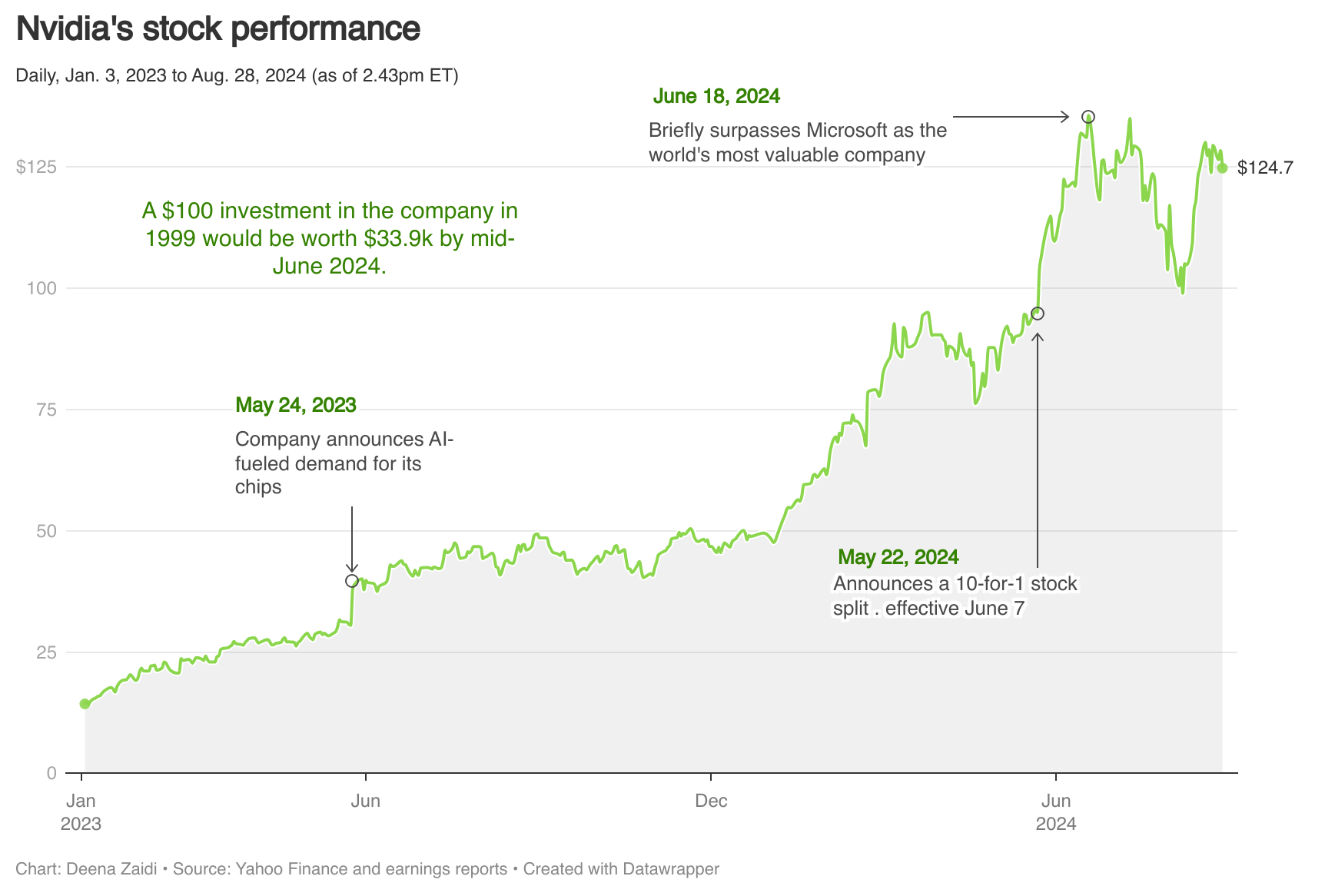

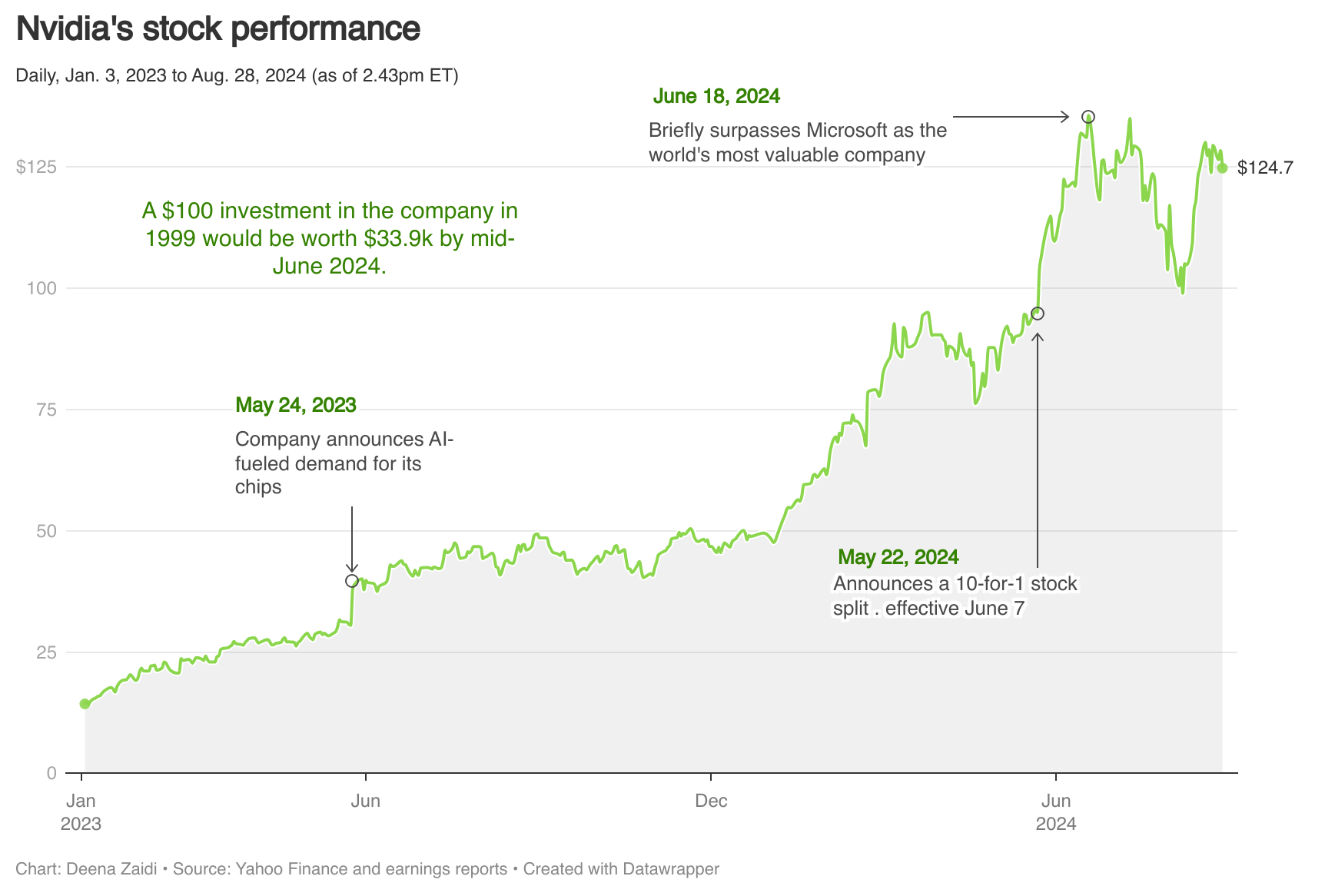

Nvidia’s dynamic growth is centered around the surge in demand for AI chips. But others might be catching up to provide stiff competition to the company.

Data and Financial Journalist

Nvidia’s dynamic growth is centered around the surge in demand for AI chips. But others might be catching up to provide stiff competition to the company.

Chatbots arrive to disrupt multiple industries. Here’s a look at some of the sectors that are most effected and demonstrate how chatbots continue to make businesses more cost effective and responsive. 1. Human Resource Space Chatbots are digitizing human resources processes and slowly transforming the space which was primarily dominated by human employees. A recent survey…

For long, insurance firms have been relying on traditional virtual assistants. But with the advent of improved analytics, insurance technology startups (better known as Insurtech)are paving way for smarter and more innovative platforms.

Suicide is extremely difficult to predict, especially in depressed individuals. But AI- algorithms could soon help doctors differentiate between patients who are depressed and those who are suicidal. Joseph Franklin, Ph.D. from Harvard University and author of a suicide research published by the American Psychological Association said, a suicide expert who conducted an in-depth assessment…