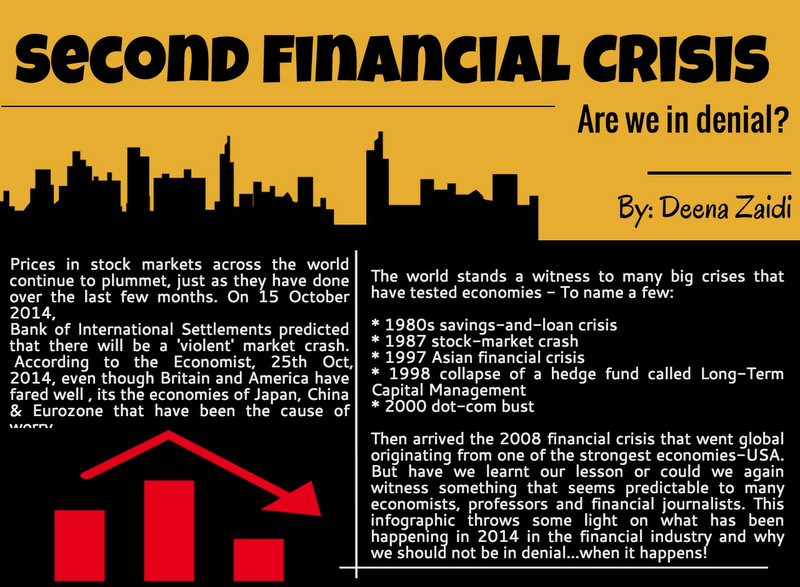

The US dollar has been on the rise every day setting high records. With the upward pressure on dollar, stronger dollar could tighten financial conditions across the growth. Further the rising dollar could be offsetting the benefit of low cost oil. Over the past six months, the trade-weighted dollar has risen 25% and faster than anytime the last 40 years. US dollar is a global unit of account in debt contracts and that could be a cause of slow down in the rest of the world. Not only that, if the dollar continues to increase, inflation and US economic could weaken.