Governments and energy producers are racing to protect global oil flows as risks rise around the Strait of Hormuz.

Data & financial journalist covering global economics and policy

Governments and energy producers are racing to protect global oil flows as risks rise around the Strait of Hormuz.

Oil prices surged after U.S. and Israeli strikes on Iran raised fears of Strait of Hormuz disruption, a chokepoint that carries about 20% of global crude supply.

Following series were published in June, 2025 and is being republished due to the recent shift in geopolitics around the Strait

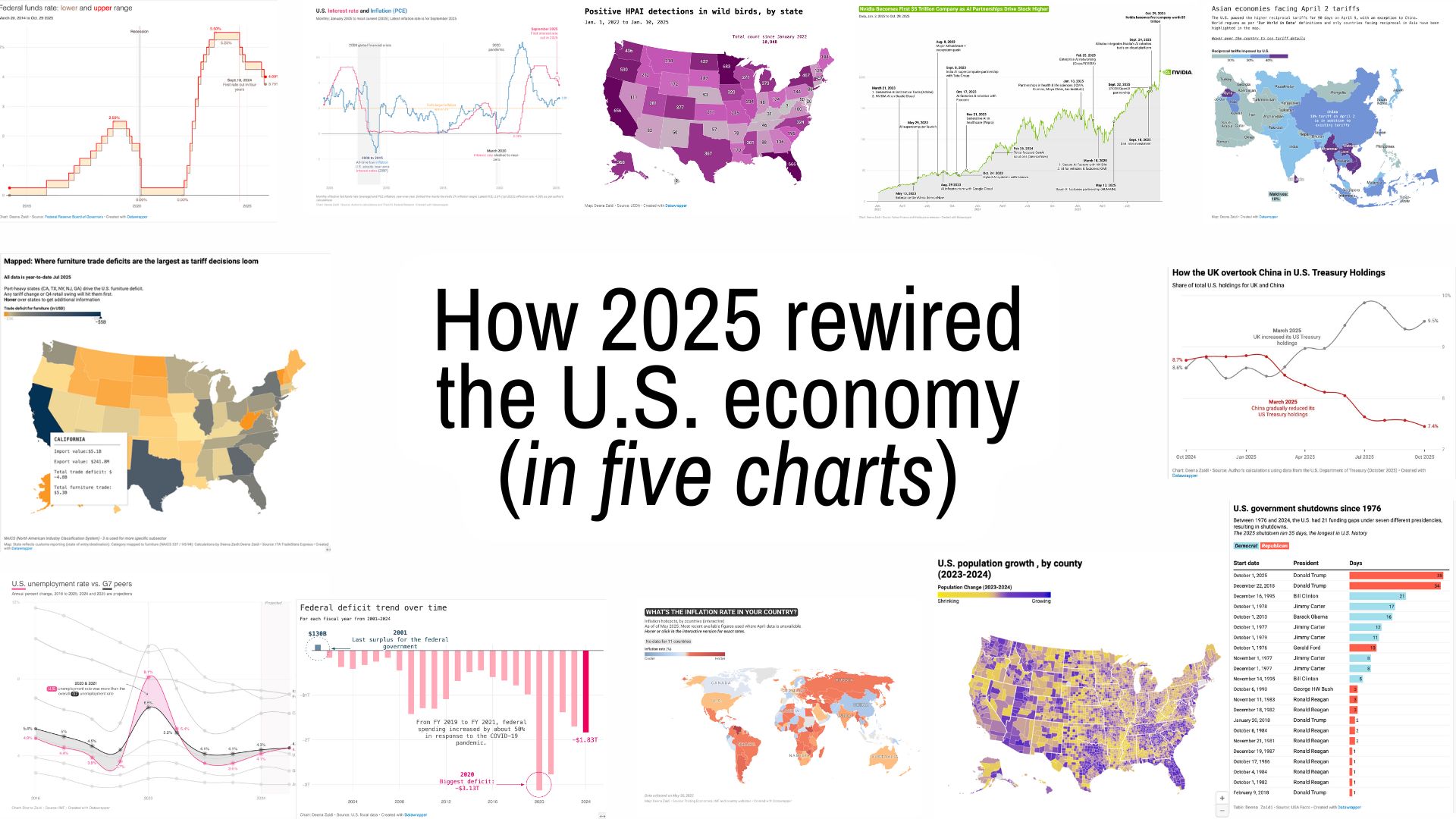

In 2025, the U.S. economy didn’t simply cool or rebound but changed in ways that were visible in the data itself.

A shutdown distorted inflation, tariffs reset global trade, U.S. debt buyers quietly swapped places, and food prices surged. I pick five charts that captured how policy and politics reshaped the American economy in 2025.