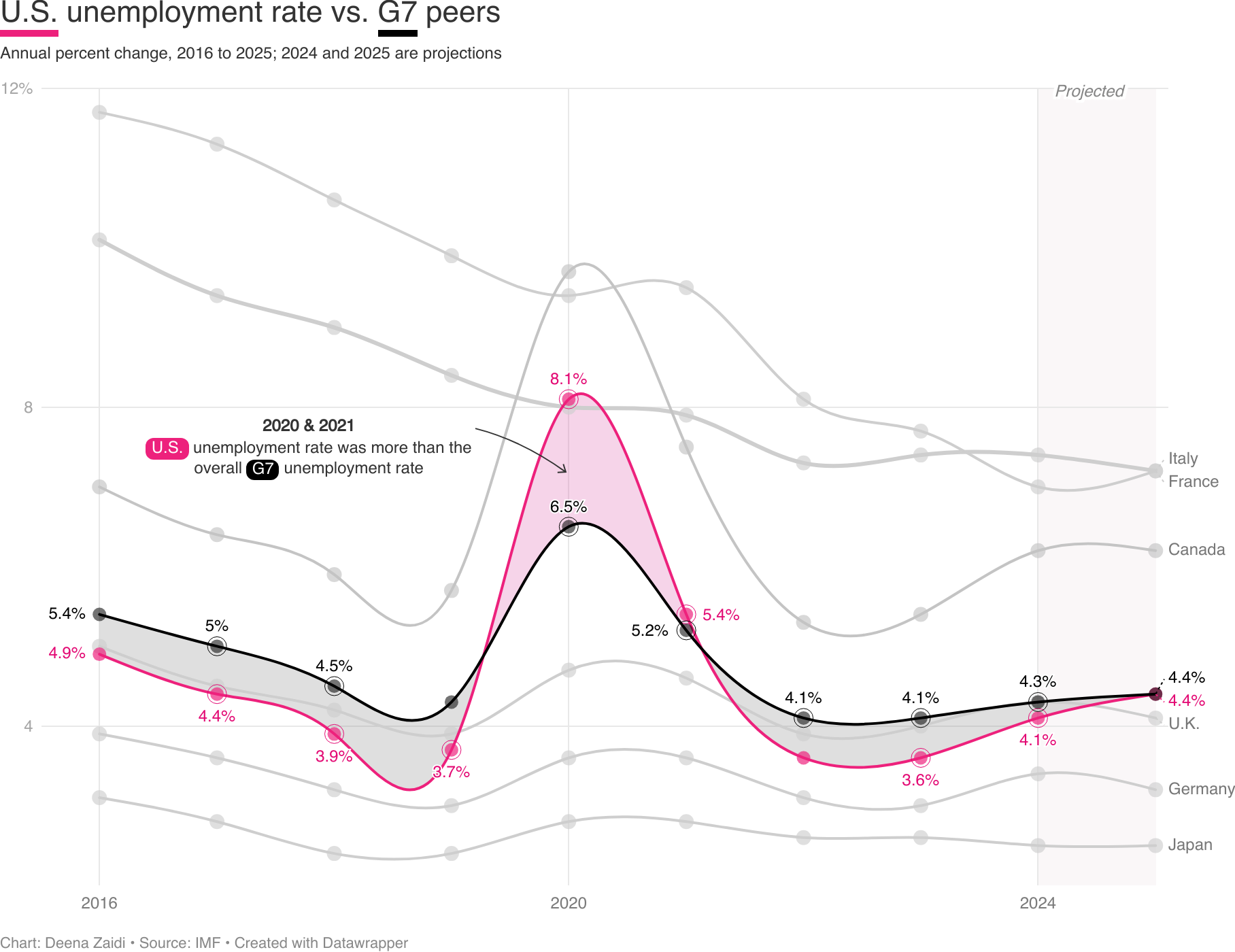

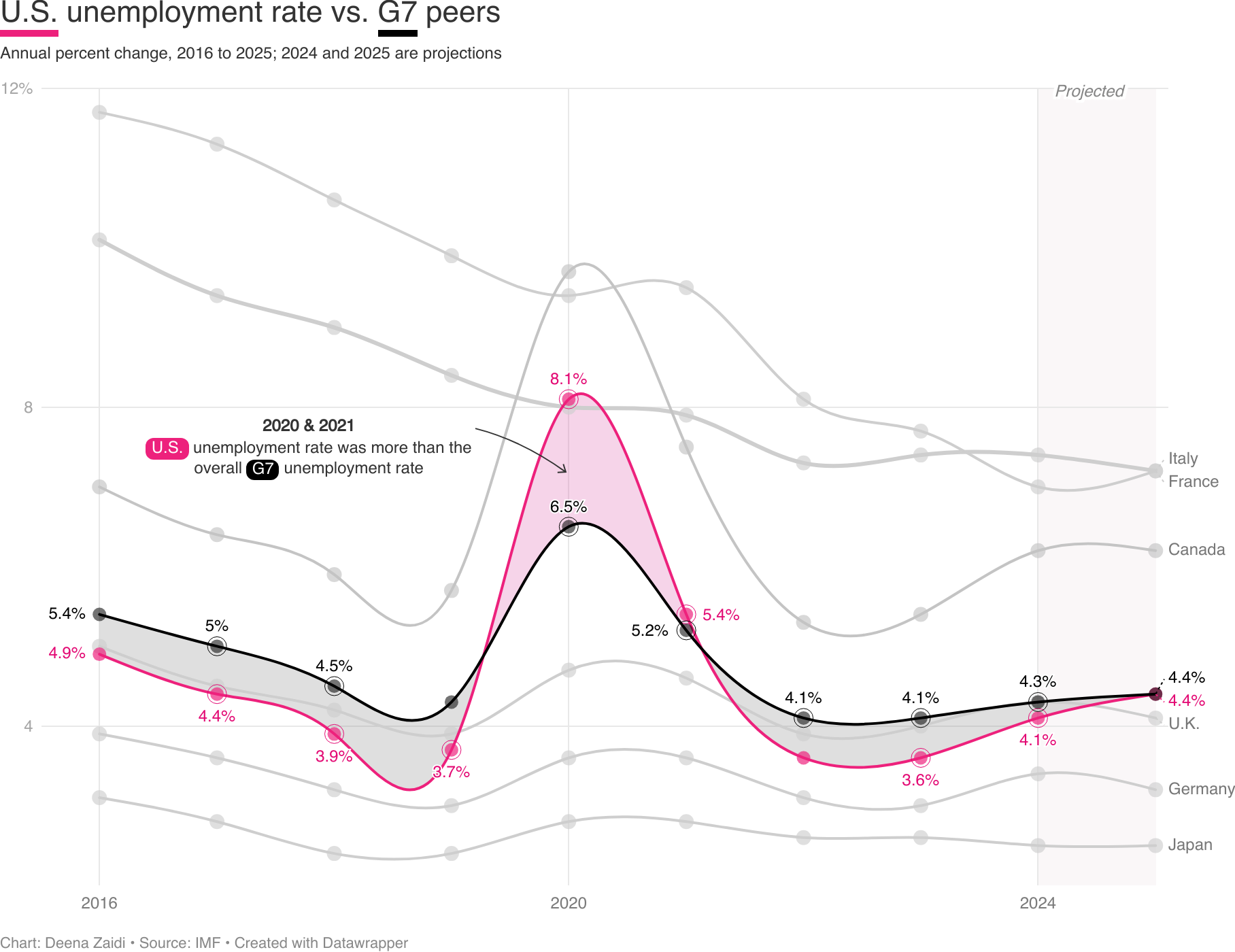

The IMF forecasts rising unemployment rates in 2024 and 2025 for G7 countries, driven by significant increases in the U.S. and Canada, despite initial declines since the 2020 pandemic.

Data and Financial Journalist

The IMF forecasts rising unemployment rates in 2024 and 2025 for G7 countries, driven by significant increases in the U.S. and Canada, despite initial declines since the 2020 pandemic.

The Federal Reserve uses interest rates as one of the many monetary policy tools to keep inflation at 2% and ensure full employment. Here’s how the terms in this relationship typically work: The relationship between the two can be summarized as follows: Lag Effect: Changes in the federal funds rate don’t immediately impact inflation. There’s…

All That there is to the Fed : Myths and what an interest rate hike means along with some facts.

In an interview with CNBC, Mohamed El Erian’s thoughts seemed to align with Bill Gross’s statements. “I would have hiked earlier and I would have gotten off zero earlier, but it’s easier to say with hindsight,” El-Erian told CNBC. “We know that there was a moment when domestic data was relatively strong and international data was okay. Now, the international data is really scary, and therefore the Fed has lost the opportunity when it had some alignment.”