Major central banks in advanced economies have started cutting their policy rates, moving their policy stance toward neutral. However for some advanced economies, the unemployment rate remains a big concern.

The International Monetary Fund (IMF) in its recent report predicts that the interest rate cuts in advanced economies could support activity at a time when labor markets in some Group of 7 (G7) are showing signs of weakness, especially with rising unemployment rates.

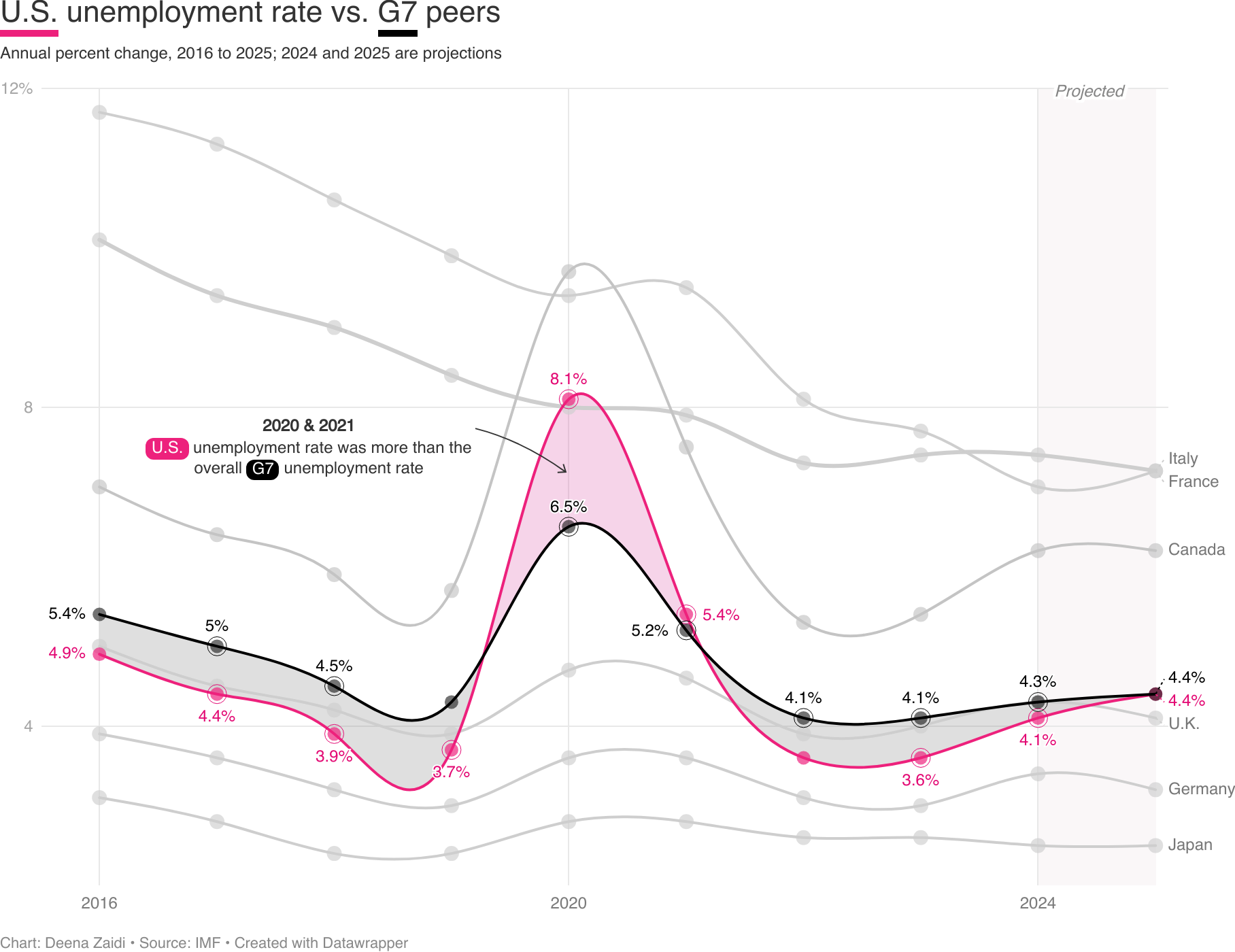

The unemployment rates of all G7 member countries— the U.S., Italy, Germany, Japan, France, Canada, and the U.K.- all fell in 2023 compared to the start of the 2020 pandemic.

As of 2023, Italy had the highest unemployment rate of the G7 countries, reaching 7.6 percent, followed by France at roughly 7.4%

One of the biggest drops in 2023 was in the U.S., from 8.1% in 2020 to 3.6% last year

But the current monthly unemployment rate stood at 4.1% in October—even though it remained unchanged from September, according to the jobs report released on Nov. 1 by the Bureau of Labor Statistics (BLS).

Despite low unemployment in 2023, the IMF now expects the unemployment rate to rise in 2024 and 2025 for some G7 countries including the U.S. According to the data, the overall unemployment rate in the G7 is projected to rise to 4.3% in 2024, and 4.4% in 2025, from 4.1% in 2023.

This push is largely driven by the rising unemployment in the U.S. and Canada. IMF predicts the U.S. unemployment rate to rise from 3.6% in 2023 to 4.1% in 2024 and 4.4% in 2025.

Canada’s unemployment rate will rise from 5.4% to 6.2%. Germany is expected to see a slight jump in numbers from 3% in 2023 to 3.4% in 2024, only to fall to 3.2% by 2025.

Other member countries such as France, Italy, and Japan will see a slight fall in the unemployment rates.