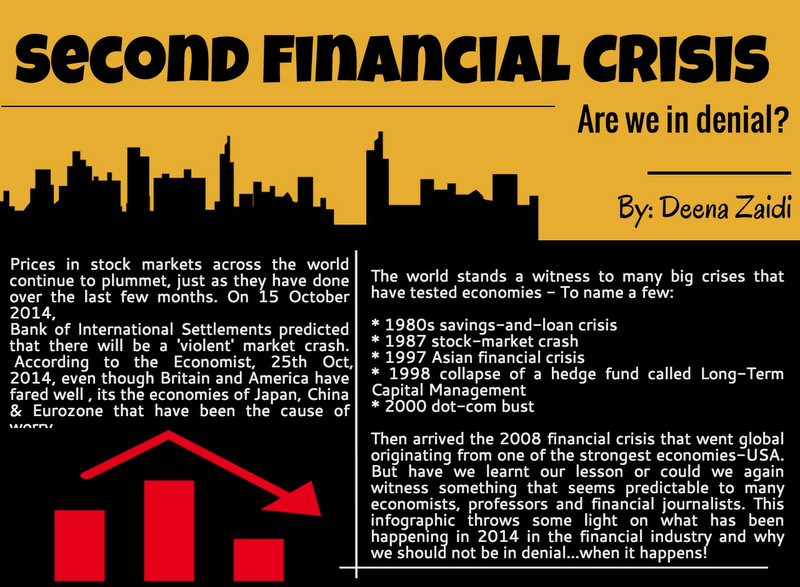

Eight years of the financial turmoil has given a reason for many debates, research, arguments, discussions and even research work to many. To many nothing has really changed, in fact to them, we might be looking at something more serious in 2016. The question that is important is whether there is any truth to the occurrence of second financial crisis or are we just in denial? This article had been previously published in 2014.