After the global computer outage on July 19 this year, that cost Delta Airlines (DAL) an estimated revenue loss of $500 million, CrowdStrike (NASDAQ: CRWD) is set to reveal its second-quarter earnings.

CrowdStrike and NVIDIA: A day before the earnings reports of both CrowdStrike and NVIDIA (NVDA) on Aug. 28, 2024, CrowdStrike announced it will be collaborating with NVIDIA to secure the future of Generative AI innovation.

-

- The announcement comes at a time when all eyes are on NVIDIA, a dominant chipmaker and a key player in the AI industry.

AI-Centric Cybersecurity: The collaboration is to provide additional safeguards for NVIDIA NIM Agent Blueprints with the AI-native CrowdStrike Falcon cybersecurity platform.

-

- “CrowdStrike pioneered AI-native cybersecurity and is at the epicenter of securing the AI systems that are driving the generative AI revolution,” said Daniel Bernard, chief business officer, CrowdStrike in a press release.

Continued Innovation: “We continue to innovate alongside NVIDIA, providing enterprises with the essential tools they need to supercharge generative AI development, utility and security,” he added.

Comparison to Palo Alto Networks

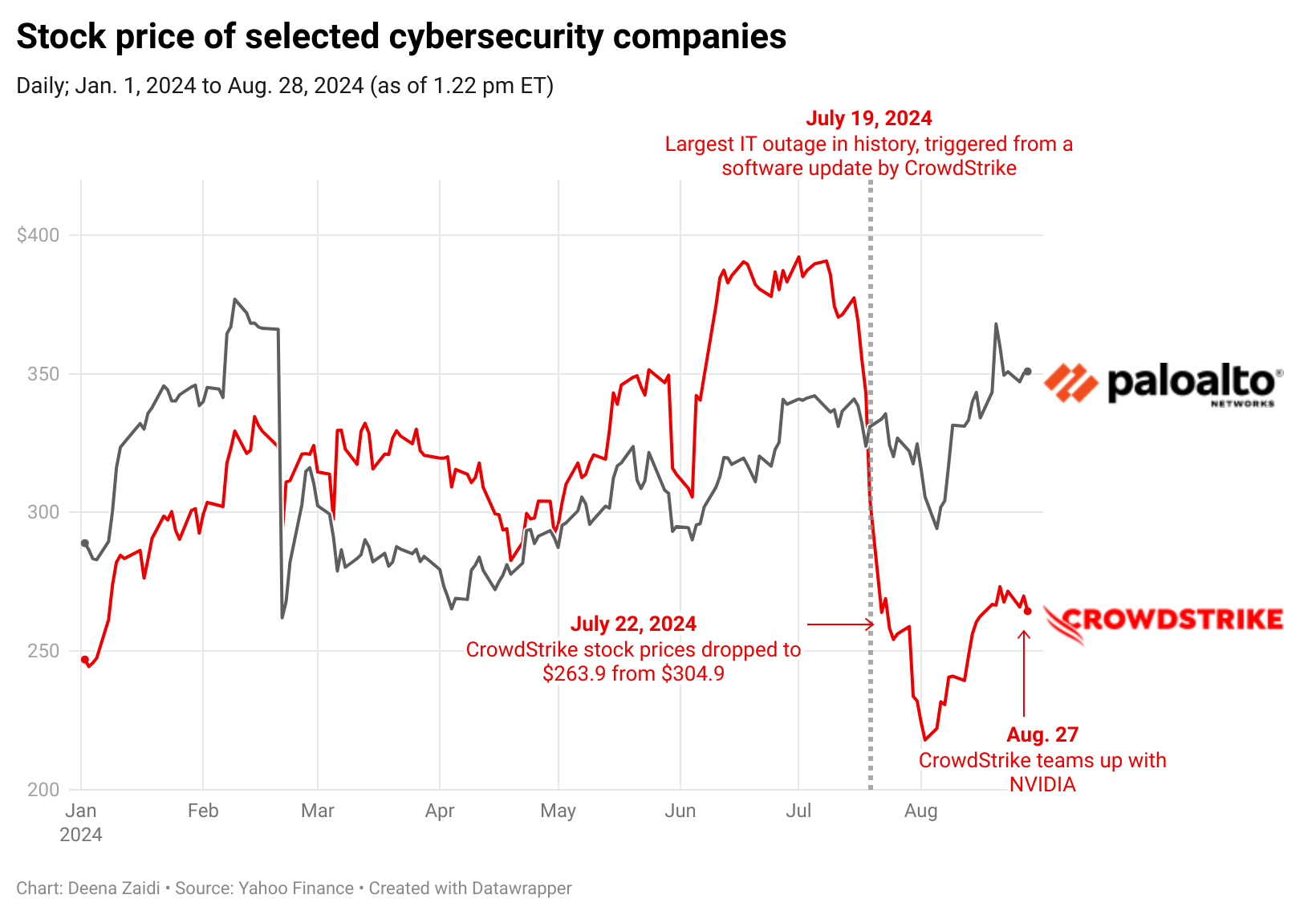

In another piece of news, a comparison with Palo Alto Networks (NASDAQ: PANW), founded in 2005 and the cybersecurity realm, shows that since January 1, 2024, Palo Alto Networks and CrowdStrike have shown different performance trajectories.

- Shares for Palo Alto surged after the company’s recent stronger-than-expected revenue and earnings report for its fiscal fourth quarter on Aug. 19, 2024.

- Shares of CrowdStrike have dipped more than 15% since the outage but the prices have seen an upward trend since the post-outage.

After the earnings release of CrowdStrike, it’ll be interesting to watch the trajectory of the company’s revenue growth as it continues to woo its existing investors who suffered through the outage.

Please note: I do not hold any shares in CrowdStrike, Nvidia or other mentioned companies in this story.