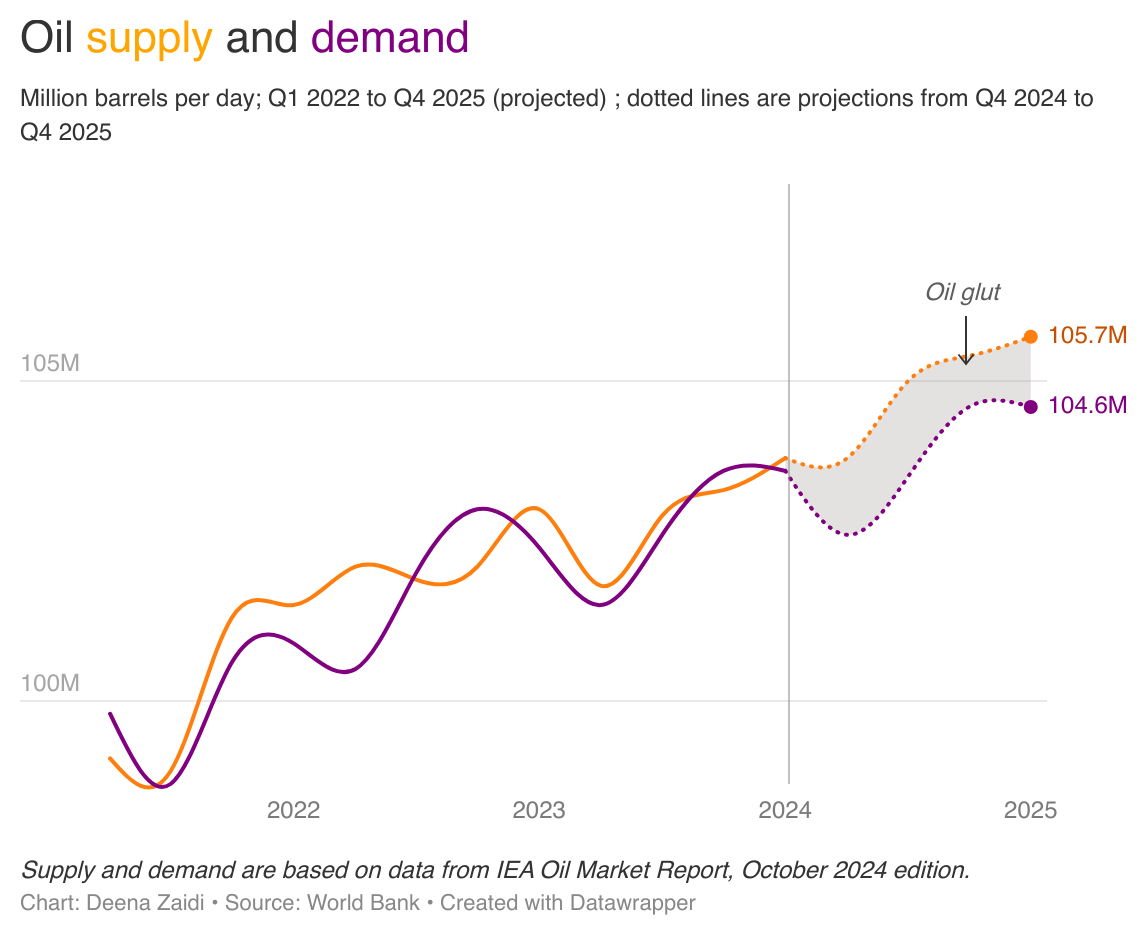

The global oil supply is expected to exceed demand by an average of 1.2 million barrels per day in 2025, according to the World Bank’s latest Commodity Markets Outlook.

Overall commodity prices will remain 30% higher than in the five years before the pandemic. The World Bank estimates the glut has been exceeded only twice before— in 2020 and 1998 (during the oil price collapse).

The expected oil glut “is so large that it is likely to limit the price effects even of a wider conflict in the Middle East,” the Bank said.

China’s slowing demand

The slowdown in oil demand in China is considered to be a major shift in the overall new oversupply. The country’s demand for oil has essentially been stagnant since the slowdown in industrial production in 2023.

Alot of this demand shift is also due to the country’s increased EV sales. According to the International Energy Agency (IEA), China sold about half a million more electric cars than over the same period in 2023. From January to March this year, nearly 1.9 million electric cars were sold in China, a 35% increase compared to sales in the first quarter of 2023.

Increased supply by non-OPEC

While OPEC+ itself maintains significant spare capacity, amounting to 7 million barrels per day, the Bank expects several non-Organization of Petroleum Exporting Countries or its allies (OPEC+) countries “to ramp up oil production,” which could fuel the oversupply, pushing down global commodity prices by almost 10% by the end of 2026. Oil supply from non-OPEC+ producers is assumed to grow by almost 2 mb/d in 2025.