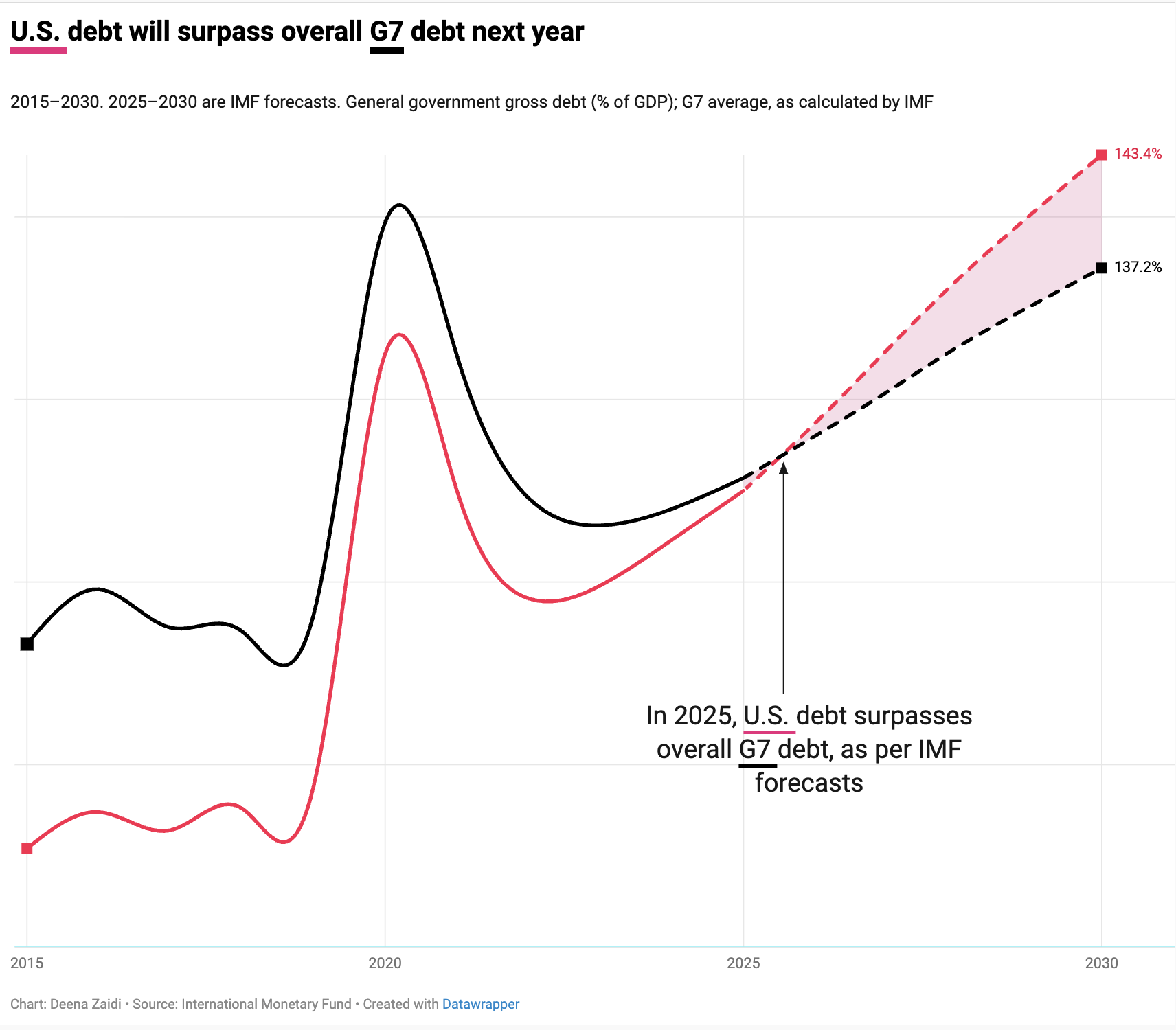

IMF projections show U.S. government debt climbing faster than most G7 peers, surpassing the group’s average in 2025 and reaching about 143% of GDP by 2030—second only to Japan.

Data & financial journalist covering global economics and policy

IMF projections show U.S. government debt climbing faster than most G7 peers, surpassing the group’s average in 2025 and reaching about 143% of GDP by 2030—second only to Japan.

The ECB cut its key rates by 25 bps effective June 11 after lowering its 2025 inflation forecast to 2%, with core inflation near target and modest GDP growth expected, but also cautioned against rising tariff uncertainty.

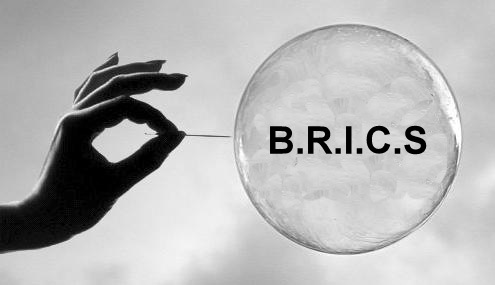

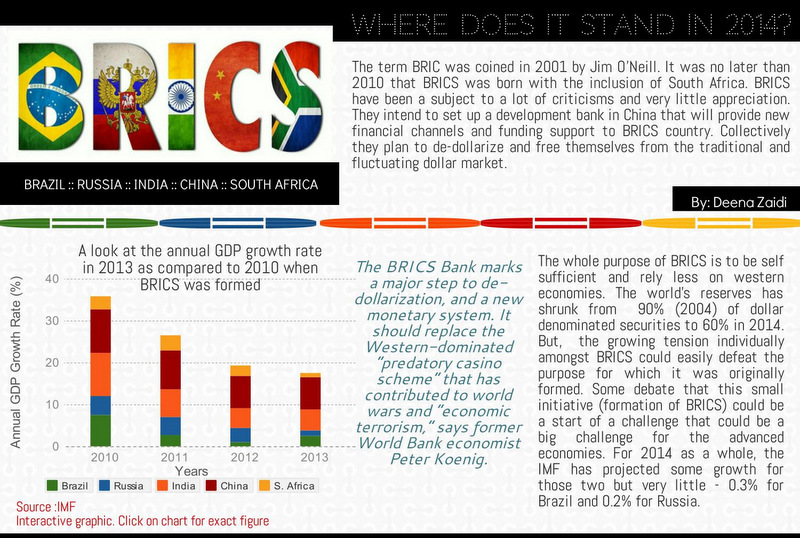

As emerging markets enter turmoil, questions regarding BRICS remain unanswered. China was known for being the second largest economy that could drive the asian markets towards infrastructural growth and development. But this year some troubling news from mostly all the emerging markets with Brazil’s debt being reduced to “junk” status. What started, as a pompous affair of five nations coming together in support of one another’s infrastructural needs, now appears to be more of a promotional event.

With the talks of a New Development Bank in China, BRICS has managed to raise some questions. Will the association of emerging markets manage to create stir in the the global economy or will it be another alliance of economies that just have meetings over nothing. Amidst many criticisms, economies of Brazil and Russia can pose more complication than contribution to the group. But it is definitely too early to completely write off BRICS.