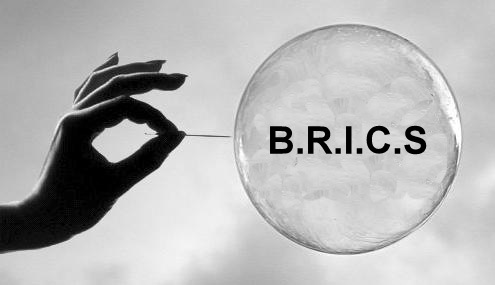

What started, as a pompous affair of five nations coming together in support of one another’s infrastructural needs, now appears to be more of a promotional event.

BRICS is slowly feeling the jolts of different emerging countries within the association that continue to worry about their own individual vested interests. What comprises of 40% of the world’s population, 21% of the world’s GDP and 30% of the global territory, seems to be slowly crumbling, leaving many Asian countries worried about their future. BRICS was eventually formed to change the world’s equation by shifting focus from western countries to Asian countries, especially emerging markets. With shifting of equations, developing countries were sure about creating a stir amongst the developed countries. While China was supposed to be the strongest out of all the emerging economies, India was regarded as a stable economy as compared to other member countries.

Brazil: After Russia’s downgrade to junk status, Brazil’s downgrade could not come at a worse time. Credit rating agency, Standard and Poor’s slashed the country’s debt status to junk status that has in turn taken a toll on the domestic currency of Brazilian real. According to S&P, Brazilian government had failed to stabilize its own economy and expectations are now that government deficit may rise due to overspending by the government. The country now is caught in stagflation and with huge current account deficits and a domestic political crisis; it could face some tough decisions ahead.

Russia: a member of BRICS, SCO and EEU (Eurasian Economic Union consisting of mostly northern Eurasia). Russia has many worries: western sanctions over Ukraine crisis; trouble with the rouble; its trade ban with 28-nation EU, Russia’s first trading partner and falling oil prices (oil being its main export). It banned foods from EU in response to Western sanctions but maintained good relations with Hungary, Cyprus and Greece. For Russia, BRICS was to restore its lost hope of its falling economy. In June 2015, European Union governments extended economic sanctions on Russia until January 31, 2016.

As the ties with the western world kept getting worse for Russia, its membership with various Asian associations had remained a positive sign for the country. But promises by BRICS remain unfulfilled for Russia as individual countries try to stabilize their own economy rather than worry about BRICS. Interestingly, a ray of hope by President Vladimir Putin was reflected in his plans for visa-free travel from India and South Africa (this again to boost Russia’s ailing tourist industry).

India: India still remains somewhat better than the rest of its BRICS peers. With ‘reasonably solid’ fundamentals, the country seems to have potential. India also is at a gaining end due to low oil prices as it is a large importer of oil. However, many global investors think other wise when it comes to investing in India. Marc Faber, a renowned global investor feels that slow pace of reforms in India is disappointing. Top two global rating agencies lowered their growth forecast for India and raised concerns about reforms and other factors. With official figures, showing growth of 7% between April and June, that is slower than 7.5% in the previous quarter. As Prime Minister Modi has already completed one year, many investors and much of public remain confused whether the promises made by the elected government remains to be delivered. Having said that, the first seven months of the elected prime minister witnessed more actions on foreign policy than economic issues. Much of the delivery still remains to be tested once global influences on Indian stock markets start to subside.

China: This year, China took some important steps like establishment of BRICS bank in Shanghai and AIIB in Beijing that worried nations of US and Japan. To many economists, it felt as if China was going to be the leader amongst emerging markets, especially in infrastructural development.

But before any of these goals could even be set, China’s economy started showing troubling signs. The stock market crash in China raised some important questions, eventually leading to a surprise devaluation of its domestic currency, the Yuan. This strengthened the belief that officials in China could resort to reforms that could be damaging to global market, particularly emerging ones.

China’s surprise devaluation on August 11 was said to be a free market practice in order to remain at par with market exchanges. But this move has been at a cost of more than $5 trillion that have so far been wiped off on global stock prices. Following the black Monday on August 24th, many doubts were cleared about the ailing economic health of the world’s second largest economy. While the developing country sent out waves of worries across the stock markets of Eurozone and US, global investor confidence in Chinese markets started to fade away gradually from both domestic and international markets. As contagion started to spread across stronger economies, the resistance to China’s fall by developed nations was put to test. While developed markets may not be adversely affected (except worries regarding China’s next surprise move), emerging markets could either be facing a full-blown crisis or a calculation that went terribly wrong.

South Africa: South Africa’s economy is shrinking and there could be some truth in the fears over a pending recession. According to trade and industry minister Rob Davies, the country needs to focus on adding value to commodities and it cannot afford to see itself just as a producer and exporter of minerals. China’s slowing growth has impacted South Africa’s economy and a dramatic slump in the price of gold, platinum, coal and iron ore has led the nation to witness marginal or no profits.

Emerging markets remain in turmoil as uncertainties grip its neighbors, weakening most economies. Whether BRICS will emerge together or individually remains to be tested but going by facts and figures, it seems evident that their association seems to be causing more harm than benefits.

© 2015 Deena Zaidi. All rights reserved. Any republishing requires permission from the Author.