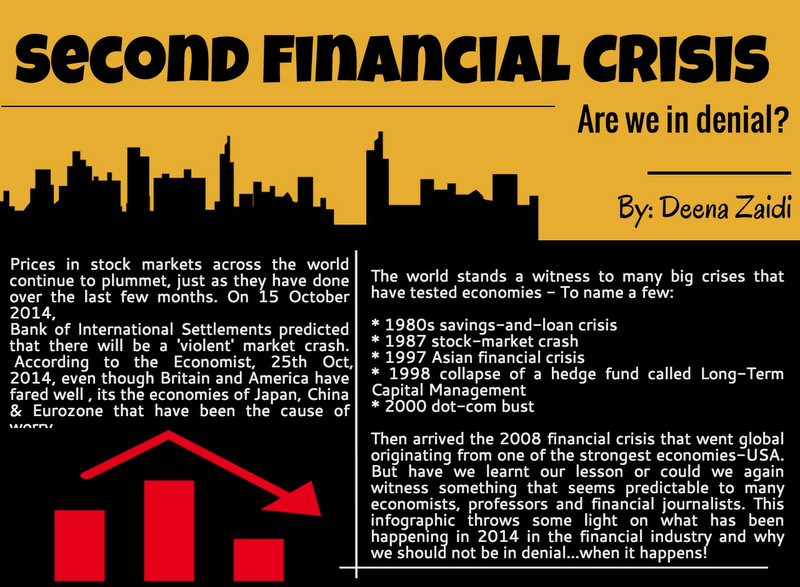

Banks have always remained too big to fail but their systemic risk became the topic of debates after the 2008 financial crisis. Living wills are a part of the post-2008 reforms to ensure that the risk does not spread to other sections of the financial system.