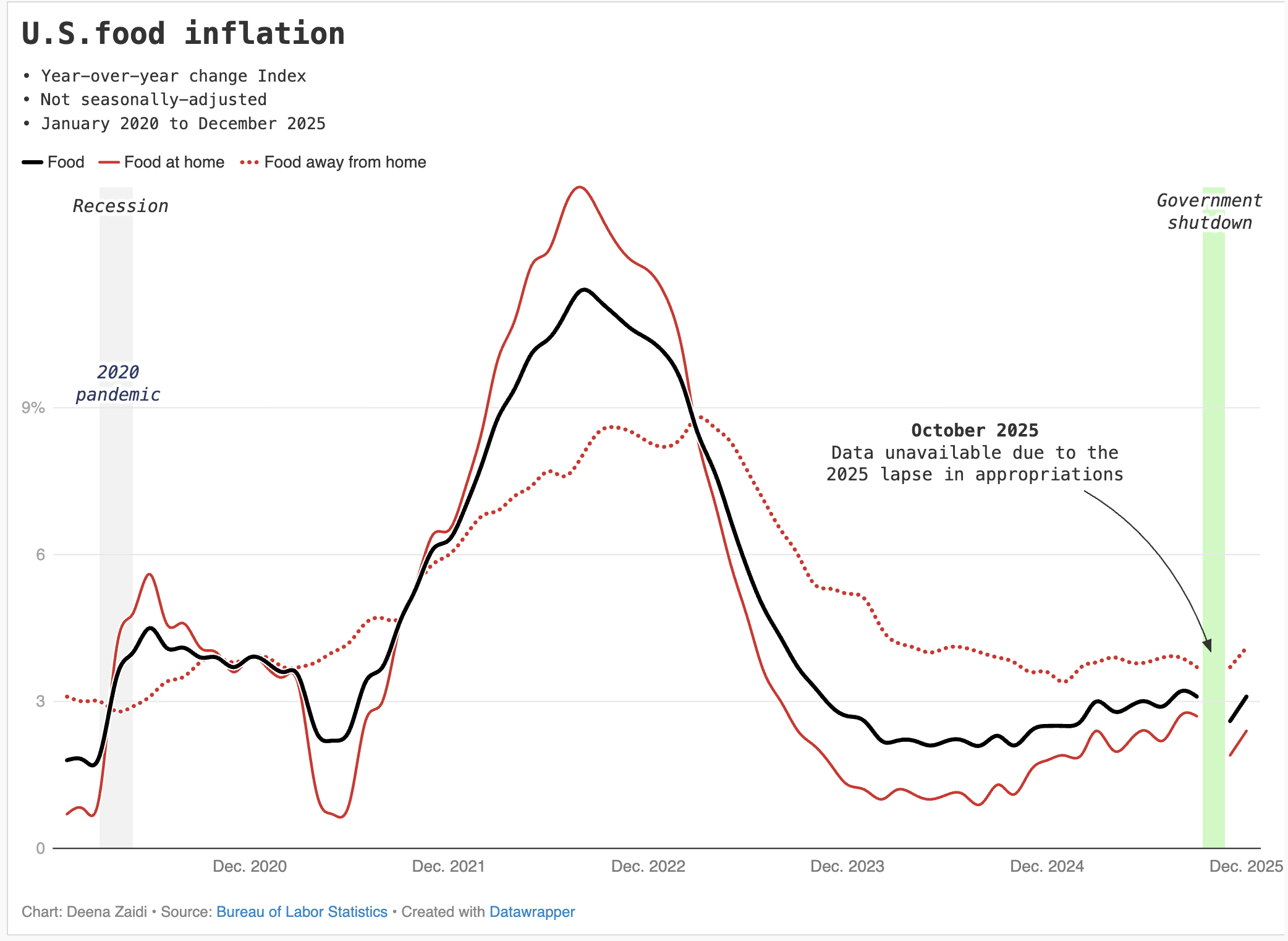

U.S. food inflation has cooled sharply from its pandemic-era peak — but the latest data come with an unusual warning label.

Data and Financial Journalist

U.S. food inflation has cooled sharply from its pandemic-era peak — but the latest data come with an unusual warning label.

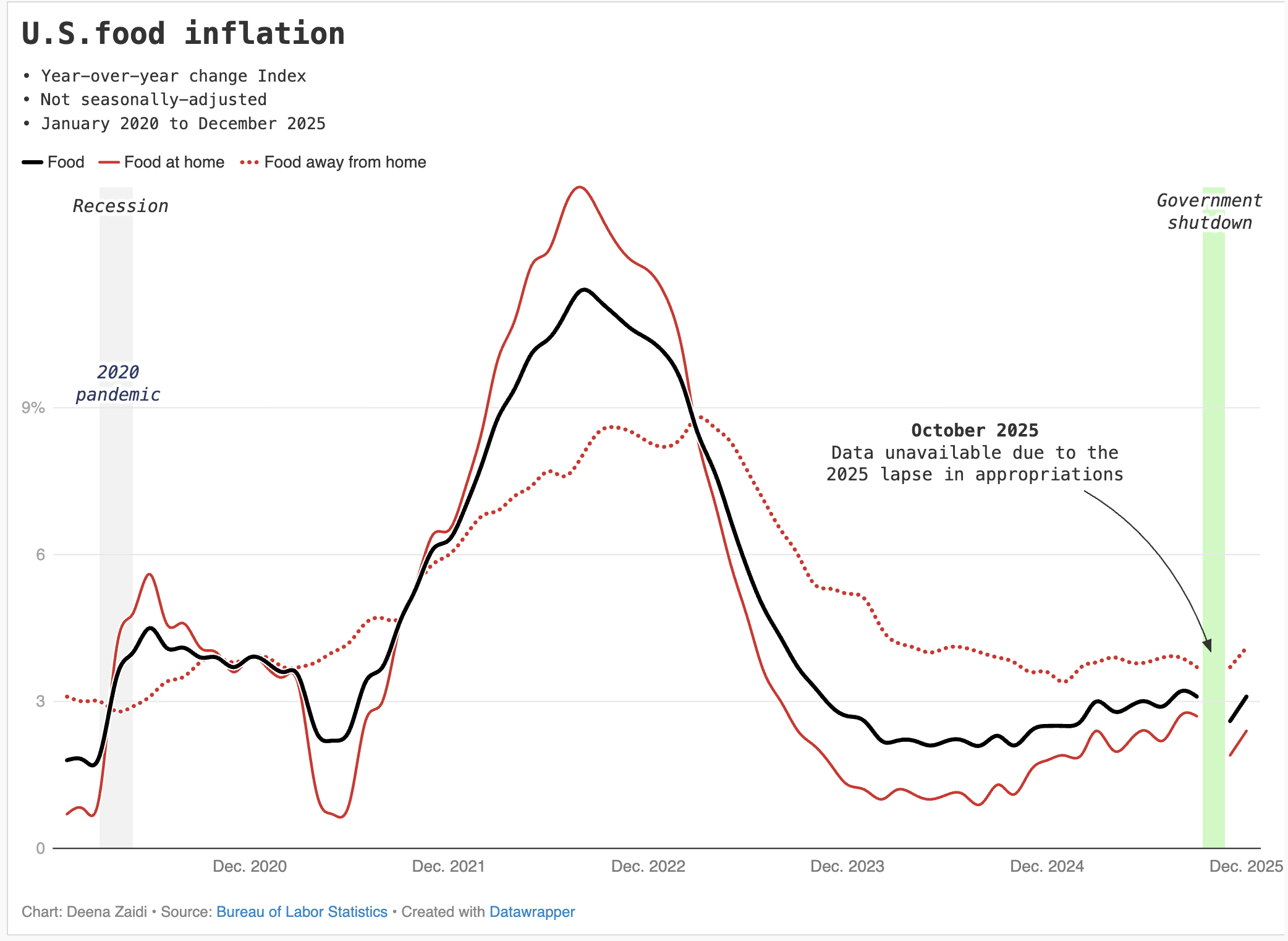

The U.S. trade deficit narrowed dramatically in October 2025, falling to $29.4 billion, the smallest monthly gap since May 2009, according to new data from the U.S. Census Bureau and Bureau of Economic Analysis. That represents a 39% drop from a revised $48.1 billion deficit in September.

In 2025, the U.S. economy didn’t simply cool or rebound but changed in ways that were visible in the data itself.

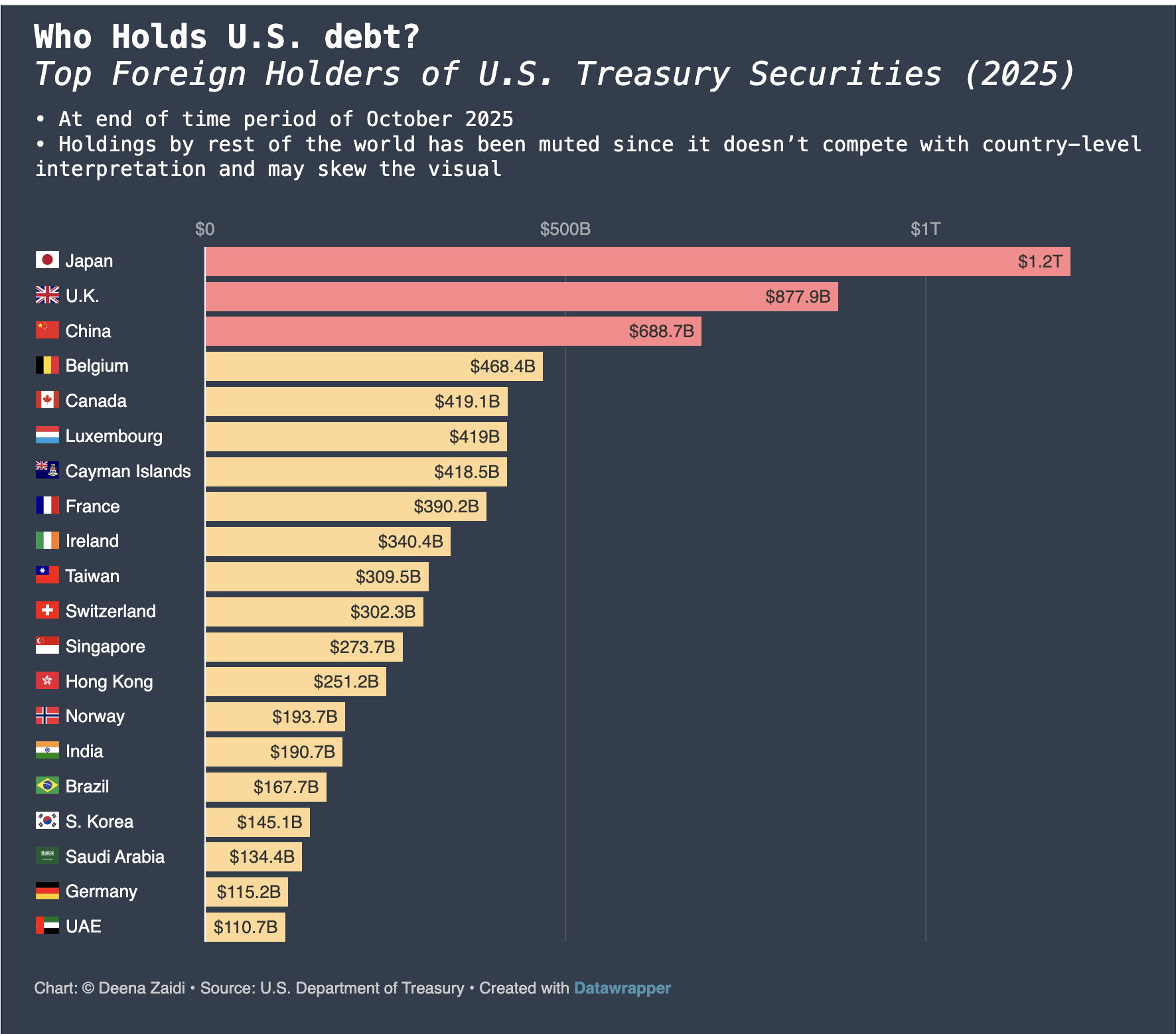

A shutdown distorted inflation, tariffs reset global trade, U.S. debt buyers quietly swapped places, and food prices surged. I pick five charts that captured how policy and politics reshaped the American economy in 2025.

Foreign investors now hold more than $9 trillion in U.S. Treasurys, but growing purchases by advanced economies contrast with pullbacks by China and other emerging markets.