Oil prices surged after U.S. and Israeli strikes on Iran raised fears of Strait of Hormuz disruption, a chokepoint that carries about 20% of global crude supply.

Data & financial journalist covering global economics and policy

Oil prices surged after U.S. and Israeli strikes on Iran raised fears of Strait of Hormuz disruption, a chokepoint that carries about 20% of global crude supply.

Following series were published in June, 2025 and is being republished due to the recent shift in geopolitics around the Strait

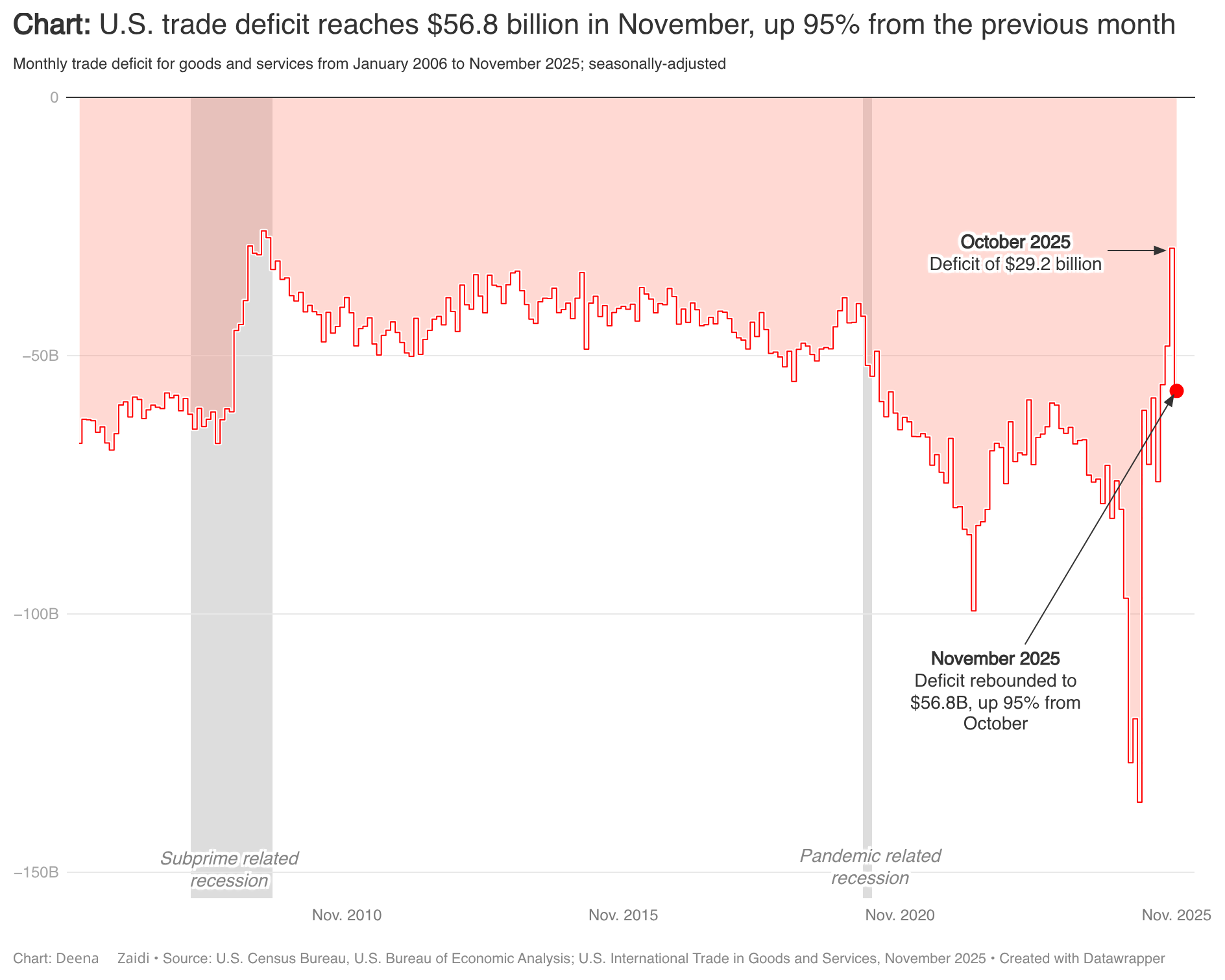

The U.S. trade deficit nearly doubled in November, jumping 95% as imports rose faster than exports, highlighting renewed volatility tied to tariffs and shifting trade flows.

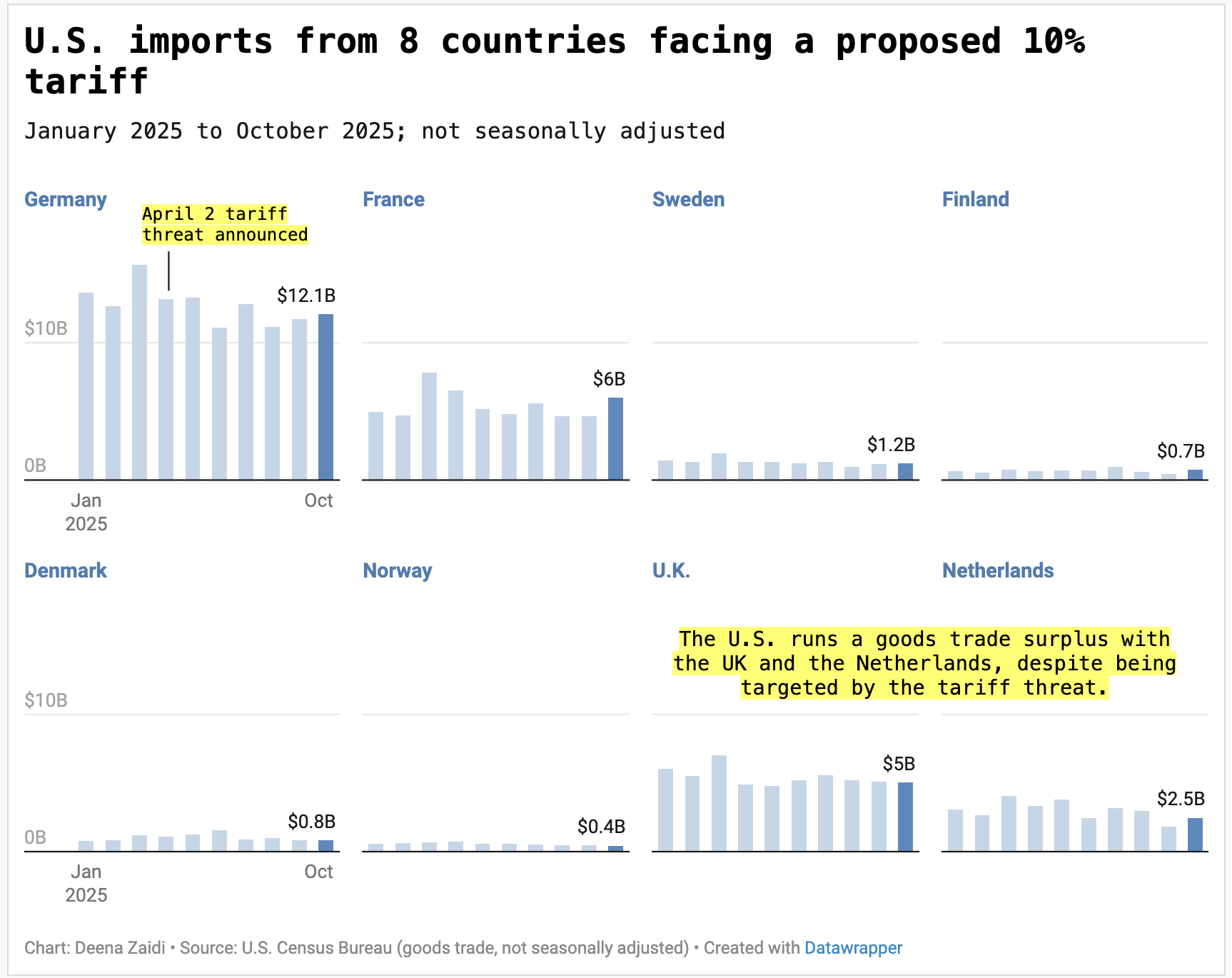

President Donald Trump said the U.S. will impose a 10% tariff on imports from eight European countries starting February 1, tying the move to opposition over Greenland.