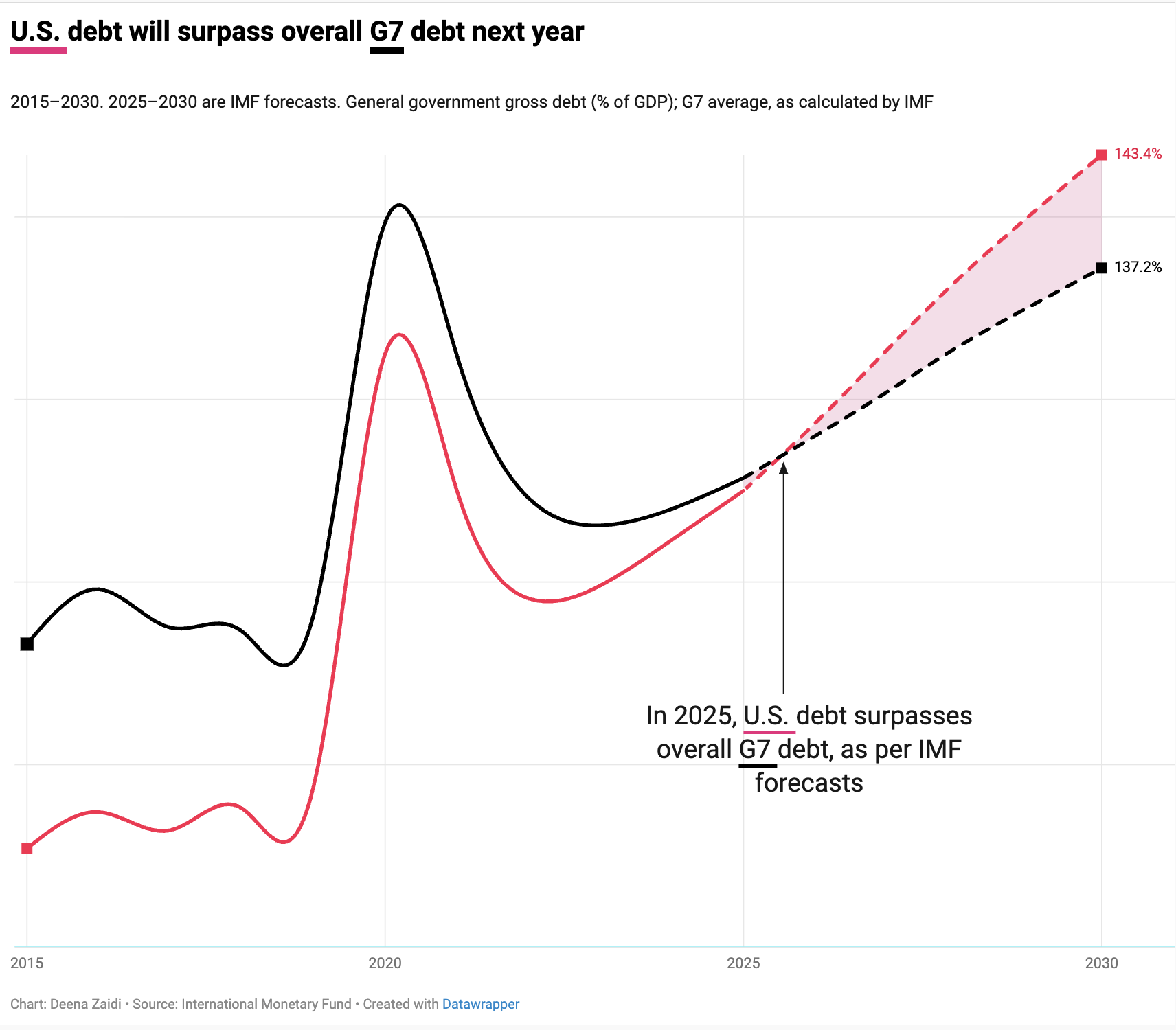

IMF projections show U.S. government debt climbing faster than most G7 peers, surpassing the group’s average in 2025 and reaching about 143% of GDP by 2030—second only to Japan.

Data and Financial Journalist

IMF projections show U.S. government debt climbing faster than most G7 peers, surpassing the group’s average in 2025 and reaching about 143% of GDP by 2030—second only to Japan.

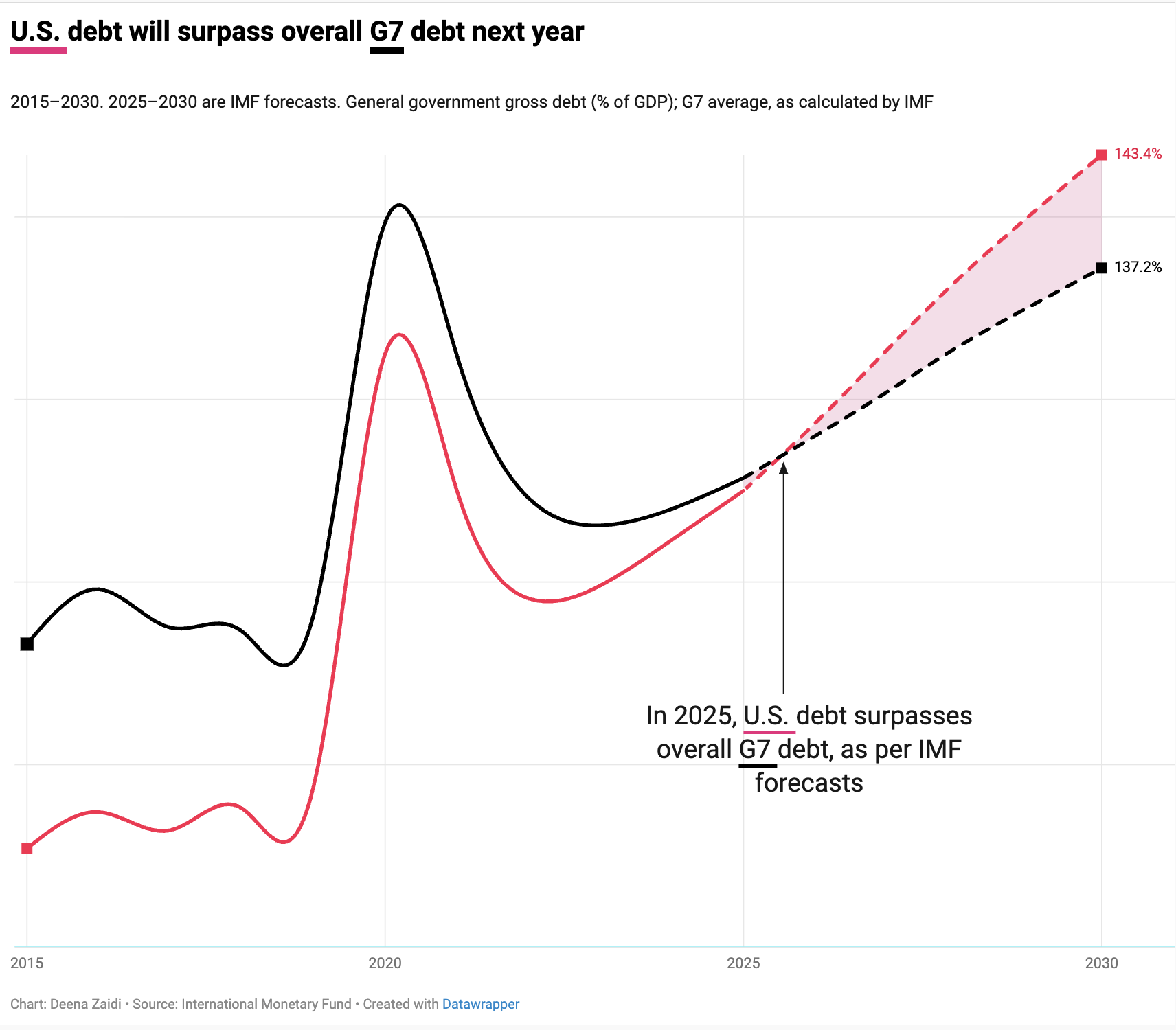

Despite U.S. tariff uncertainty and China’s ban on chips, the AI GPU leader, Nvidia continues to grow – all due to the strong demand for GPUs (graphics processing units) which it aims to fulfill through strategic partnerships. Its recent partnerships with South Korea’s top companies and its earlier $100 billion OpenAI deal are just the latest in NVIDIA’s long history of AI alliances.

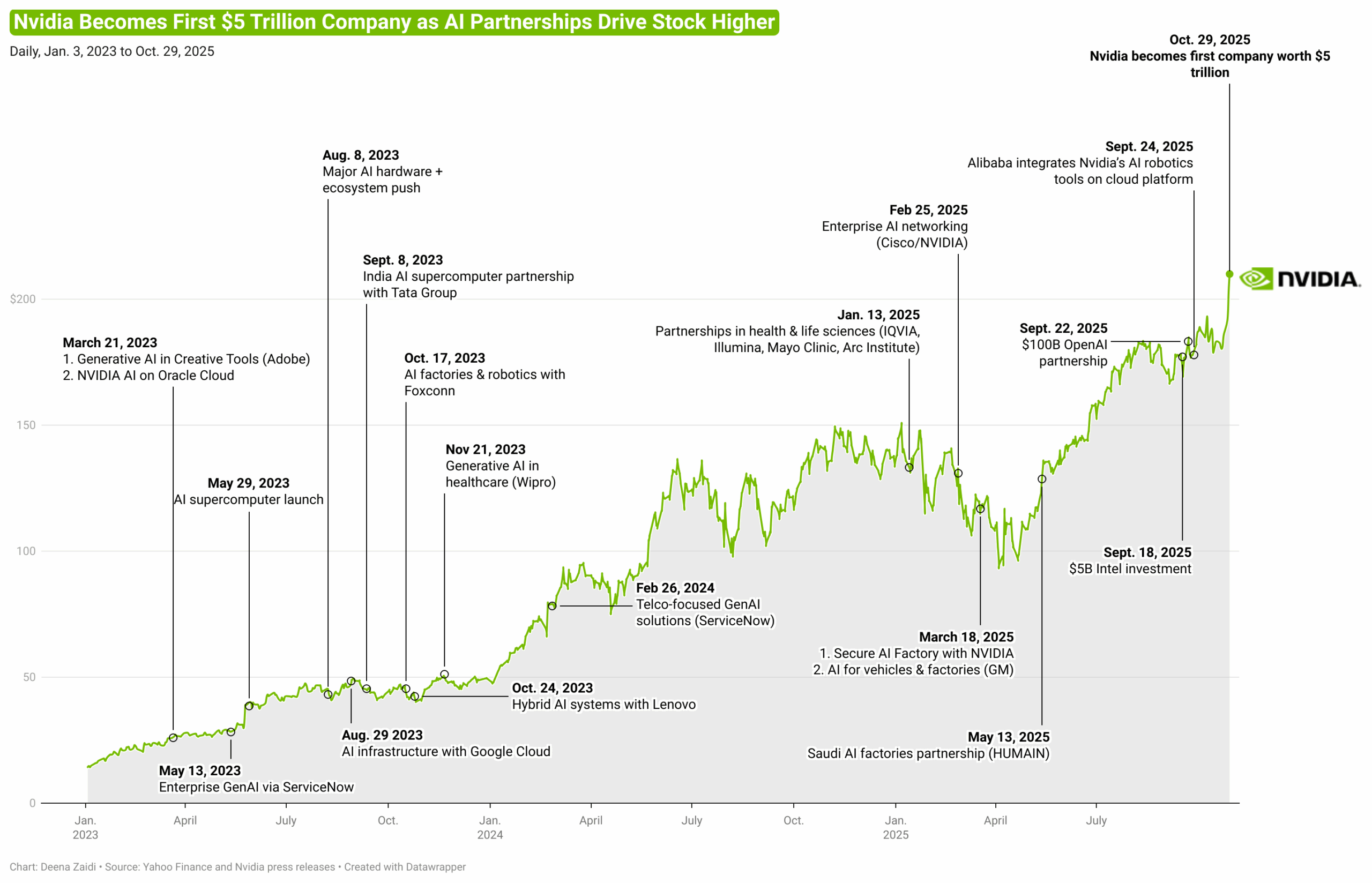

Persistently high inflation makes this reduction a tricky one. The interest rate cut is the first in Trump’s second term as well as the first in 2025.

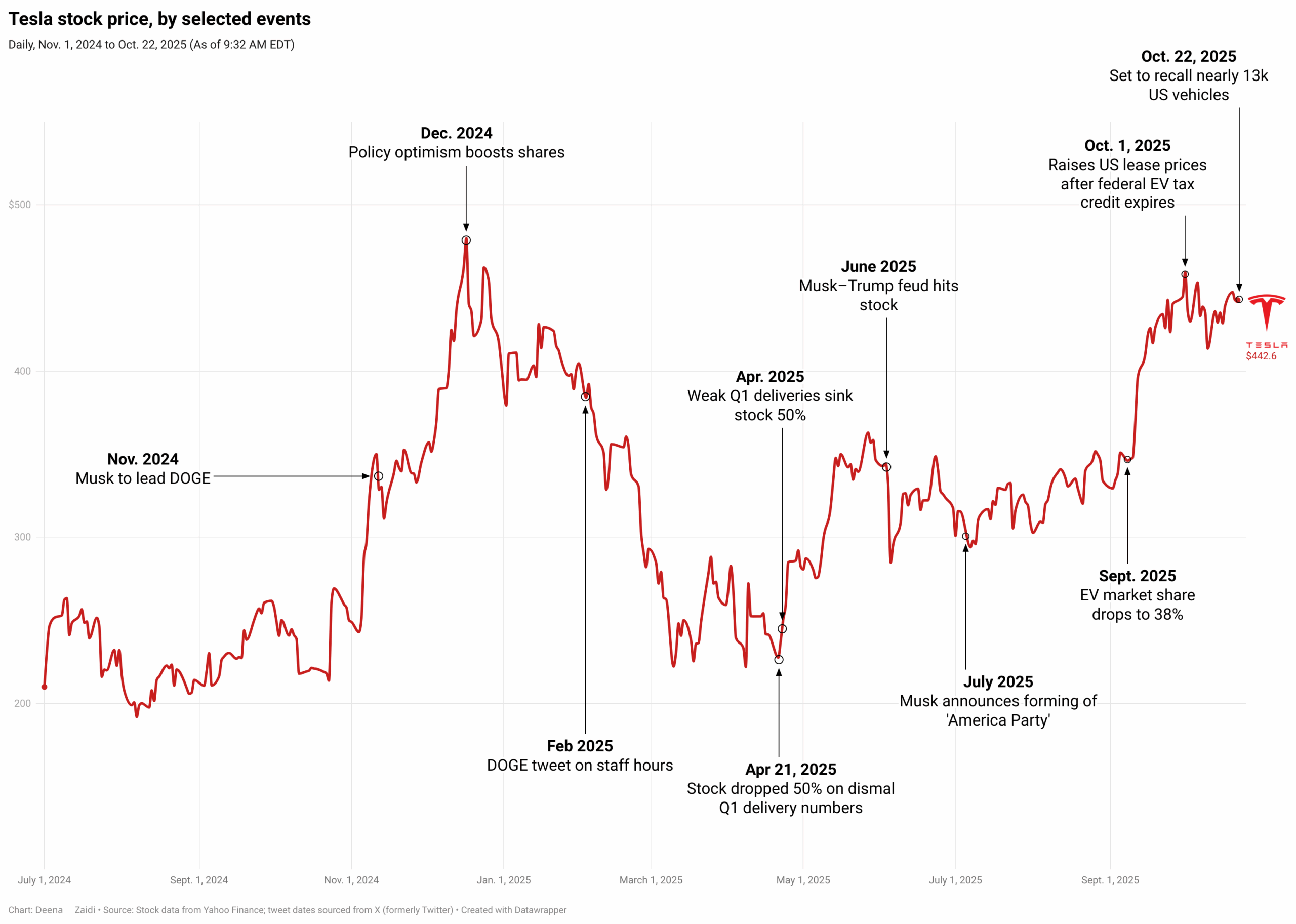

Tesla’s stock is a fascinating case study—one that not only reflects traditional market forces but also captures the increasingly powerful influence of the CEO’s political leanings on investor’s confidence.