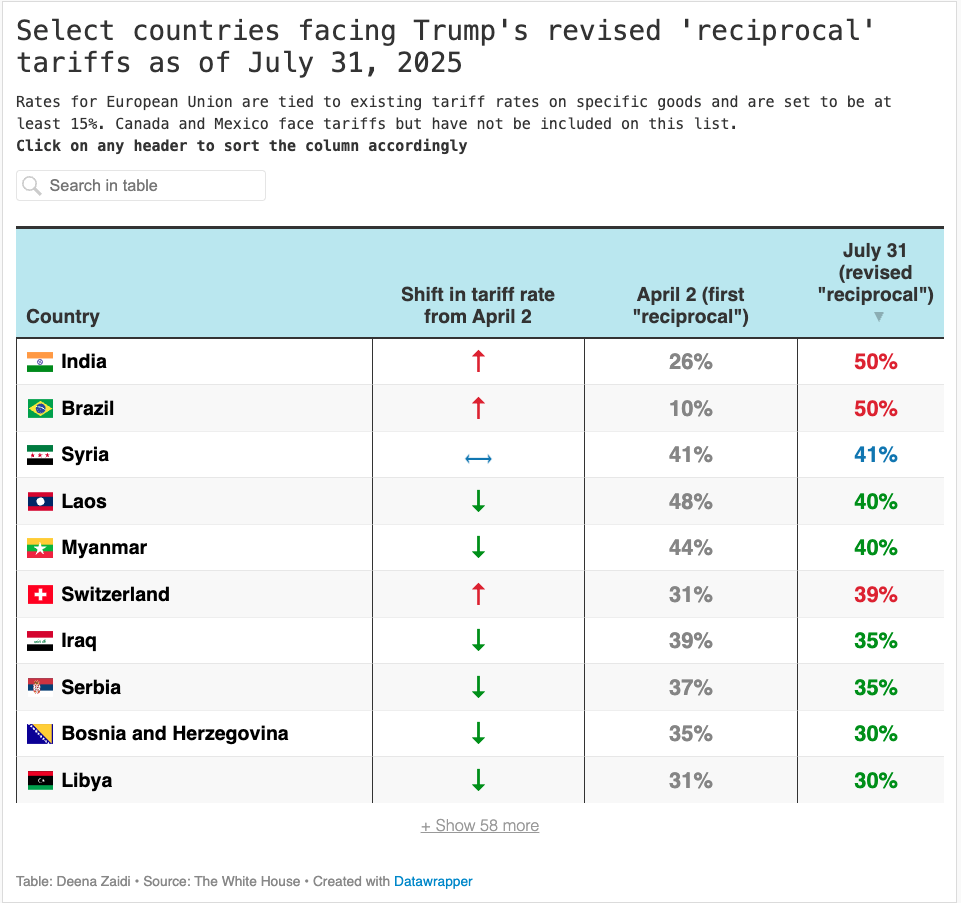

Despite sanctions, Russia’s crude oil exports remain steady. Trade flows have pivoted from Europe to Asia, with China and India now the top buyers. India’s growing imports—and its refusal to join Western sanctions—have triggered steep new U.S. tariffs.