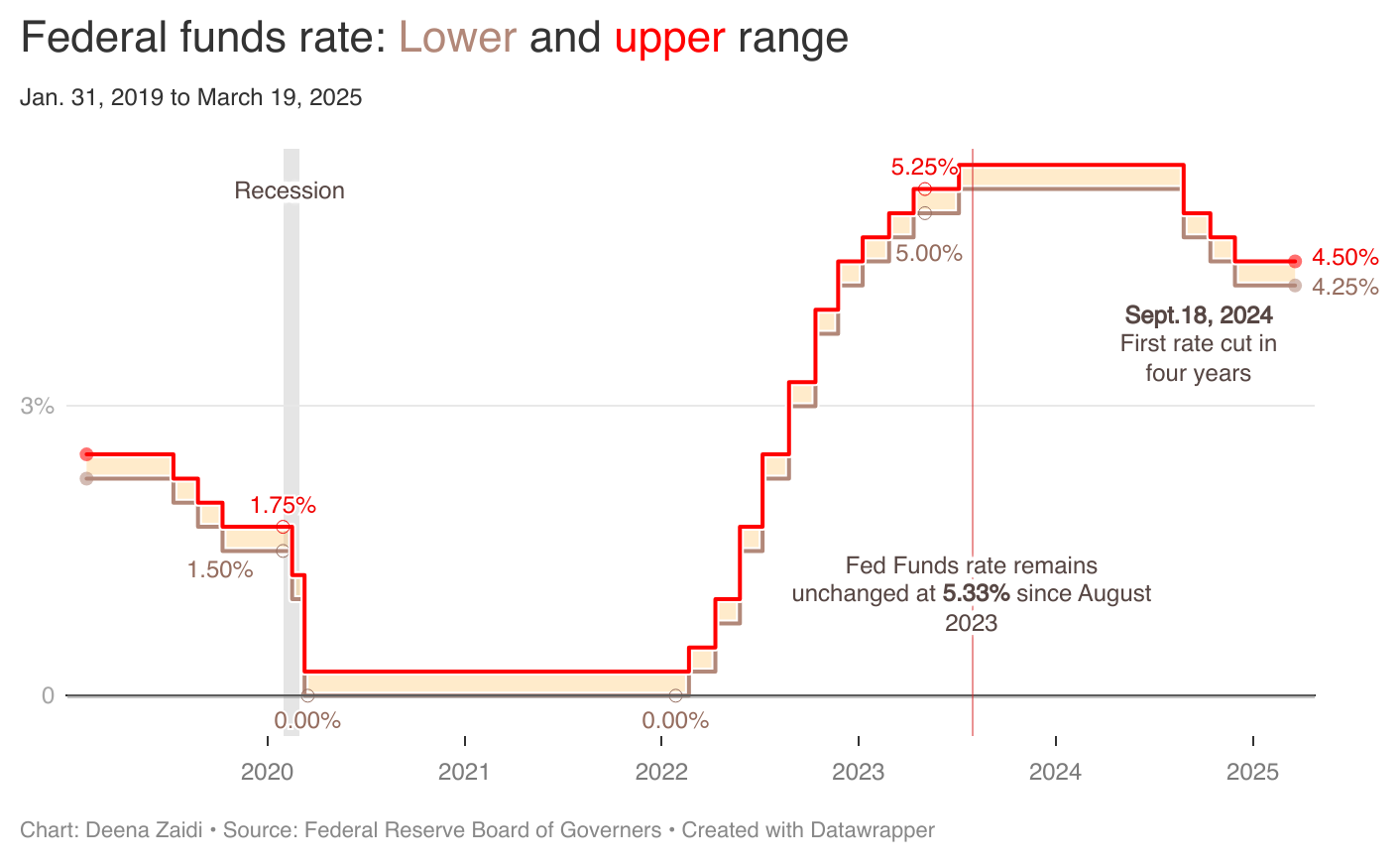

The Federal Reserve keeps its interest rate unchanged, maintaining its target range at 4.25% to 4.5%.

When the Fed sets a target for interest rate, it commits itself to adjusting the money supply. To lower the Fed Funds rate, the Fed’s bond trades buy government bonds, increasing the money supply which in turn lowers the equilibrium interest rate.

The Committee is set to maintain this target range until it carefully assesses incoming data. It continues to reduce its Treasury securities and agency debt and agency mortgage-backed securities.

Starting April, the Committee will:

- lower the monthly redemption cap on Treasury securities from $25 billion to $5 billion

- maintain the monthly redemption cap on agency debt and agency mortgage-backed securities at $35 billion.

While recent indicators point out towards a solid economic activity, with unemployment rate stabilizing at low levels, the Fed says , “inflation remains somewhat elevated.”

The cautious approach

The Fed has been cautious about cutting interest rates too early. The effective Fed Funds rate is the interest rate banks charge each other to borrow overnight. When necessary, the Fed raises or lowers its target range for the federal funds rate.

Lowering the target range means “easing” of monetary policy, often accompanied by lower short-term interest rates in financial markets. This is typically ideal for a sluggish economy or during low inflationary conditions.

Economic impact: Changes in the target range for the federal funds rate influence short-term interest rates for other financial instruments, especially the spending decisions of households and businesses.

- Collectively these have broader implications on economic activity, employment and inflation.

The lagging effect: Changes in the federal funds rate do not have an immediate impact on inflation.

- There’s often a lag between changes in monetary policy and their effect on the economy.

- In short, it might take several months to years for changes in interest rates to fully influence inflation.