Following series were published in June, 2025 and is being republished due to the recent shift in geopolitics around the Strait

Data & financial journalist covering global economics and policy

Following series were published in June, 2025 and is being republished due to the recent shift in geopolitics around the Strait

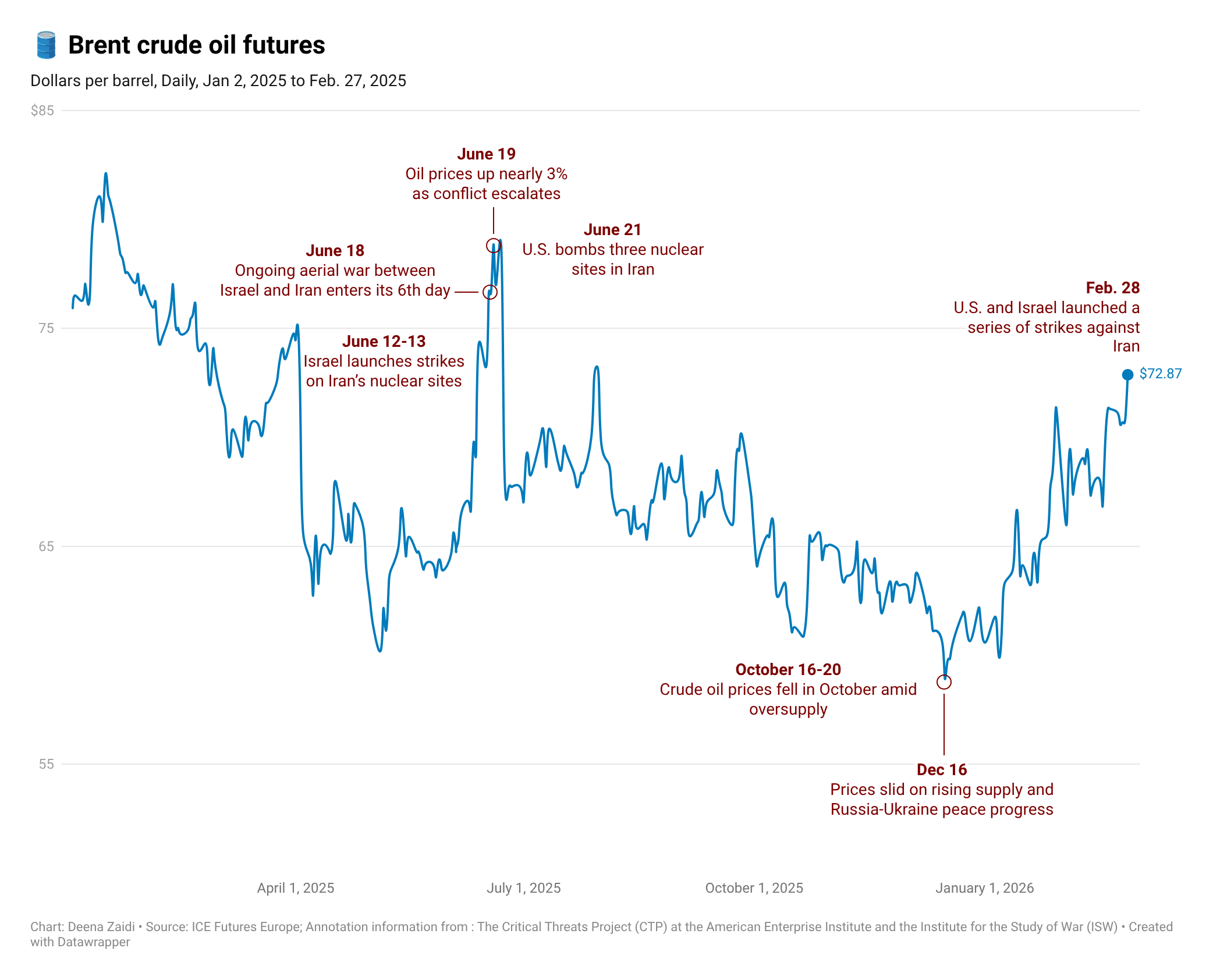

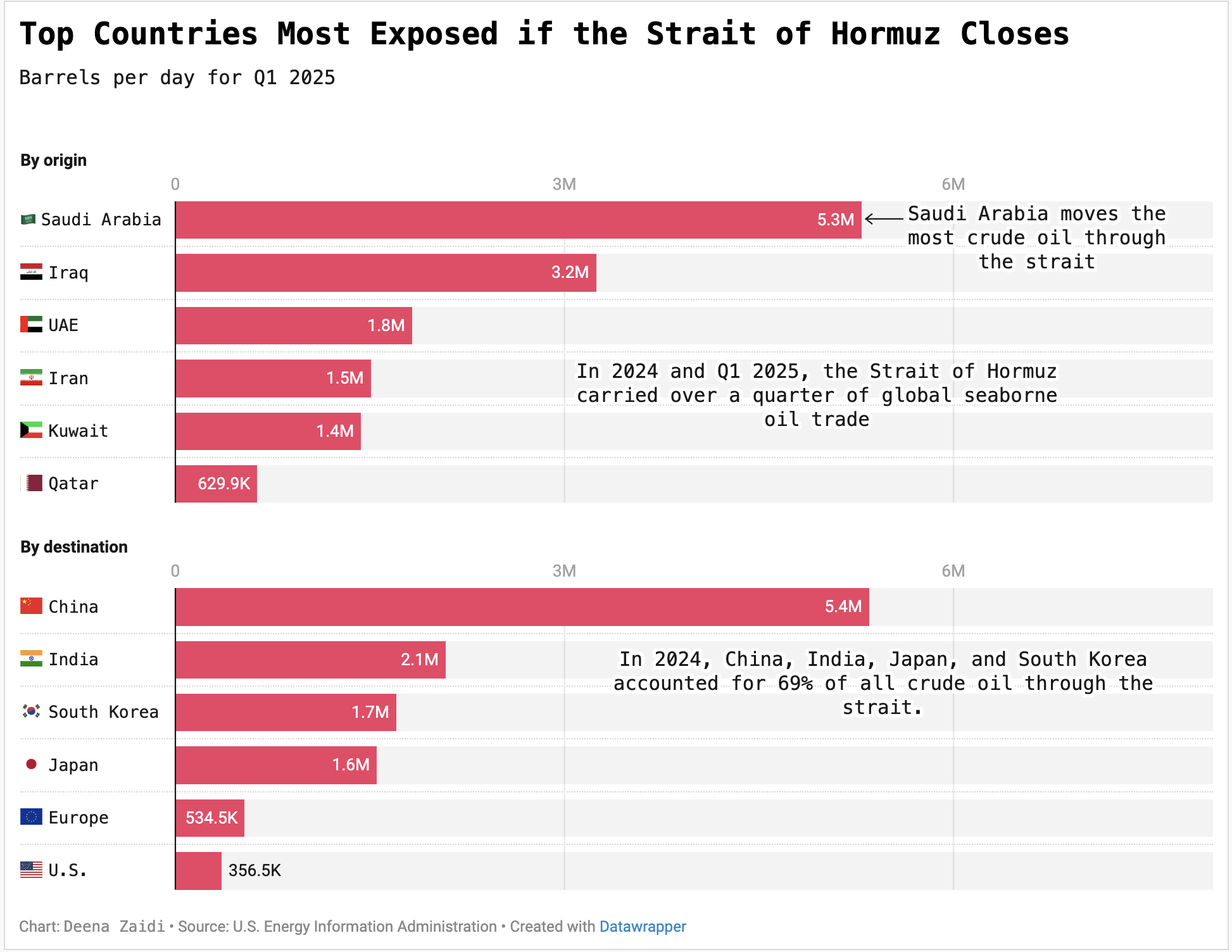

Over a quarter of global seaborne oil flows through the Strait of Hormuz—making Asia’s top economies especially vulnerable to any disruption.

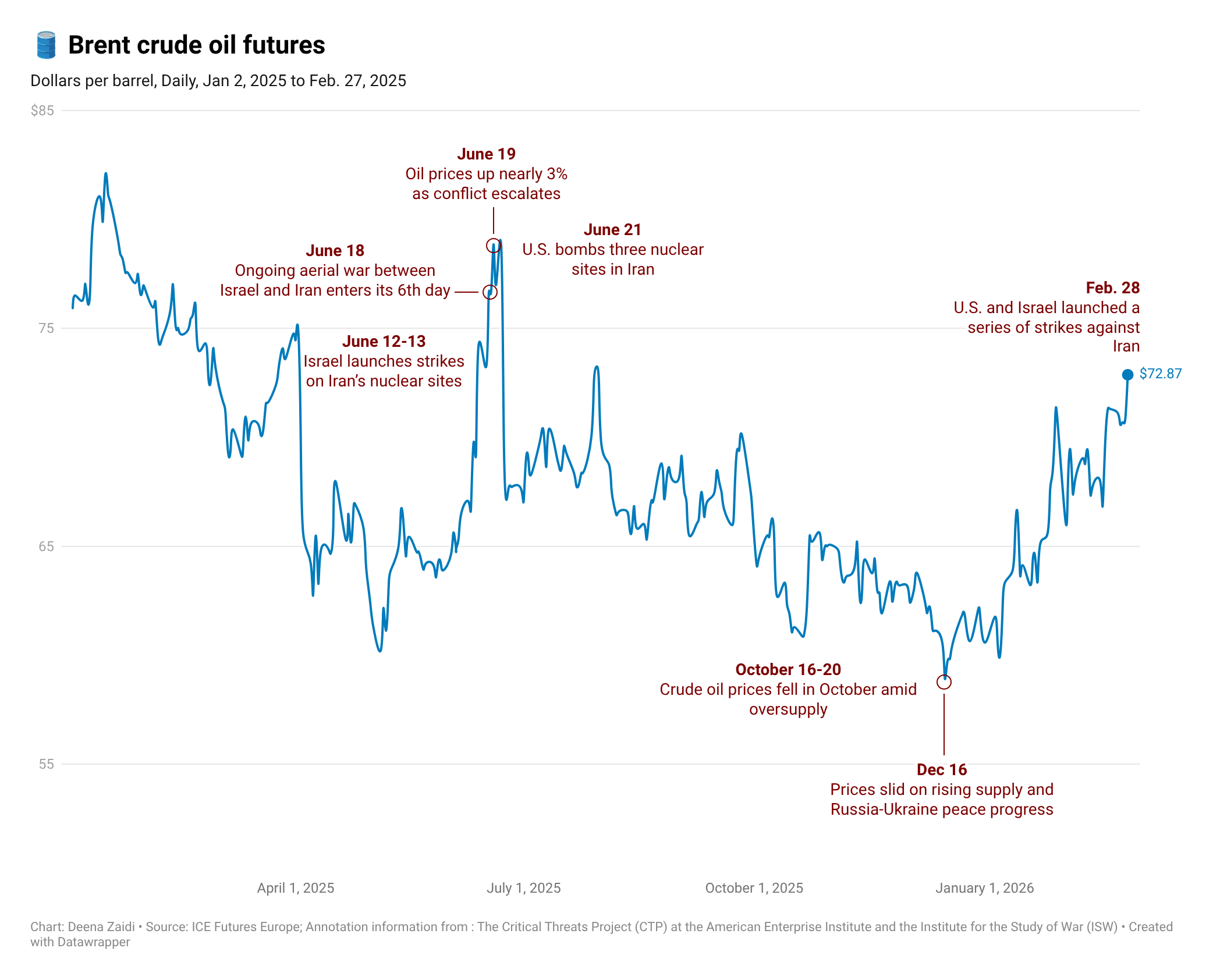

Israel’s strikes on Iran’s strategic sites have sent Brent crude and gold prices sharply higher, while potential threats to Kharg Island and the Strait of Hormuz chokepoints could force shipping reroutes, risking wider global supply-chain disruptions.

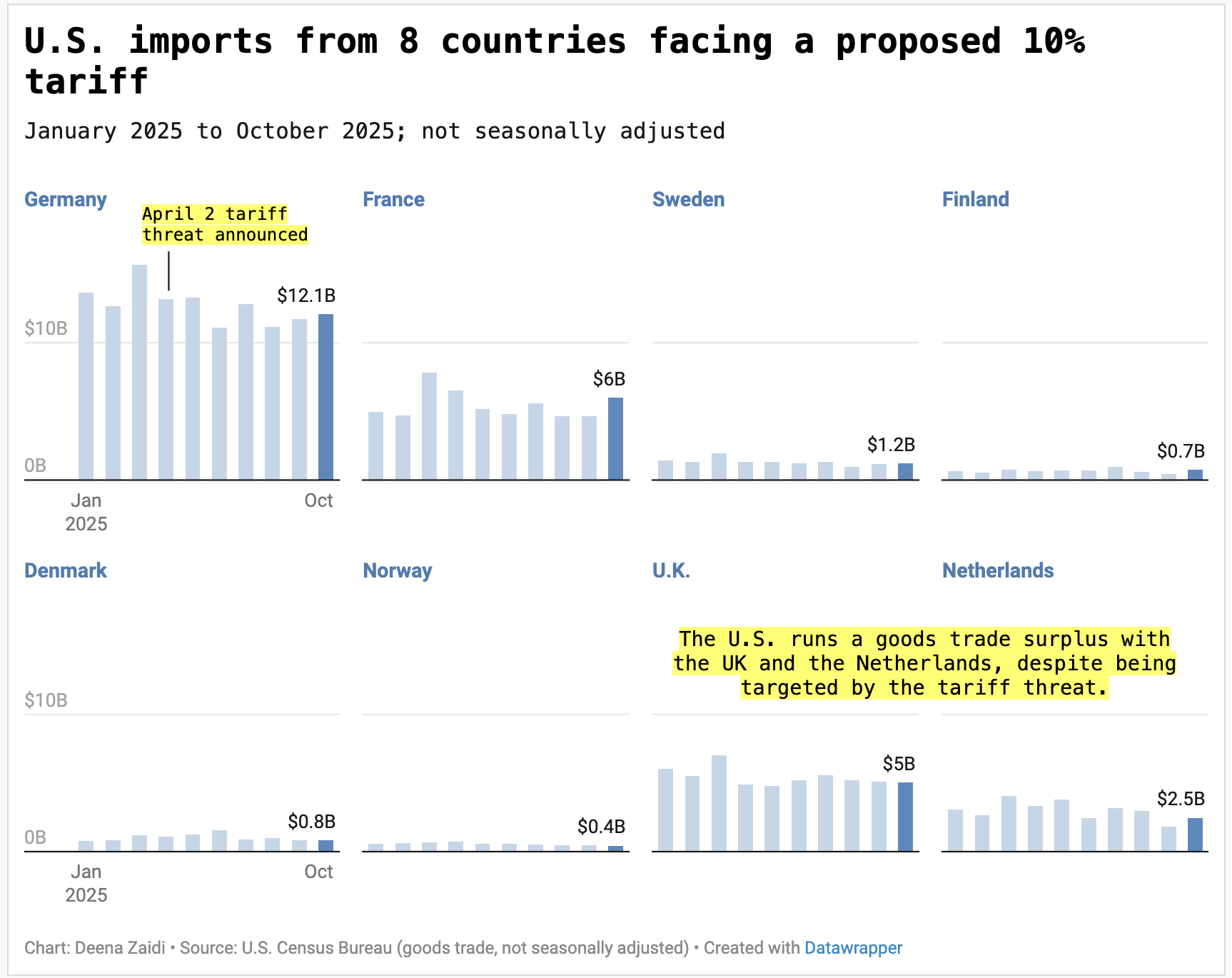

President Donald Trump said the U.S. will impose a 10% tariff on imports from eight European countries starting February 1, tying the move to opposition over Greenland.