Governments and energy producers are racing to protect global oil flows as risks rise around the Strait of Hormuz.

Data & financial journalist covering global economics and policy

Governments and energy producers are racing to protect global oil flows as risks rise around the Strait of Hormuz.

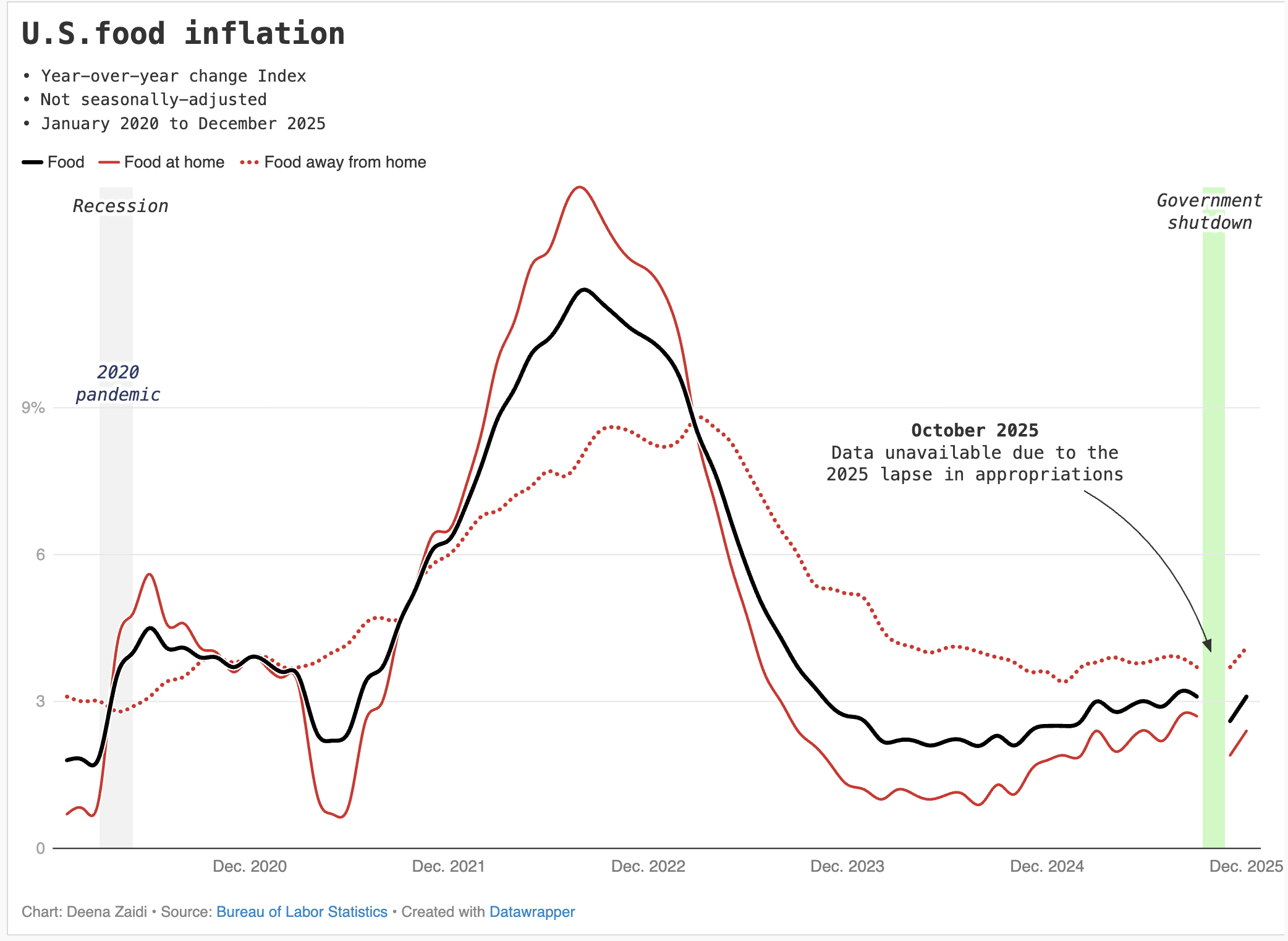

U.S. food inflation has cooled sharply from its pandemic-era peak — but the latest data come with an unusual warning label.

In 2025, the U.S. economy didn’t simply cool or rebound but changed in ways that were visible in the data itself.

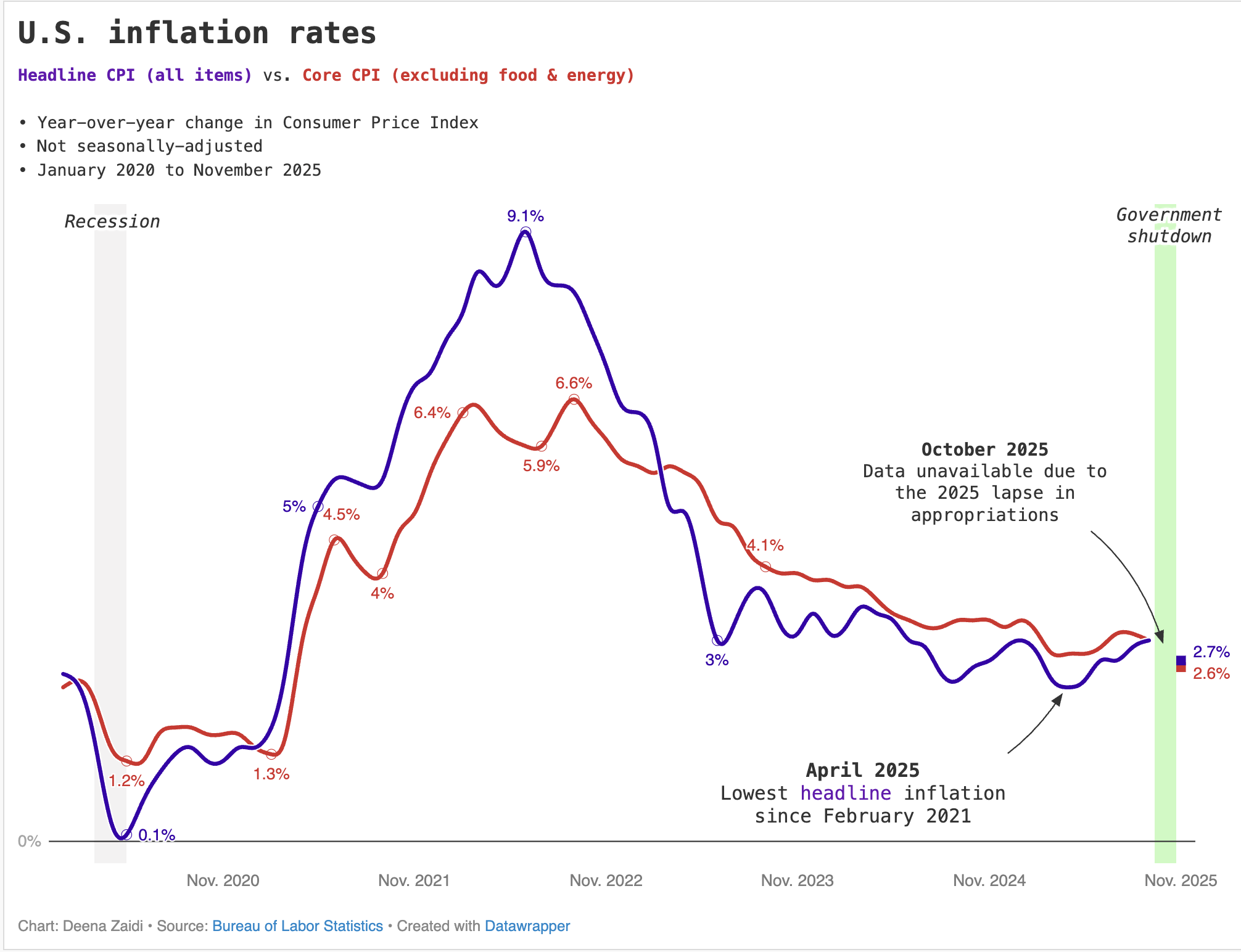

A shutdown distorted inflation, tariffs reset global trade, U.S. debt buyers quietly swapped places, and food prices surged. I pick five charts that captured how policy and politics reshaped the American economy in 2025.

U.S. inflation cooled sharply in November, but the 2.7 percent reading is not considered official after a government shutdown forced changes in how the CPI was calculated.