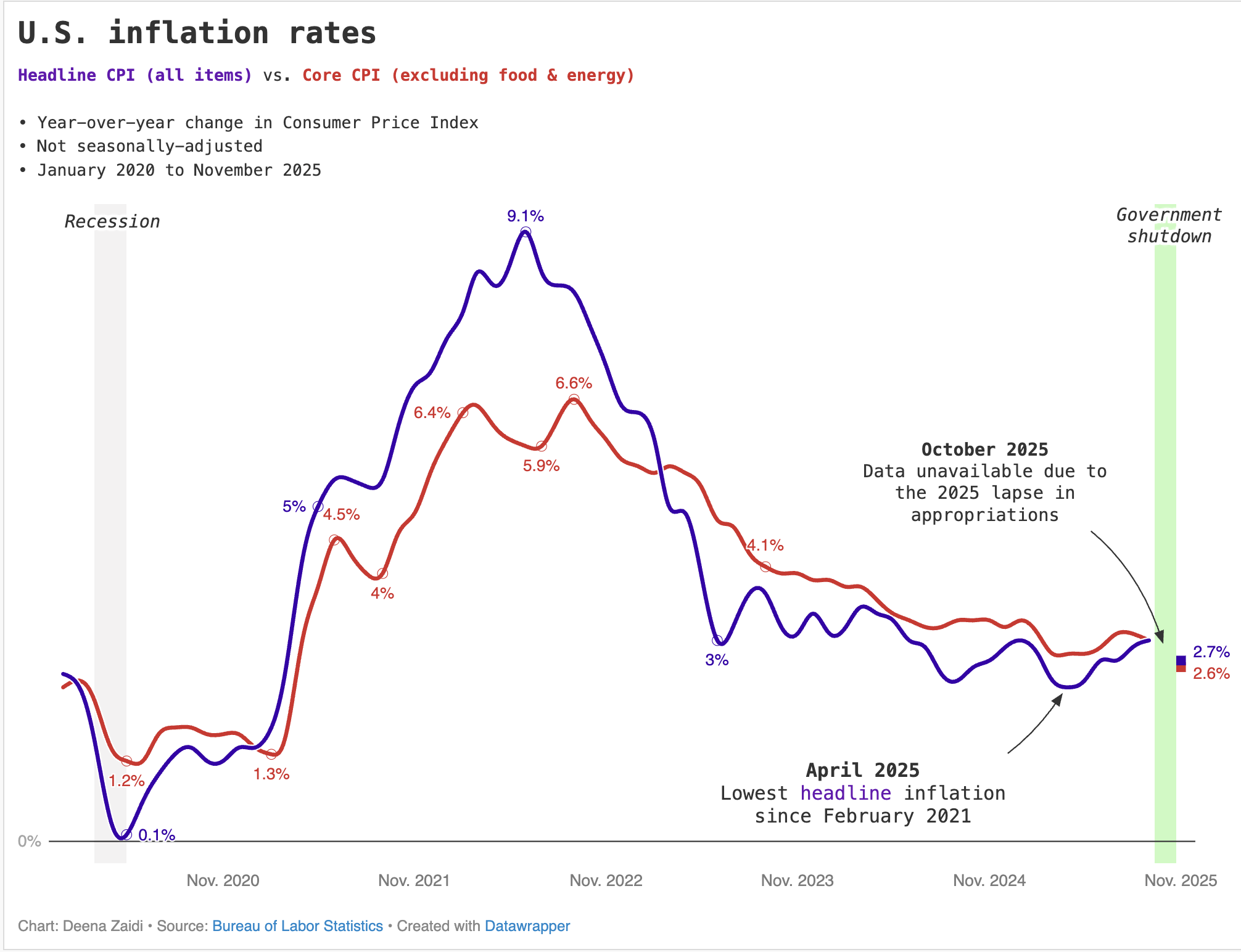

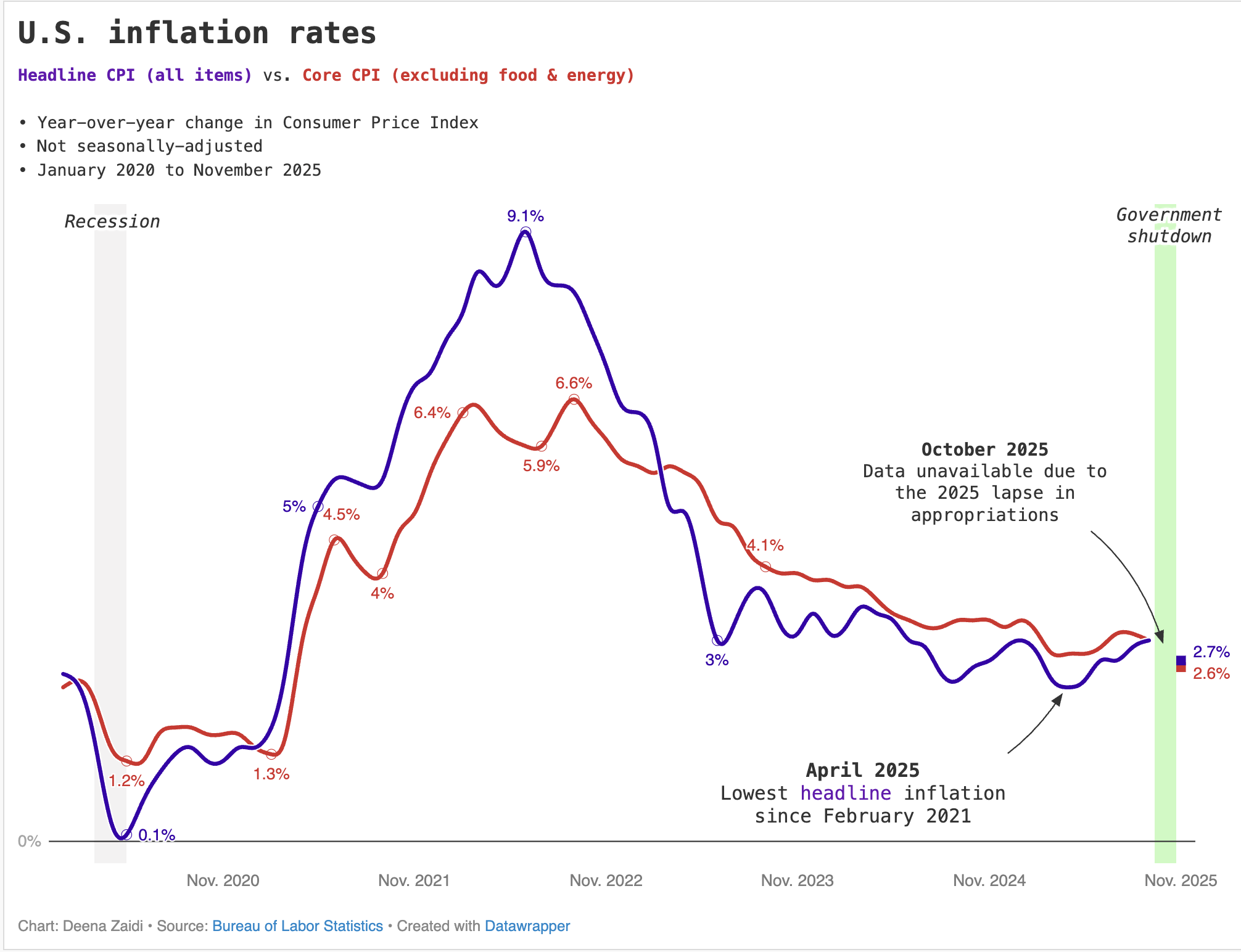

U.S. inflation cooled sharply in November, but the 2.7 percent reading is not considered official after a government shutdown forced changes in how the CPI was calculated.

Data and Financial Journalist

U.S. inflation cooled sharply in November, but the 2.7 percent reading is not considered official after a government shutdown forced changes in how the CPI was calculated.

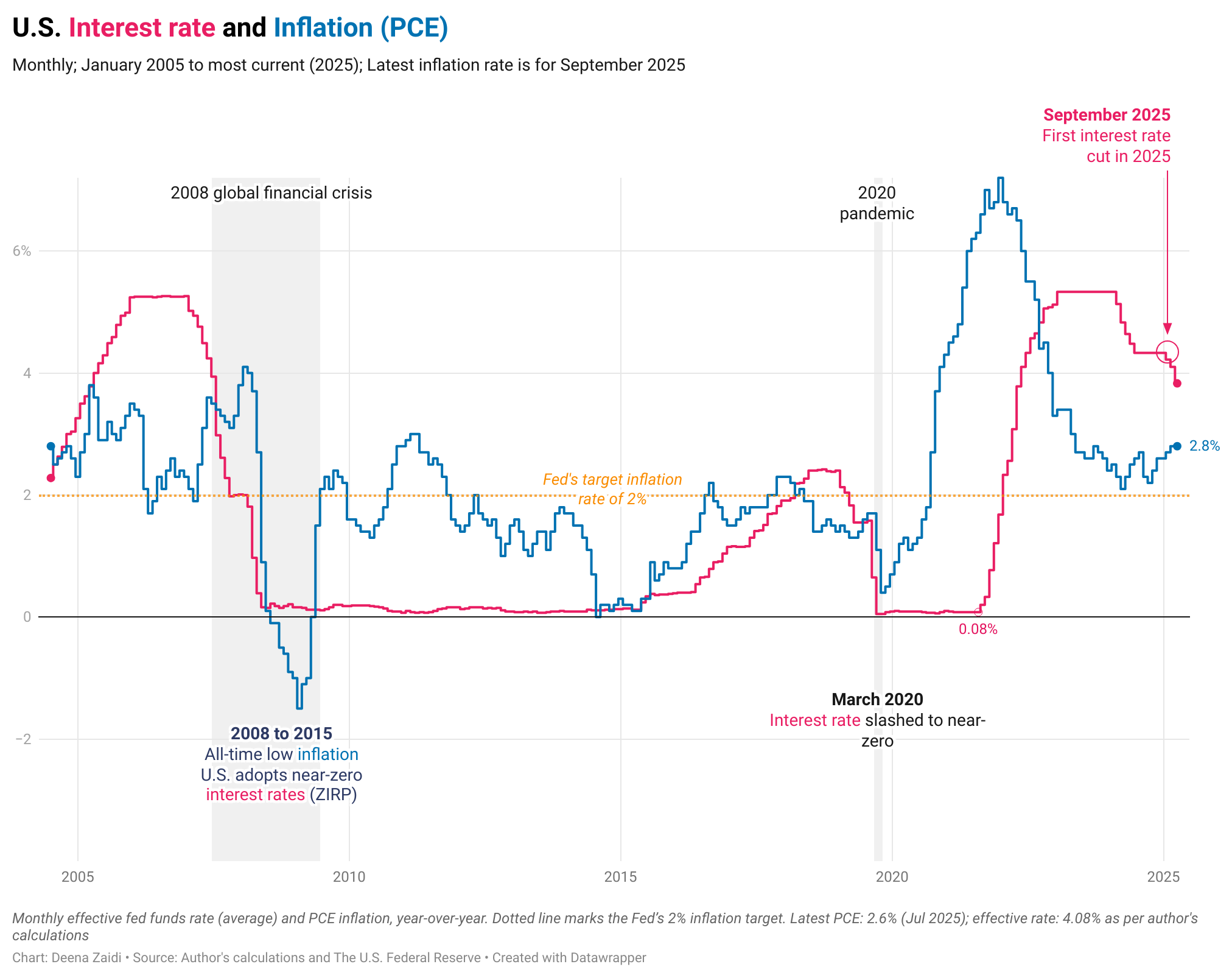

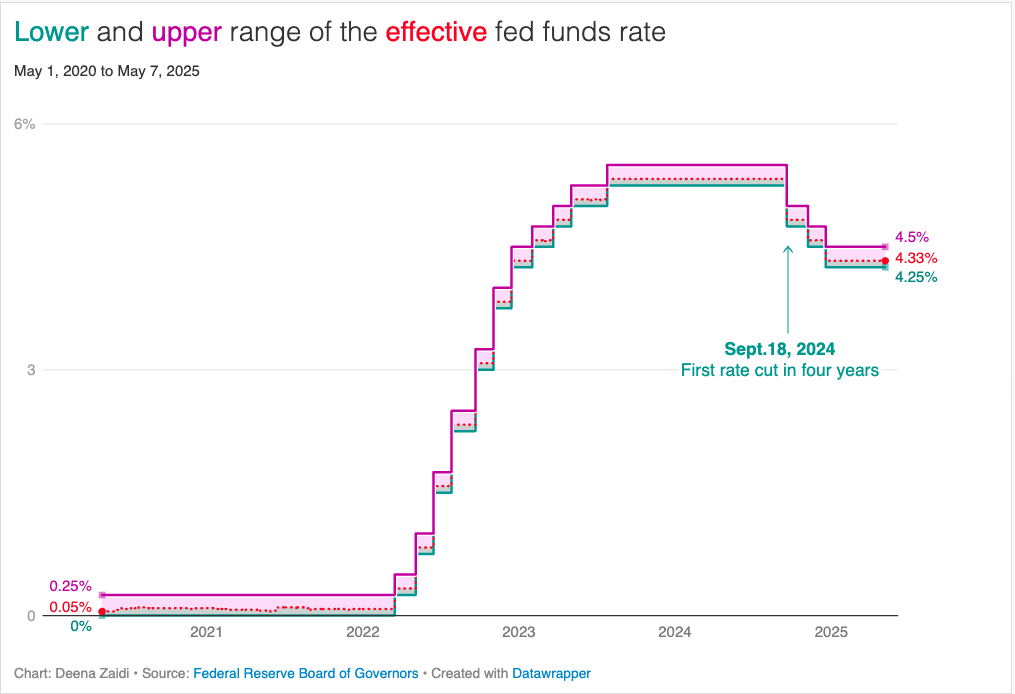

Persistently high inflation makes this reduction a tricky one. The interest rate cut is the first in Trump’s second term as well as the first in 2025.

In Japan, the only Asian economy in G7, core inflation rose at its fastest annual pace in over two years, climbing to 3.5% in April, according to data released Friday. I mapped the inflation (with some caveats) to look at the overall inflation trend in G7 economies.

Inflation fell to 2.3% in April. The Fed is keeping rates steady at 4.25%-4.5% as new tariffs fuel inflation risks, prompting a cautious wait-and-see approach.