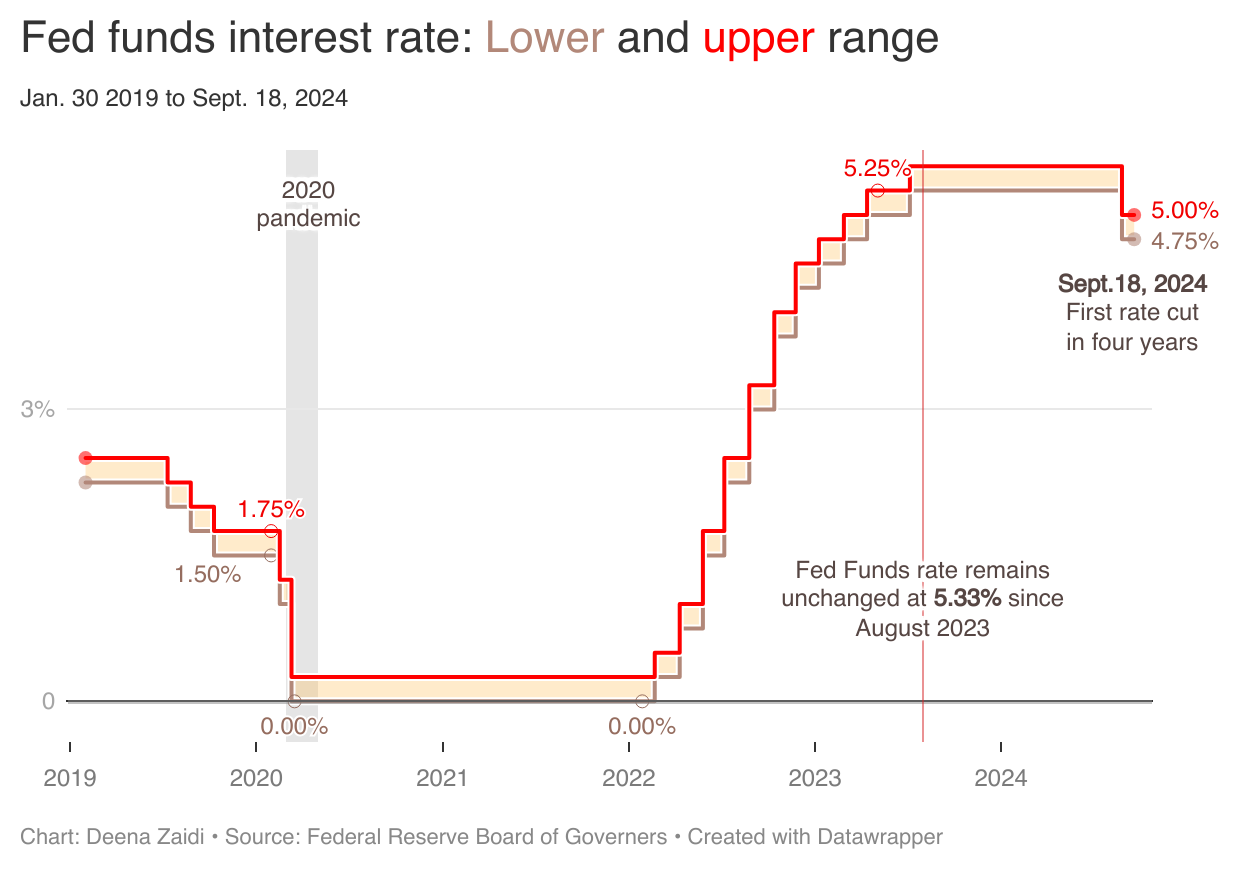

On Sept. 18, 2024, in an aggressive move, the Federal Reserve announced an interest rate cut of 50 basis points—its first since March 2020.

- A rate cut of any size would be the Fed’s first in more than four years and is considered a big move ahead of the U.S. presidential election.

- The Federal Open Market Committee (FOMC) stated, “The Committee has gained greater confidence that inflation is moving sustainably toward 2% and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

- “The economic outlook is uncertain,” according to the release.

First, The Fed is always cautious about cutting interest rates too early. However, current macroeconomic data indicates it’s about time—especially with recent inflation at a three-year low (2.5%) and sluggish jobs report.

- Some experts believe that the Fed’s target inflation is already off by 75 basis points and the central bank is a bit late in cutting back on rates—at least by Taylor’s rule, which captures the approximate relation between the Fed’s policy rate target and its dual mandate macro indicators (inflation and unemployment)

- The effective Fed Funds rate is the interest rate banks charge each other to borrow overnight. When necessary, the Fed raises or lowers its target range for the federal funds rate.

- Lowering the target range means “easing” of monetary policy, often accompanied by lower short-term interest rates in financial markets. This is typically ideal for a sluggish economy or during low inflationary conditions.

- Raising the target range represents a “tightening” of monetary policy, which raises interest rates, typically needed for an overheated economy or high inflationary conditions.

- When the Fed sets a target for interest rate, it commits itself to adjusting the money supply.

- To lower the Fed Funds rate, the Fed’s bond trades buy government bonds, increasing the money supply which in turn lowers the equilibrium interest rate.

Economic impact: Changes in the target range for the federal funds rate influence short-term interest rates for other financial instruments, especially the spending decisions of households and businesses.

- Collectively these have broader implications on economic activity, employment and inflation.

The lagging effect: Changes in the federal funds rate don’t immediately impact inflation.

- There’s often a lag between changes in monetary policy and their effect on the economy.

- In short, it might take several months to years for changes in interest rates to fully influence inflation.

Also sharing this interesting insight by The Wall Street Journal: “Fed Enters Tricky Terrain: Rate Cuts in a Decent Economy”