Gold prices set a new record high on Tuesday, topping $2,760 per ounce at one point, amid moves by global central banks as international tensions grow.

Central bank purchases have been key in driving up gold, often considered a haven in times of uncertainty and turmoil. Global uncertainties and the Federal Reserve slashing interest rates this year giving bullion a lift.

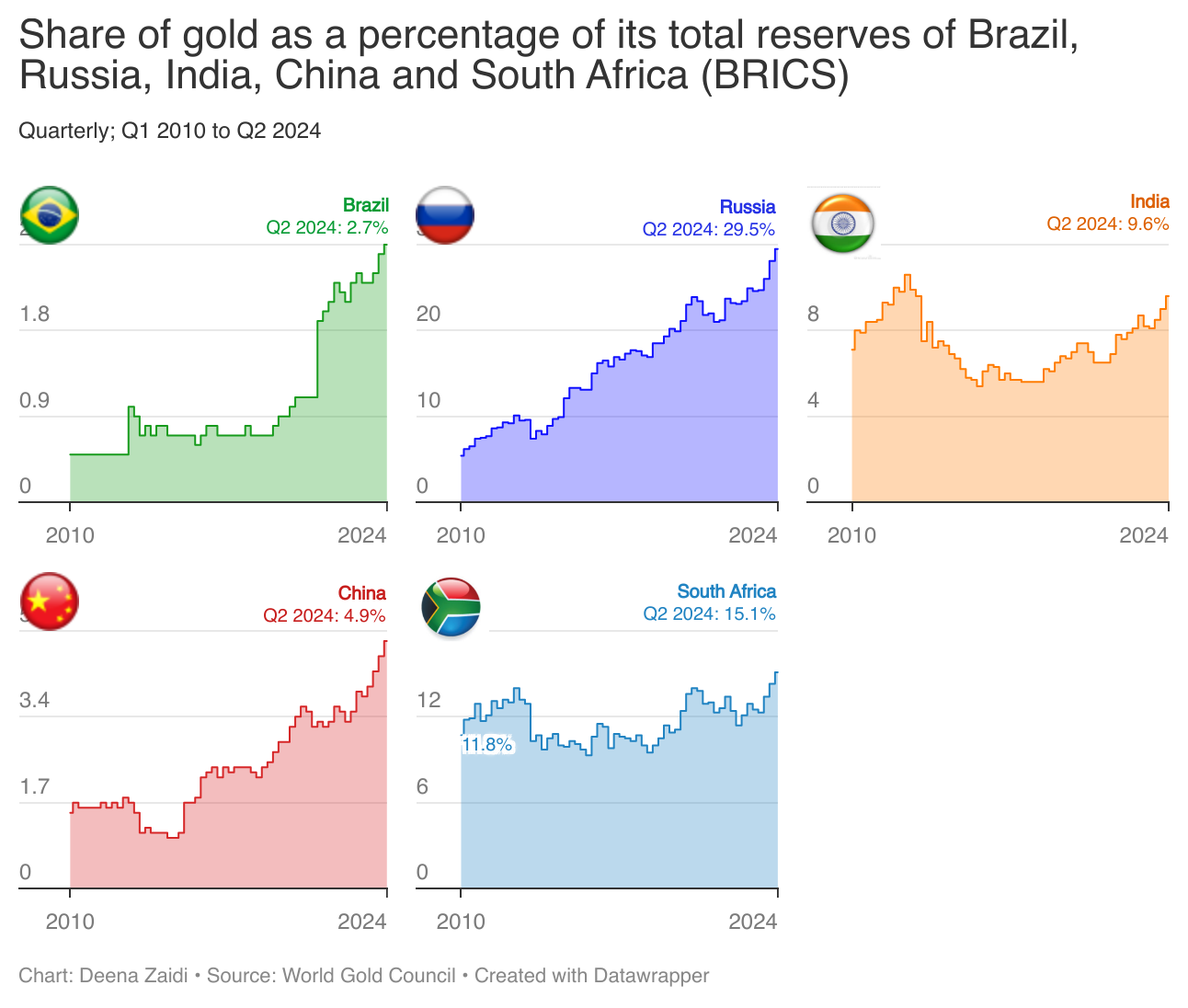

The value of the U.S. dollar trades inversely to gold and more developing countries are aiming to lessen dependence on the U.S. dollar or de-dollarize. Together, BRICS (Brazil, Russia, India, China and South Africa) hold 20% of the world’s gold reserves and have been increasing their share of gold reserves.

Three of the BRICS members, namely China, Russia, and South Africa are also major players in worldwide gold mining, which affects the prices of gold. Russia and China hold 74% of BRICS’ total gold reserves, making the precious metal a potential hedge against the U.S. dollar dominance. This year is the first BRICS summit after Egypt, Ethiopia, Iran, and the UAE joined the bloc.

In April this year, the world’s second-largest economy, China led the pack, stockpiling gold for the 17th straight month. In 2023, the People’s Bank of China (PBOC) outpaced all central banks, steadily beefing up by adding 225 tons of gold to its reserves, the highest increase since 1977, with total gold reserves reaching 2,235 tons by the end of December last year. As of the second quarter of 2024, China’s total reserves included 4.9% of gold reserves, a huge jump from 1.5% in 2010.

Russia continued to trade and grow despite sanctions in 2022 through alternative payment methods involving a few countries. This allowed it to bypass the U.S. dollar. Gold demand has been on the rise in India after recent tariff cuts in July this year. As of the second quarter of 2024, 9.6% of total reserves were gold, a huge rise from 6.5% in the same quarter three years ago.

Bullion is also used by investors as a hedge against market and global risk and that’s probably a reason why Costco started selling gold bars last year.

Gold reserves still make up a large portion of most global central bank reserves and the U.S. leads with 72.41% of its total reserves in gold, which is 8,133 tons as of the second quarter of 2024.

During the same quarter central banks of Uzbekistan and Portugal, each had 75% and 74% of their total reserves being gold, respectively. Countries in Europe including Germany, France, Italy and Austria follow closely after.

For most central banks the rush to hoard gold isn’t just about financial strategy, but it’s often tied to geopolitical woes. After the EU and US slapped Russia with sanctions, which included freezing its central bank’s foreign reserves, it made many central banks rethink the kind of reserve assets they should be holding.

On Thursday gold market powered ahead as the market continued to focus on overall factors, such as geopolitical risk, interest rates, and gold reserves held by central banks