In June, foreign investors went on a Treasury-buying spree, pumping tens of billions into the U.S. economy within a month, while Hong Kong, Ireland and India trimmed their share.

For starters: American debt can be bought via U.S. Treasury securities (these are either through bills, notes or bonds), which represent an IOU from the government to the investor.

- While majority of the debt is owed domestically, foreign investors currently hold over $9 trillion.

- For many years, China was America’s biggest creditor, but geopolitical tensions between the two superpowers sparked some significant changes.

The data: Recent data from the U.S. Department of Treasury shows heavy foreign buying resulted in overall gain in net foreign inflows into the U.S. financial assets despite private investment slowing down.

- Total foreign holdings of U.S. Treasuries touched $9.13 trillion in June, up from $9.05 trillion in May.

- Treasuries owned by foreigners were up nearly $1 trillion, at least 10% higher from the previous year.

- Over the past month, U.K, Belgium, and Norway have been steadily increasing their share of U.S. Treasuries, while countries such as Ireland, India, China, and Hong Kong are pulling back.

Data caveats: The U.S. Treasury data reflects where securities are held which is not based on investors’ nationality, so some holdings may represent money from other countries.

- Some of the largest holders are international financial centers whose clients are presumably based elsewhere.

Who holds the most U.S. debt?

And it has long remained the largest foreign holder of U.S. debt, with a record $1.15 trillion in June, up $12.6 billion from the previous month’s $1.13 trillion, followed by the UK ($858 billion) and China ($756 billion).

But British holdings have climbed steadily

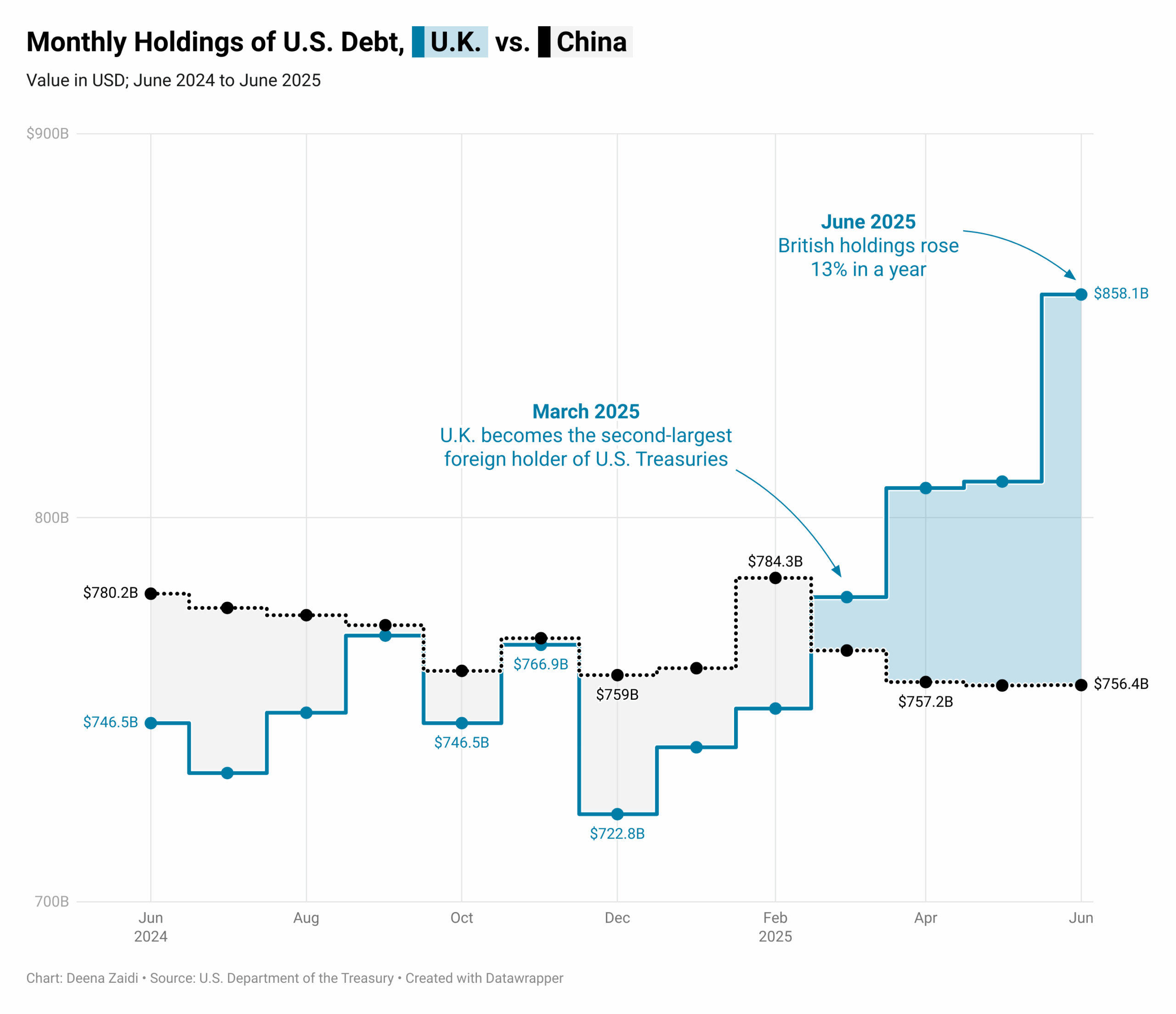

In one year, U.K. holdings of U.S. Treasuries jumped 13%, from $747 billion in June 2024 to a record $858 billion in June 2025. About 6% of that increase came in June alone.

- The country overtook China in March to become the second-largest foreign holder of U.S. debt.

- China, meanwhile, has been cutting back since the pandemic, selling Treasuries to support its currency, the yuan.

- In May, its holdings fell to $756 billion — the lowest since February 2009, when they dropped to $744 billion.

- Britain’s role is somewhat unique: it acts as a custody hub, meaning much of the buying runs through the financial hub of London on behalf of hedge funds and other investors — similar to the Cayman Islands or the Bahamas.