Foreign investors held $9.1 trillion in U.S. Treasuries as of May, up 11% from $8.1 trillion a year earlier, according to the recent Treasury International Capital (TIC) data from the U.S. Department of the Treasury

The current country’s national debt is $36.6 trillion.

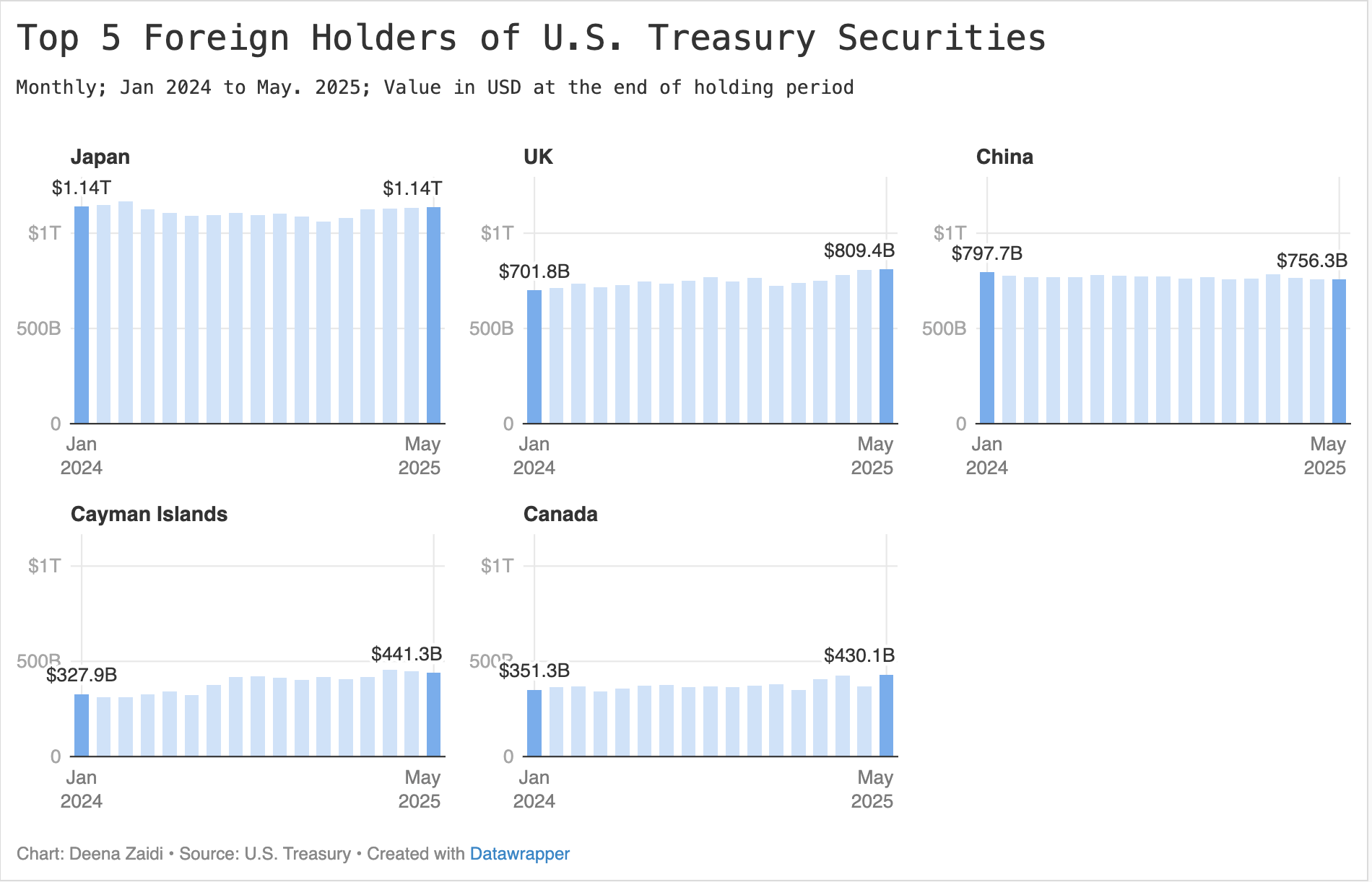

While total foreign holdings of U.S. securities rose 5% from January to May, Canada emerged as the most aggressive buyer. The leading trade partner increased its holdings by 22% to $430 billion in a span of five months—the largest jump by any country this year.

Data from Statistics Canada | Statistique Canada shows strong foreign divestment in Canadian shares during the month, and more exposure to foreign securities

Other top gainers included the UAE, France, and Belgium, each posting double-digit increases.

Meanwhile, Ireland, Germany, Hong Kong and China decreased their holdings during the same period.

So which country is the largest foreign holder of U.S. securities?

Japan remains the largest foreign holder of U.S. debt, with over $1 trillion, followed by the UK ($809 billion) and China ($756 billion).

But China’s role is shifting.

Despite a brief boost of $784 billion n February this year), it has since cut its holdings by 4%, following a broader multi-year trend of divestment.

The graphic below highlights the major foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury, as of May 2025.