Israel’s targeted airstrikes on Iranian nuclear and military sites has already rattled global markets.

Market Shock: Brent & Gold Spike

Albeit brief, the Brent crude futures was up nearly 10%, briefly, as counterstrikes raised fears of a wider regional war.

An escalated conflict between Iran and Israel means oil supply disruption. In February this year, Iranian oil exports had held strong which led to an increase in the overall output generated by the Organization of the Petroleum Exporting Countries (OPEC).

But oil isn’t the only commodity getting impacted. Safe-haven assets such as gold climbed toward multi-year highs. The gold price hit its highest level for nearly two months, rising 1.2% to $3,423.30 an ounce.

Ripple effects extend beyond oil and gold: maritime insurers and freight ships are already repositioning fleets to avoid high-risk corridors. These adjustments could spill over causing supply disruptions, inflating costs for bulk commodities and manufactured goods moving between regions of Asia, Europe, and North America .

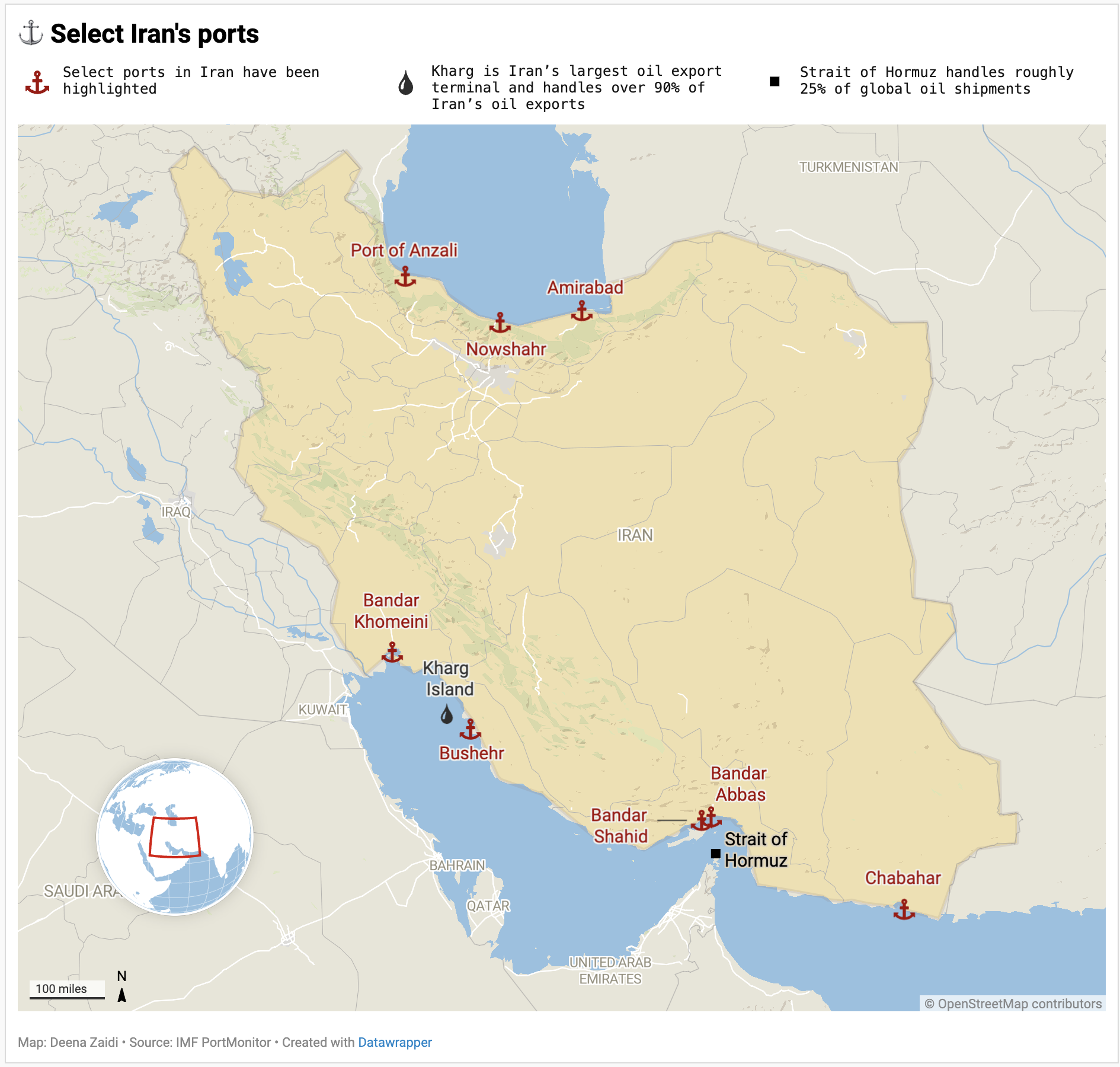

Iran’s key ports handles trade of products such as vegetables, minerals and metals but the oil trade volume typically passes through critical channels of Kharg Island and Strait of Hormuz.

Kharg Island- Iran’s “oil island”

Over 90 % of Iran’s crude exports are loaded at Kharg Island terminal before being shipped to global markets and an escalation could choke the oil supply. Iran had recently boosted its oil storage capacity by 2 m barrels at some refurbished Kharg terminals. Any attack on Iran’s oil island could send Brent crude prices soaring.

Strait of Hormuz: 20M bpd at Risk

The narrow passage between Iran and Oman, known as the Strait of Hormuz- is a linchpin for global crude flows since 20 million barrels daily transit this route—this is roughly 25% of global oil shipments. In the past, Iran has warned to shut down the critical Strait of Hormuz to traffic in retaliation for Western pressure. A closure of the Strait could mean trade disruptions, overcrowding of alternate routes, and impact global oil prices.

Shipping continued through the Strait of Hormuz, at the time of writing this story. Even though a most part of the Strait lies in Oman, Greece and U.K. advised merchant ships to avoid the Strait of Hormuz.

Shipping Reroutes & Supply-Chain Costs

Global oil markets now face the prospect of sustained disruptions, since roughly one-fifth of the world’s crude exports flow through the Strait of Hormuz. While OPEC+ producers retain spare capacity, most of it resides in Persian Gulf states where the risk of military spillover is highest.

The U.K. Maritime Trade Operations centre has urged ships to steer clear of the Gulf of Aden, which could potentially add up to two weeks in transit time for some routes.

Caution is being taken to transit the Arabian Gulf, Gulf of Oman and Straits of Hormuz and vessels have been advised to report incidents or suspicious activity.

Unless diplomatic channels defuse the standoff, the risk premiums on energy and shipping could remain elevated for weeks. But the International Energy Agency in its release said there’s plenty of oil to cushion any shortfall: non-OPEC+ production is rising faster than demand.

Non-OPEC+ output is forecast to rise by 1.3 mb/d this year—nearly double the 700 kb/d growth in global demand, according to IEA. The IEA member governments collectively hold over 1.2 billion barrels of emergency reserves, ready to be released to the market in case of a severe disruption.