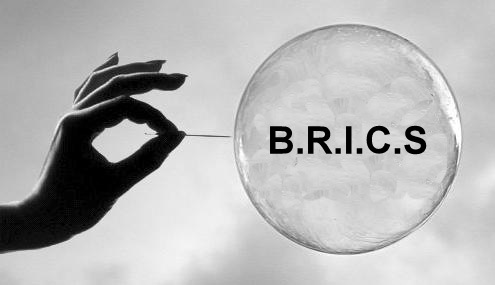

While the nations involved remain very optimistic about getting co-operation especially during meetings, it might not be as simple and easy as it seems. While emerging markets have their own tale to tell and could be struggling economically, things might appear difficult in the long run.