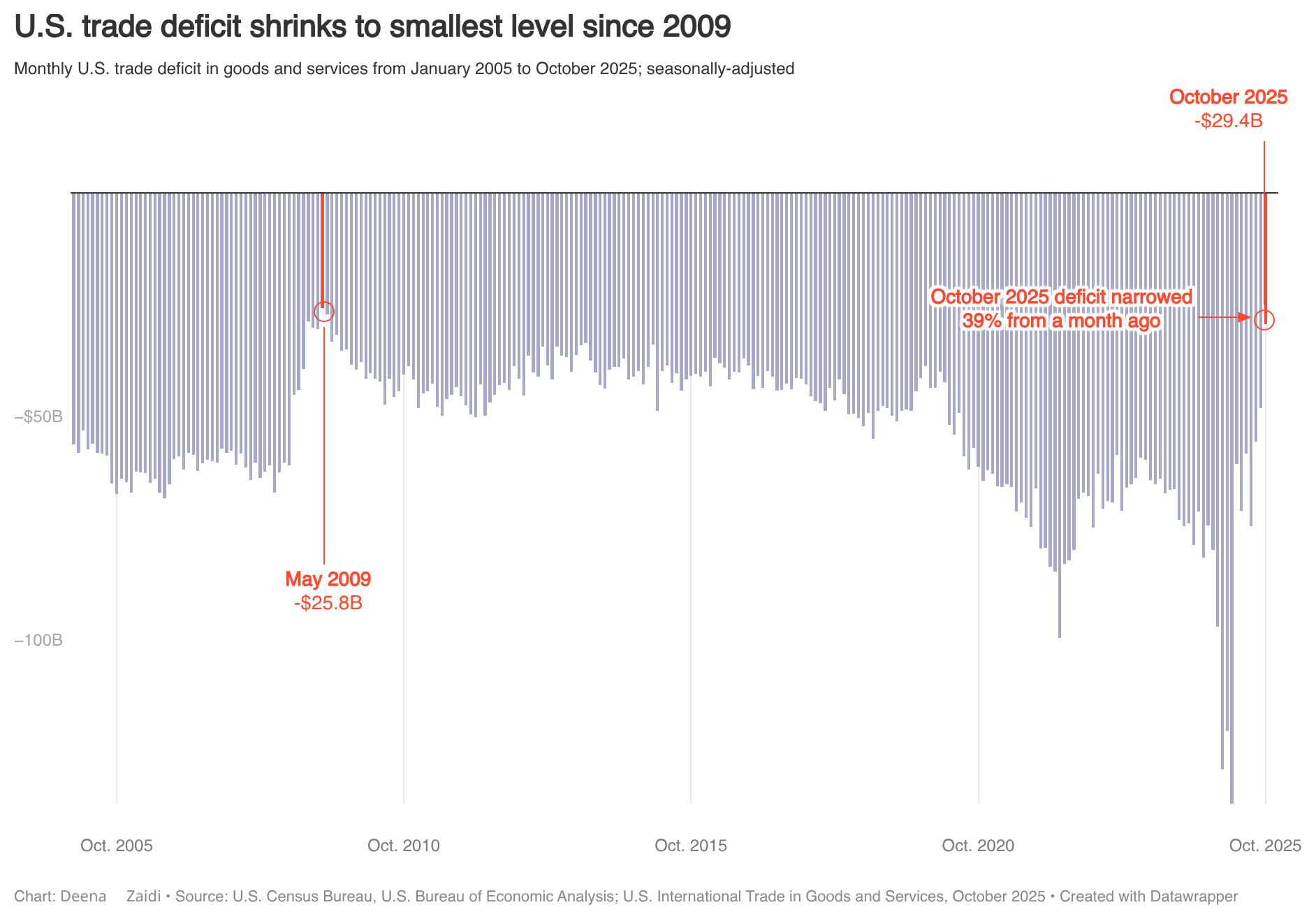

The U.S. trade deficit narrowed dramatically in October 2025, falling to $29.4 billion, the smallest monthly gap since May 2009, according to new data from the U.S. Census Bureau and Bureau of Economic Analysis. That represents a 39% drop from a revised $48.1 billion deficit in September.