China’s central bank is exploring the idea of establishing overseas warehouses to help settle certain products traded on the Shanghai Gold Exchange (SGE).

“We will support the Shanghai Gold Exchange and other institutions in cooperating with overseas exchanges through product licensing, and expand the use of renminbi-denominated benchmark prices in major international markets,” according to a joint statement released on Monday by the People’s Bank of China, the National Administration of Financial Regulation, the State Administration of Foreign Exchange and the Shanghai Municipal People’s Government.

The People’s Bank of China (PBoC) has been adding gold to its reserves for five consecutive months: March saw a 2.8 tons reported addition to China’s official gold holdings and Q1 ended with a net gain of 12.8 tons.

According to the World Gold Council, the global gold price strength will be boosted by a re-structuring of the world trade order and the world market volatility.

The exchange will also be encouraged to partner with international markets to boost the global use of its yuan-denominated gold benchmark. The news comes at a time when the trade war between China and U.S. has intensified.

Chinese insurers entered the gold market with four companies as SGE members on March 24 this year. They executed their first trades of SGE gold contracts the following day. This potentially could mean long-term investments to offset any losses from rising trade uncertainty and tariff risk imposed by the U.S.

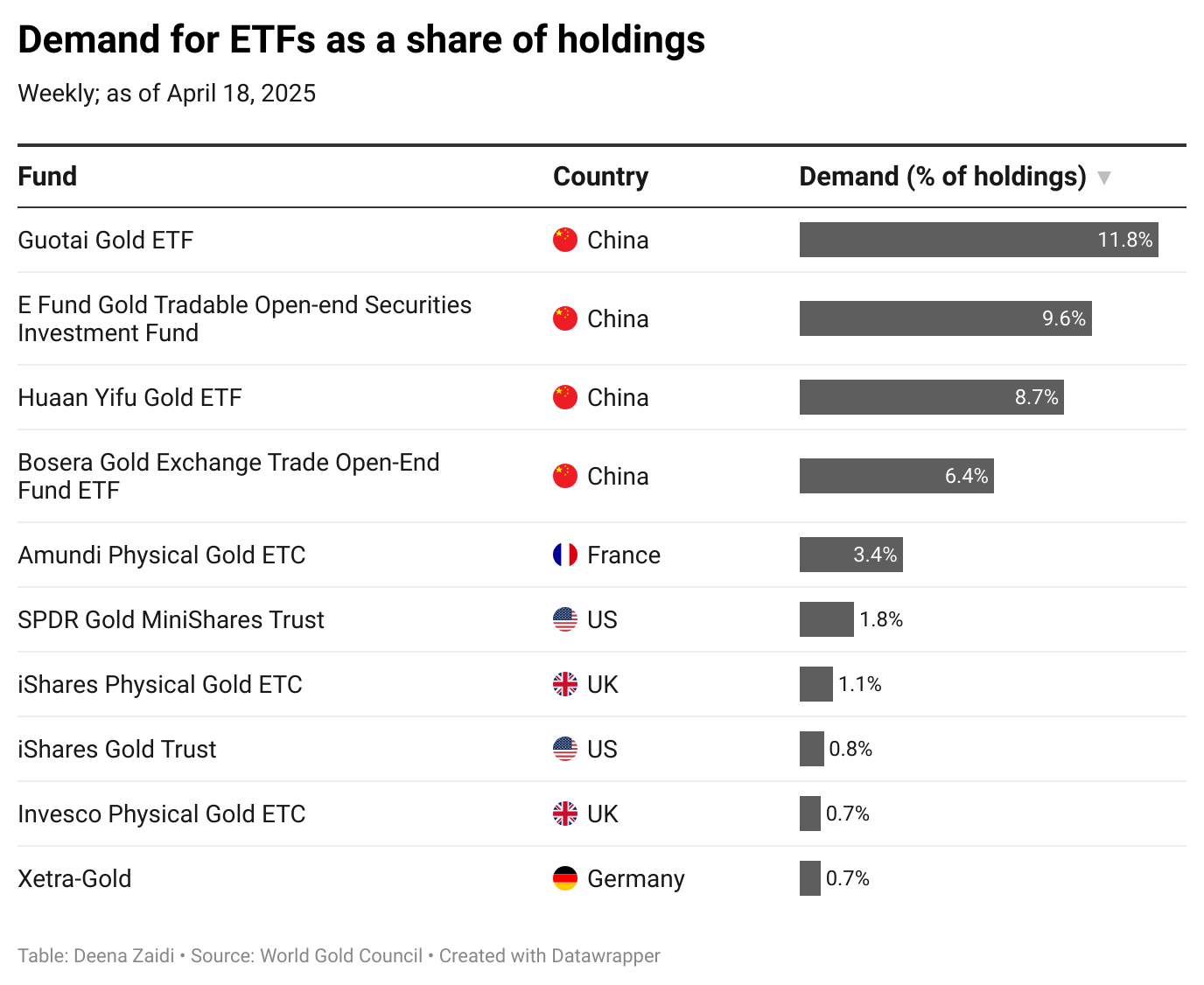

The gold ETF demand has also risen amongst investors. During the first two weeks of April, Chinese gold ETFs’ collective holdings surged another 29 tons. Demand for physically-backed gold exchange-traded funds (Gold ETFs) from China showed an uptick.

Central bank purchases have also been key in driving up gold, since the yellow metal is considered a haven in times of uncertainty and turmoil. Global uncertainties and the Federal Reserve slashing interest rates had given the bullion a lift.

The value of the U.S. dollar also trades inversely to gold and more countries are aiming to lessen dependence on the U.S. dollar, largely owed to the tariff risk.