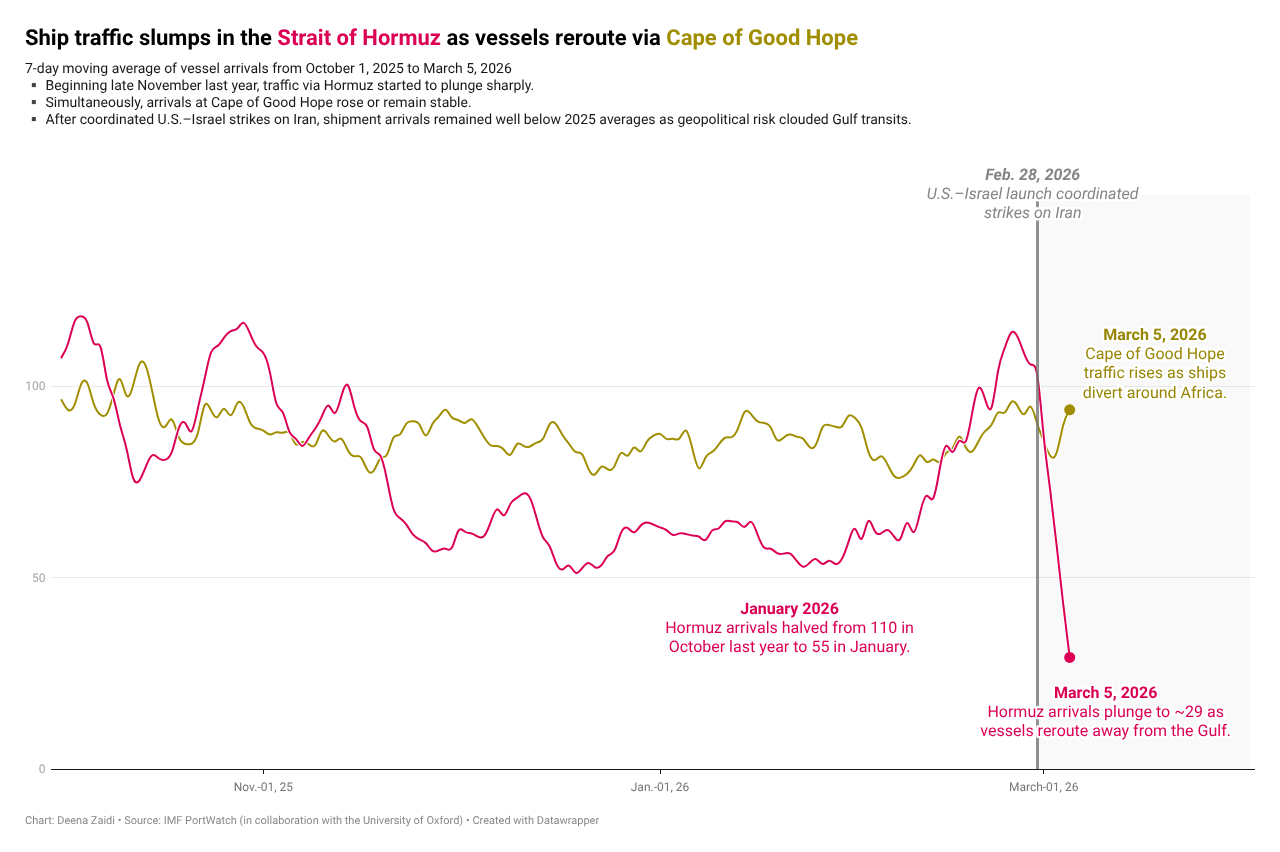

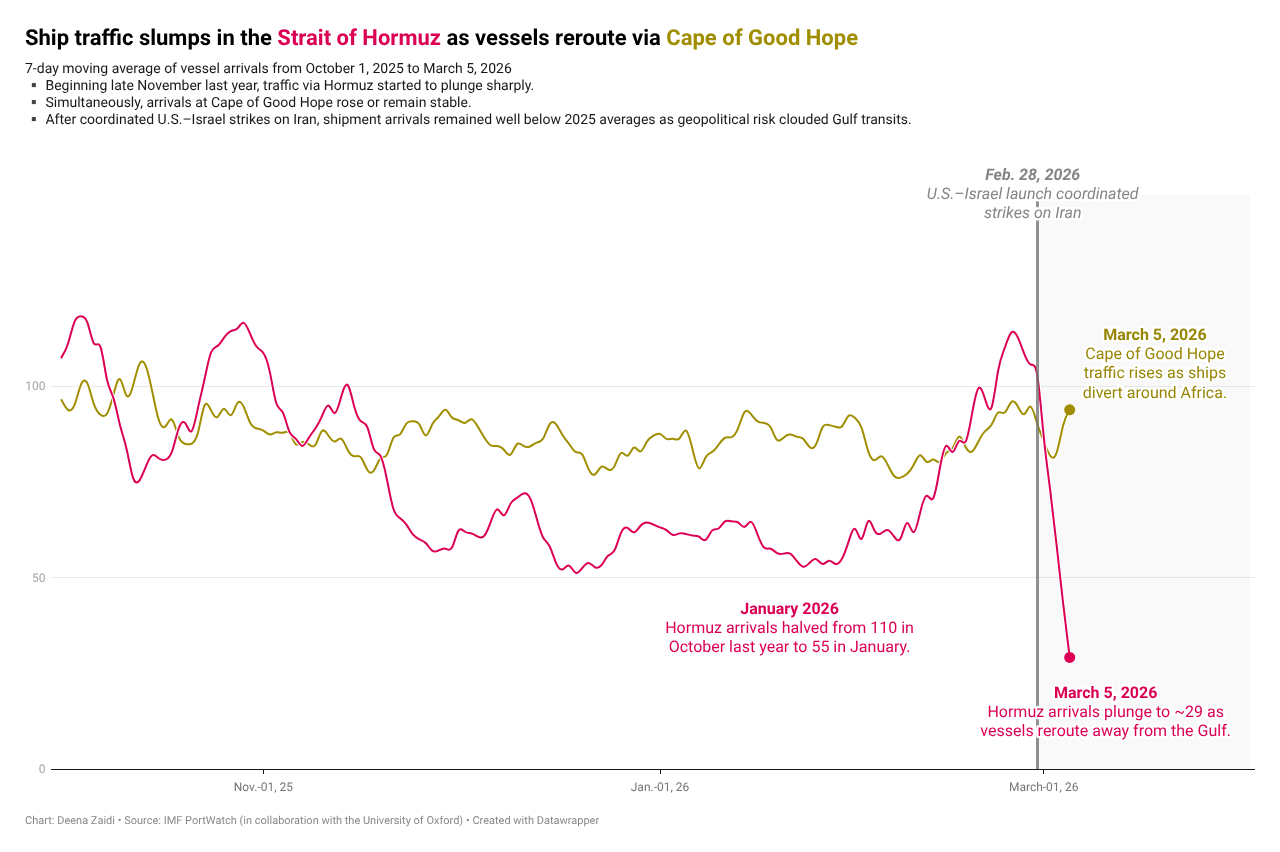

Ship traffic through the Strait of Hormuz is falling sharply as vessels avoid the Gulf following U.S.–Israel strikes on Iran, pushing oil prices to a 19-month high on fears of supply disruptions.

Data & financial journalist covering global economics and policy

Ship traffic through the Strait of Hormuz is falling sharply as vessels avoid the Gulf following U.S.–Israel strikes on Iran, pushing oil prices to a 19-month high on fears of supply disruptions.

Following series were published in June, 2025 and is being republished due to the recent shift in geopolitics around the Strait

Over a quarter of global seaborne oil flows through the Strait of Hormuz—making Asia’s top economies especially vulnerable to any disruption.

In 2025, the U.S. economy didn’t simply cool or rebound but changed in ways that were visible in the data itself.

A shutdown distorted inflation, tariffs reset global trade, U.S. debt buyers quietly swapped places, and food prices surged. I pick five charts that captured how policy and politics reshaped the American economy in 2025.