The U.S. received its biggest downgrade among advanced economies from the International Monetary Fund (IMF) as a result of tariff uncertainty.

“The global economy is at a critical juncture,” the report said.

The international organization revised its estimates, citing a 37% probability of the country going into recession this year, up from 25% in its October estimate last year. The US inflation forecast was also raised by 1 percentage point, up from 2%.

The IMF chief economist Pierre-Olivier Gourinchas said the IMF was not forecasting a recession in the U.S., but the odds of a downturn had increased.

“We are entering a new era as the global economic system that has operated for the last 80 years is being reset,” said Gourinchas.

According to the report, consumer, business, and investor sentiment was optimistic at the beginning of the year but recently moved to a more pessimistic stance as uncertainty looms with new tariff announcements.

The overall data on real activity has been disappointing, with GDP growth in the fourth quarter of 2024 trailing IMF’s January 2025 forecasts.

For trading partners, tariffs are mostly a negative demand shock, which drives foreign customers away from their products, even if some countries can benefit from the trade diversion.

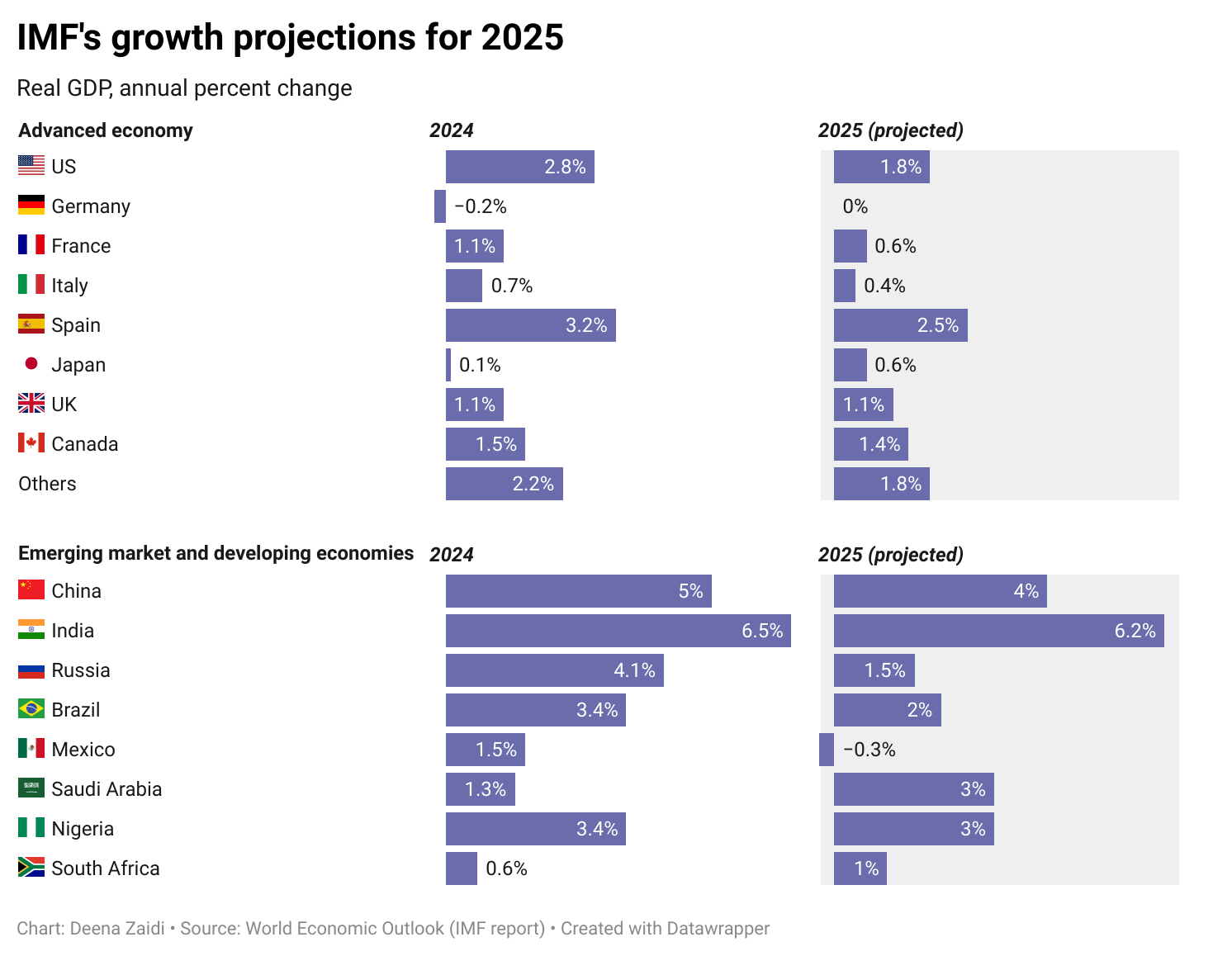

IMF also lowered China’s growth forecast for this year to 4%, a 0.6 percentage point reduction. In addition, China’s inflation was revised down by about 0.8 percentage point by the Fund. The country has been a leading partner of the U.S. and has been in a trade war after series of tariffs were slapped by the Trump administration.

Big forecast cuts were made for other trading partners too.

Canada and Mexico, both U.S. neighbors have been targeted by a range of Trump’s tariffs and saw their growth forecasts slashed. Canada’s growth forecast for this year was cut to 1.4%, instead of 2% growth projected in January, reflecting tariff uncertainty and geopolitical tensions.

Mexico saw its biggest downgrade, now predicted to contract by 0.3% in 2024-a sharp reversal from the 1.4% growth forecasted in January.

Overall, the Euro area growth prediction was also trimmed to 0.8% for this year.