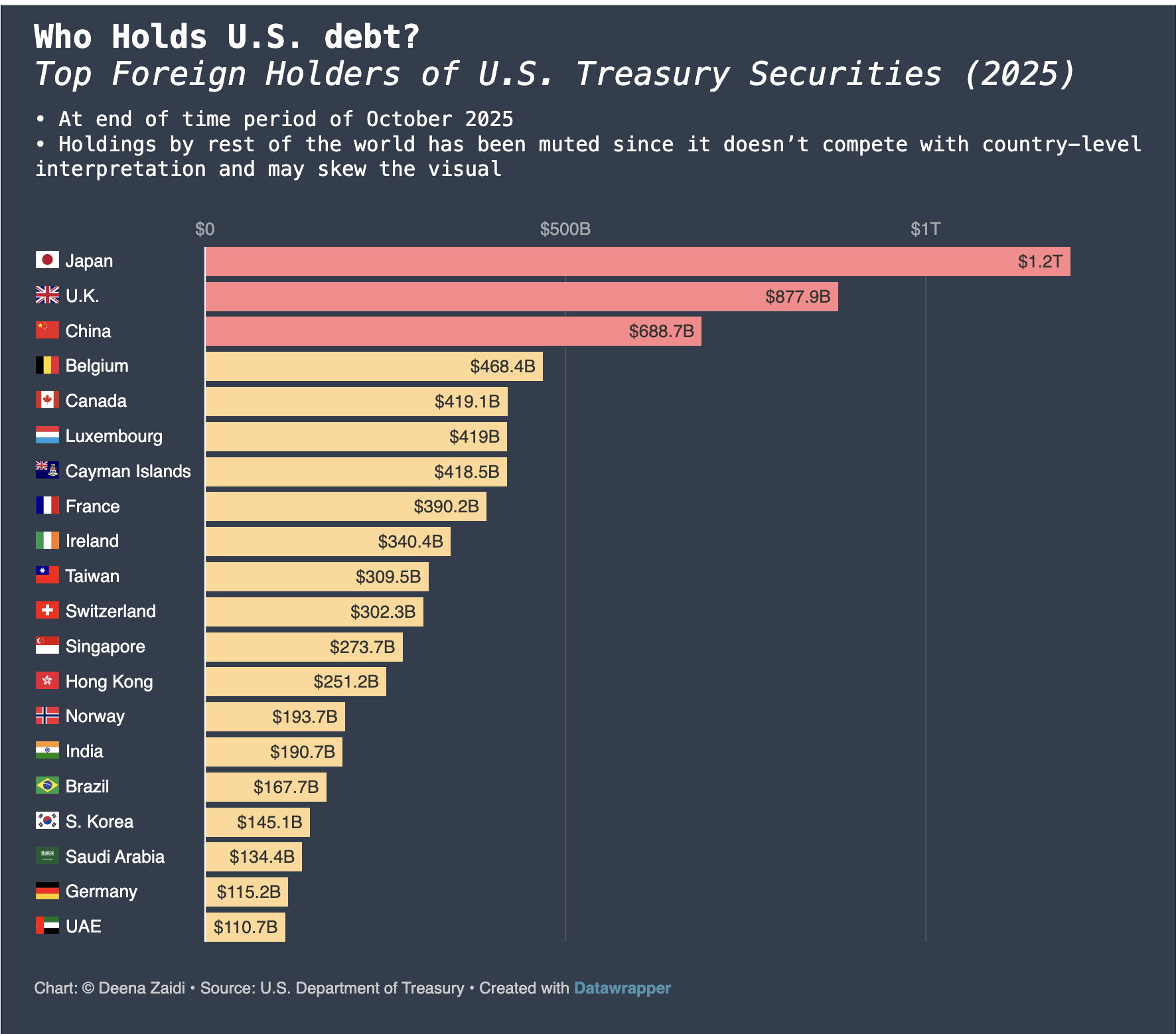

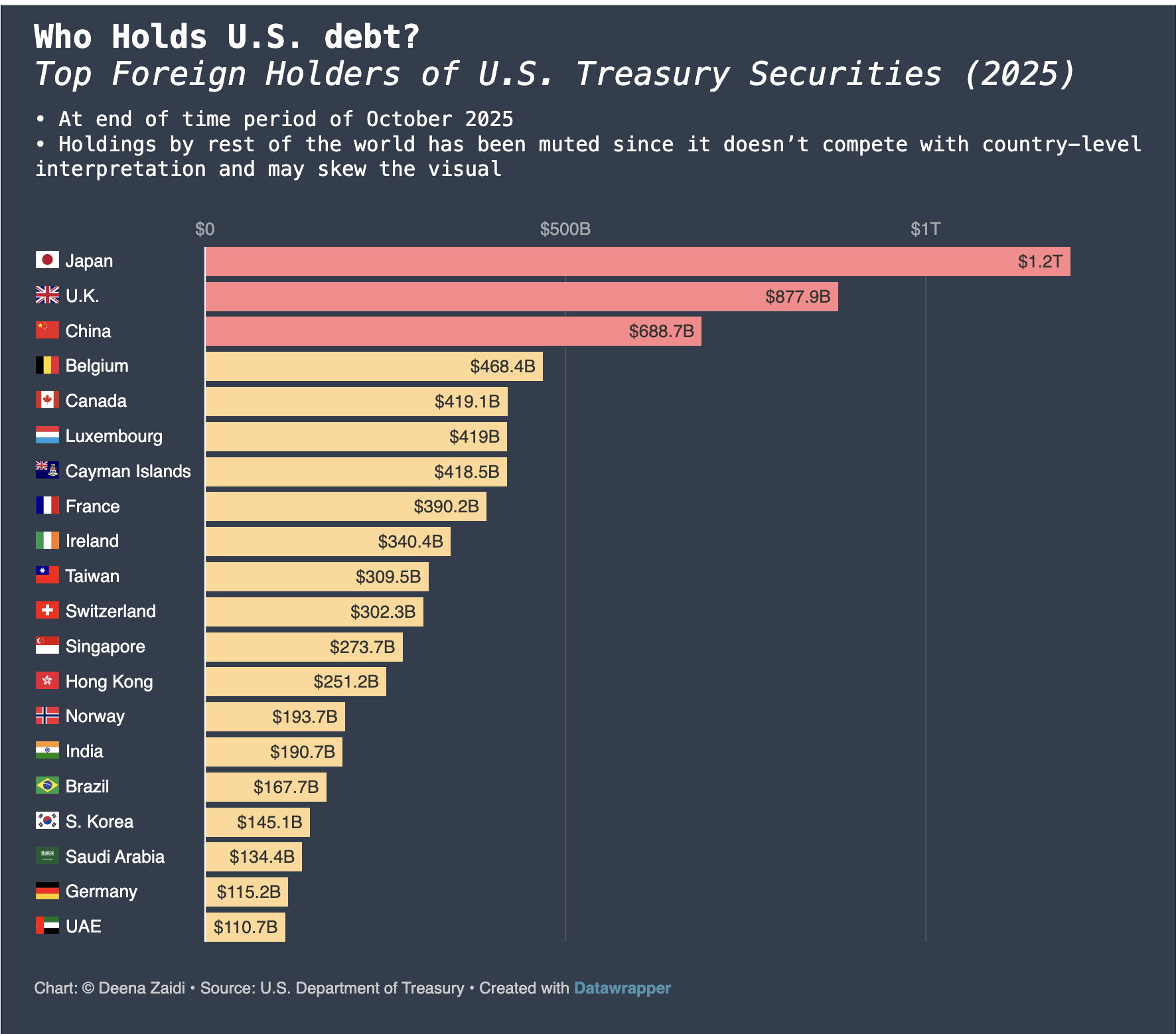

Foreign investors now hold more than $9 trillion in U.S. Treasurys, but growing purchases by advanced economies contrast with pullbacks by China and other emerging markets.

Data and Financial Journalist

Foreign investors now hold more than $9 trillion in U.S. Treasurys, but growing purchases by advanced economies contrast with pullbacks by China and other emerging markets.

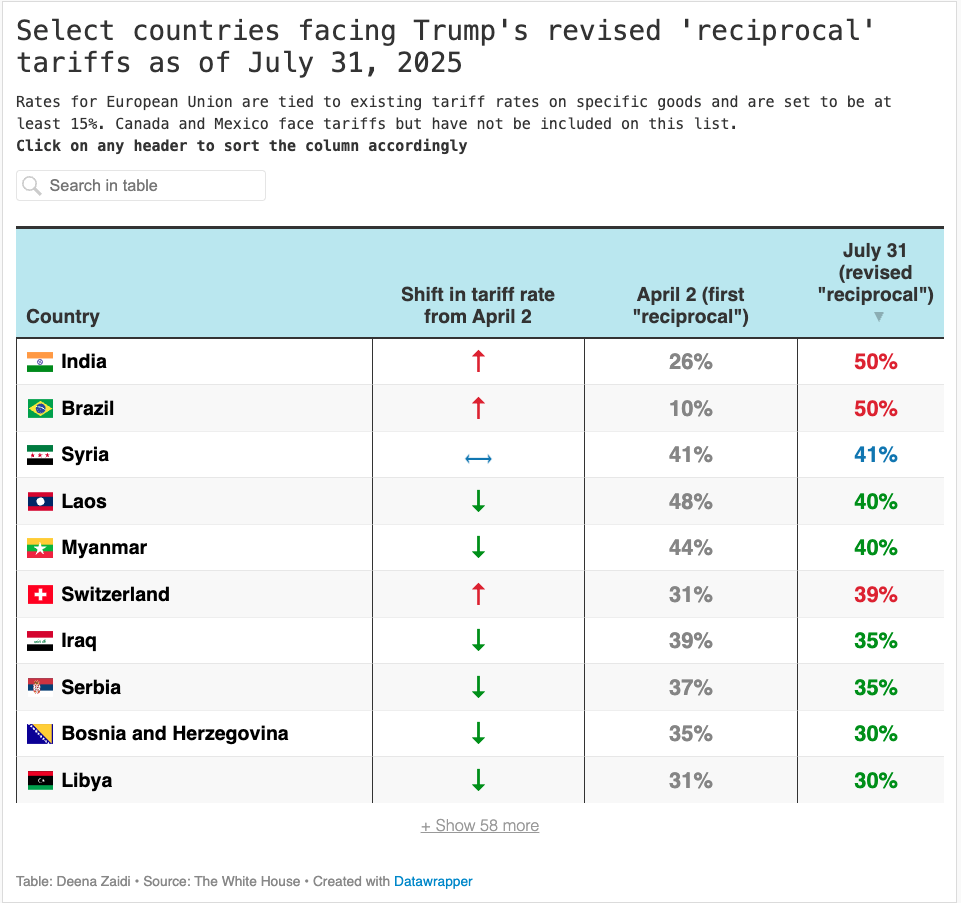

Despite sanctions, Russia’s crude oil exports remain steady. Trade flows have pivoted from Europe to Asia, with China and India now the top buyers. India’s growing imports—and its refusal to join Western sanctions—have triggered steep new U.S. tariffs.

After months of negotiations, pauses, and delays, a sweeping new tariff slate took effect Thursday—marking a new era in U.S. trade policy, with import rates reaching their highest levels since the Great Depression.

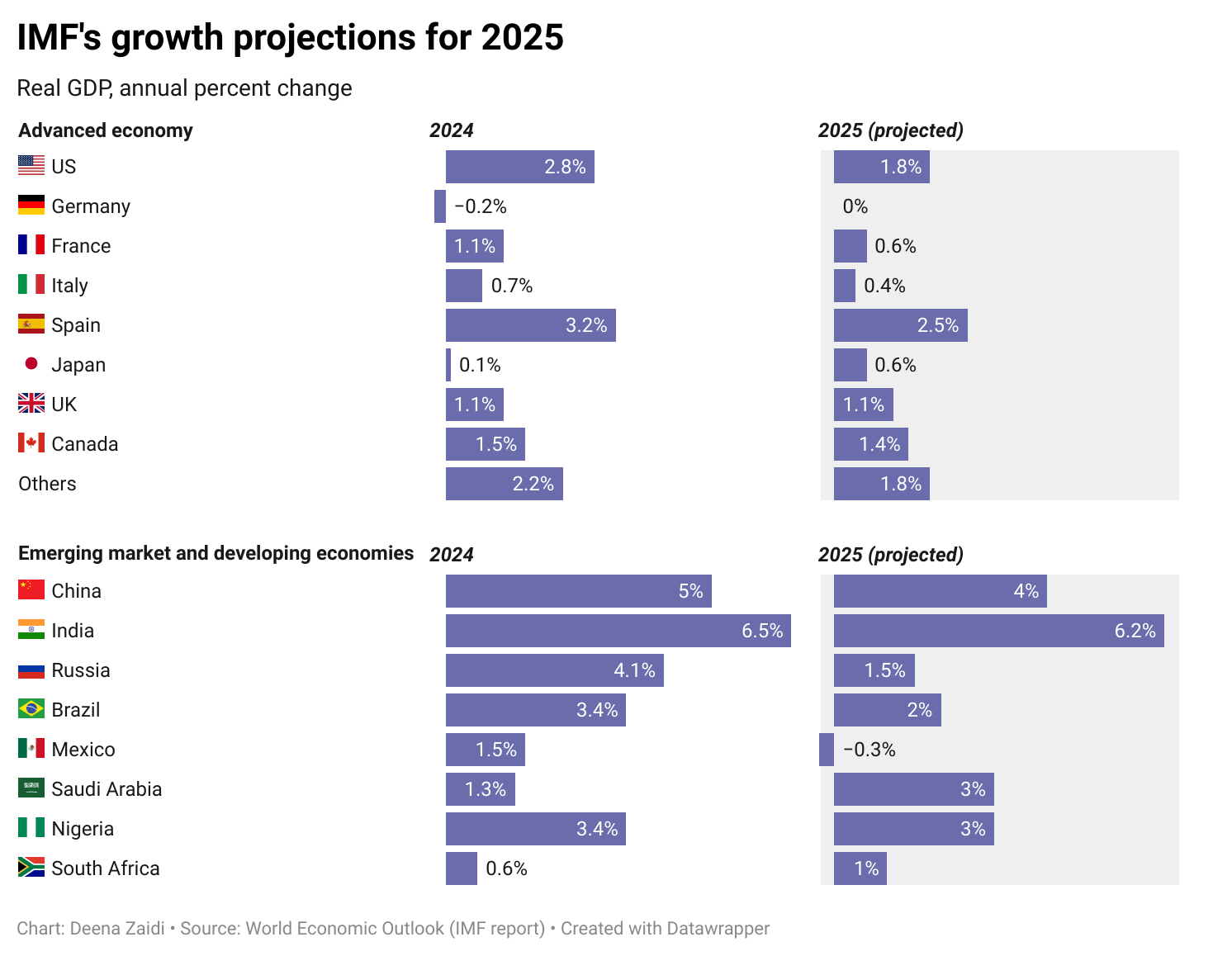

IMF issued its steepest downgrade for the U.S. among advanced economies, citing rising tariff-related uncertainty and a heightened risk of recession. Global economic sentiment has dimmed, with the IMF now projecting a 37% chance of a U.S. downturn—up sharply from 25% just months ago.