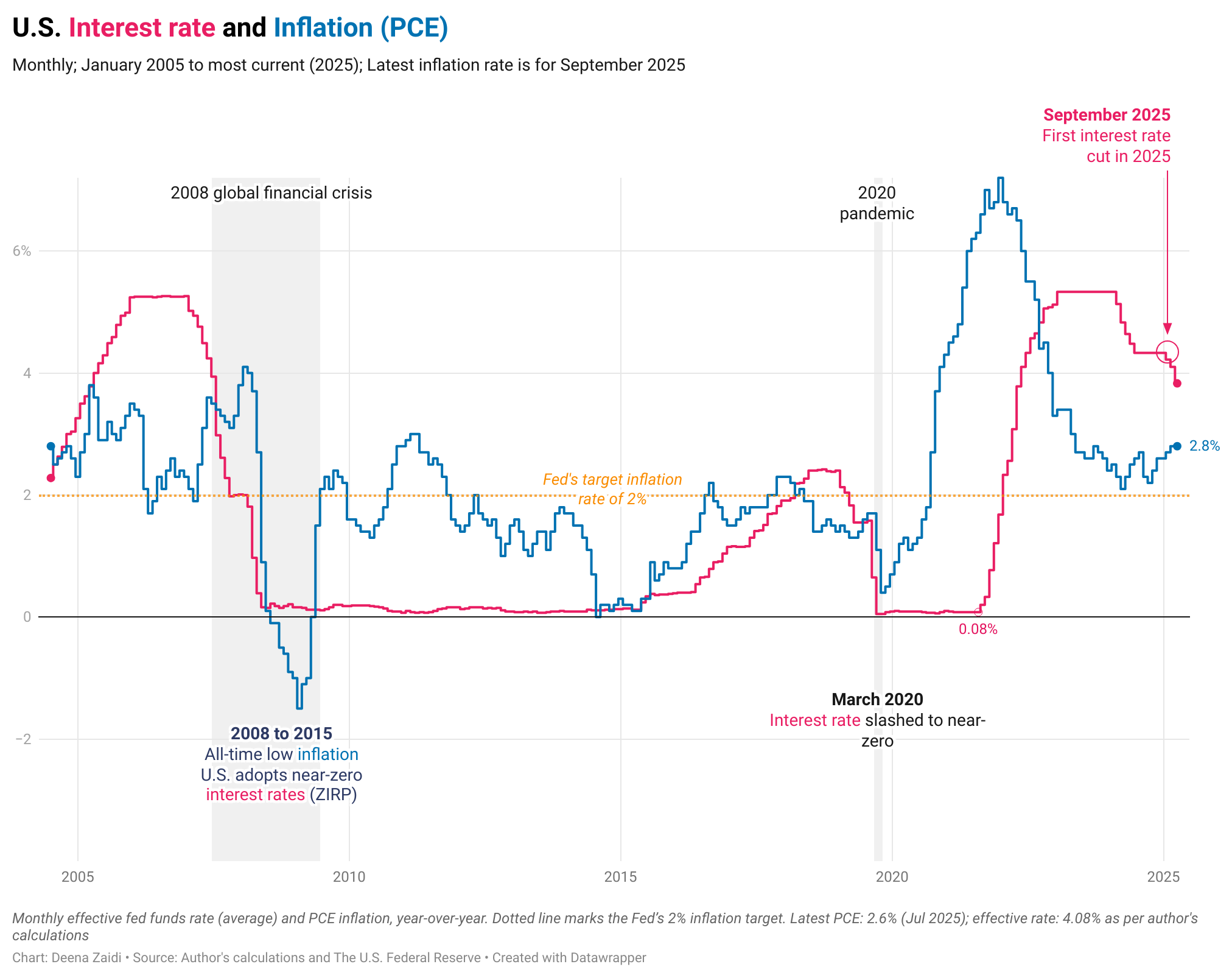

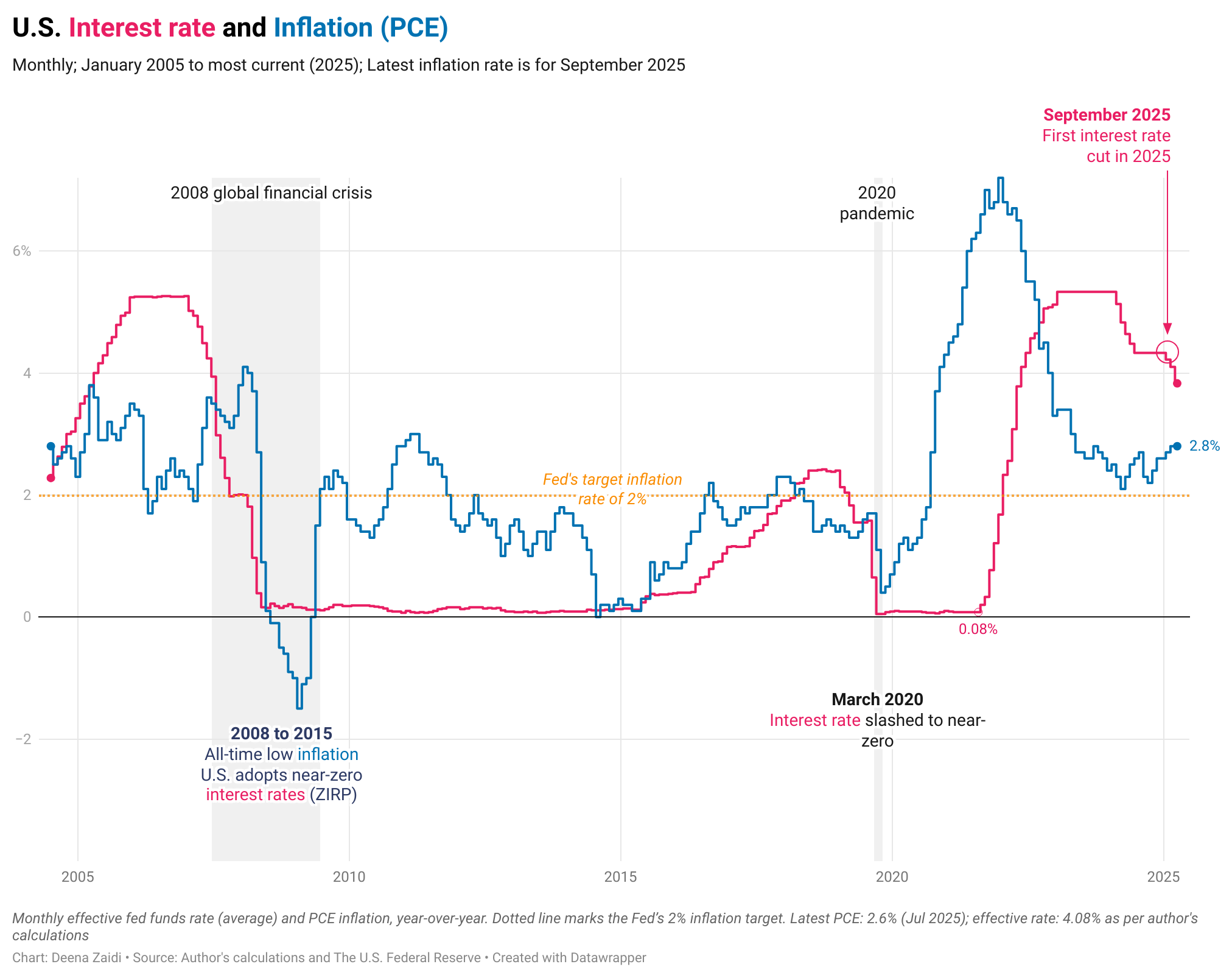

Persistently high inflation makes this reduction a tricky one. The interest rate cut is the first in Trump’s second term as well as the first in 2025.

Data & financial journalist covering global economics and policy

Persistently high inflation makes this reduction a tricky one. The interest rate cut is the first in Trump’s second term as well as the first in 2025.

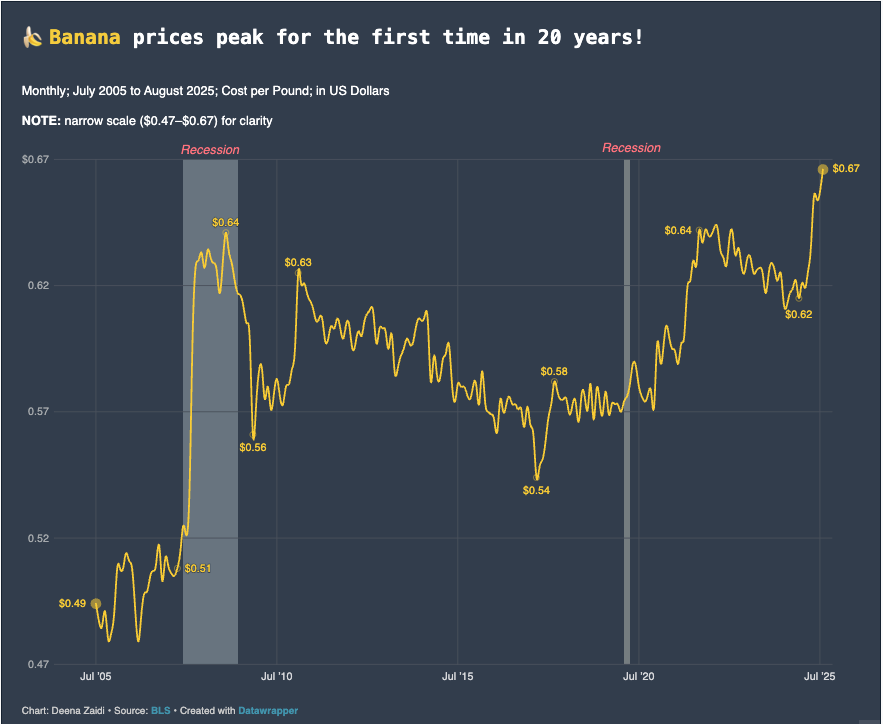

The August inflation data overlaps with President Trump’s latest round of tariffs on major U.S. trading partners. But while the direct impact is up for debate, beef’s surge suggests tariffs may already be filtering into consumer prices.

The burgers, stews, and chili on your menu might get pricier. U.S. beef prices have reached record highs amid inflation pressures, supply shortages, and new tariffs on Brazilian imports. With the U.S. cattle inventory at its lowest since 1951 and Brazil facing steep tariff hikes, beef prices may climb even higher in 2025.

The ECB cut its key rates by 25 bps effective June 11 after lowering its 2025 inflation forecast to 2%, with core inflation near target and modest GDP growth expected, but also cautioned against rising tariff uncertainty.