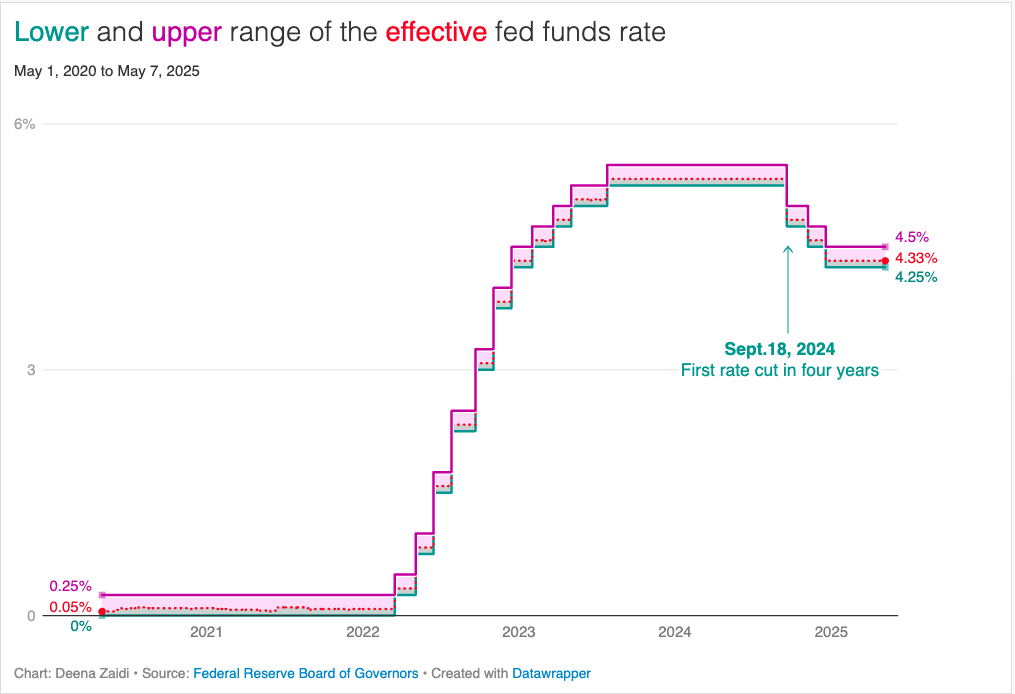

The Federal Reserve keeps its interest rate unchanged, maintaining its target range at 4.25% to 4.5%. Current interest rate still stands at 4.33%, where as inflation for April fell to 2.3%, from 2.4% in March.

Tariffs threaten economic growth and could drive inflation

Rising uncertainty around Trump’s tariffs means inflation for the country, which could slow down the economy.

Since the last rate-setting meeting in March, Trump has imposed 10% tariffs on nearly all of U.S. imports, in addition to 145% tax on goods from China. Higher taxes on imported goods could lead to longer periods of inflation.

“The level of the tariff increases announced so far is significantly larger than anticipated,” Fed Chair Jerome Powell told the Economic Club of Chicago last month. “The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

The International Monetary Fund (IMF) recently downgraded U.S. citing tariff-related uncertainty. It now sees a 37% probability of a U.S. recession this year—up from 25% in October.

The US inflation forecast was also raised by 1 percentage point, up from 2%.

Fed’s cautious stance

The Fed has been cautious about cutting interest rates too early, as it continues to assess inflation and growth signals before adjusting policy.

The Federal Open Market Committee (FOMC) doesn’t set a specific federal funds rate, but rather a range and adjusts this influence monetary policy and economic conditions.

The effective Fed Funds rate is the interest rate banks charge each other to borrow overnight. When necessary, the Fed raises or lowers its target range for the federal funds rate.

Lowering the target range means “easing” of monetary policy, often accompanied by lower short-term interest rates in financial markets. This is typically ideal for a sluggish economy or during low inflationary conditions.

Impact of interest rate changes

When the Fed sets a target for interest rate, it commits itself to adjusting the money supply. To lower the Fed Funds rate, the Fed’s bond trades buy government bonds, increasing the money supply which in turn lowers the equilibrium interest rate.

Changes in the target range for the federal funds rate influence short-term interest rates for other financial instruments, especially the spending decisions of households and businesses. Collectively these have broader implications on economic activity, employment and inflation.

Still, monetary policy has a lag and it can take months or even years for rate changes to fully impact inflation and growth.