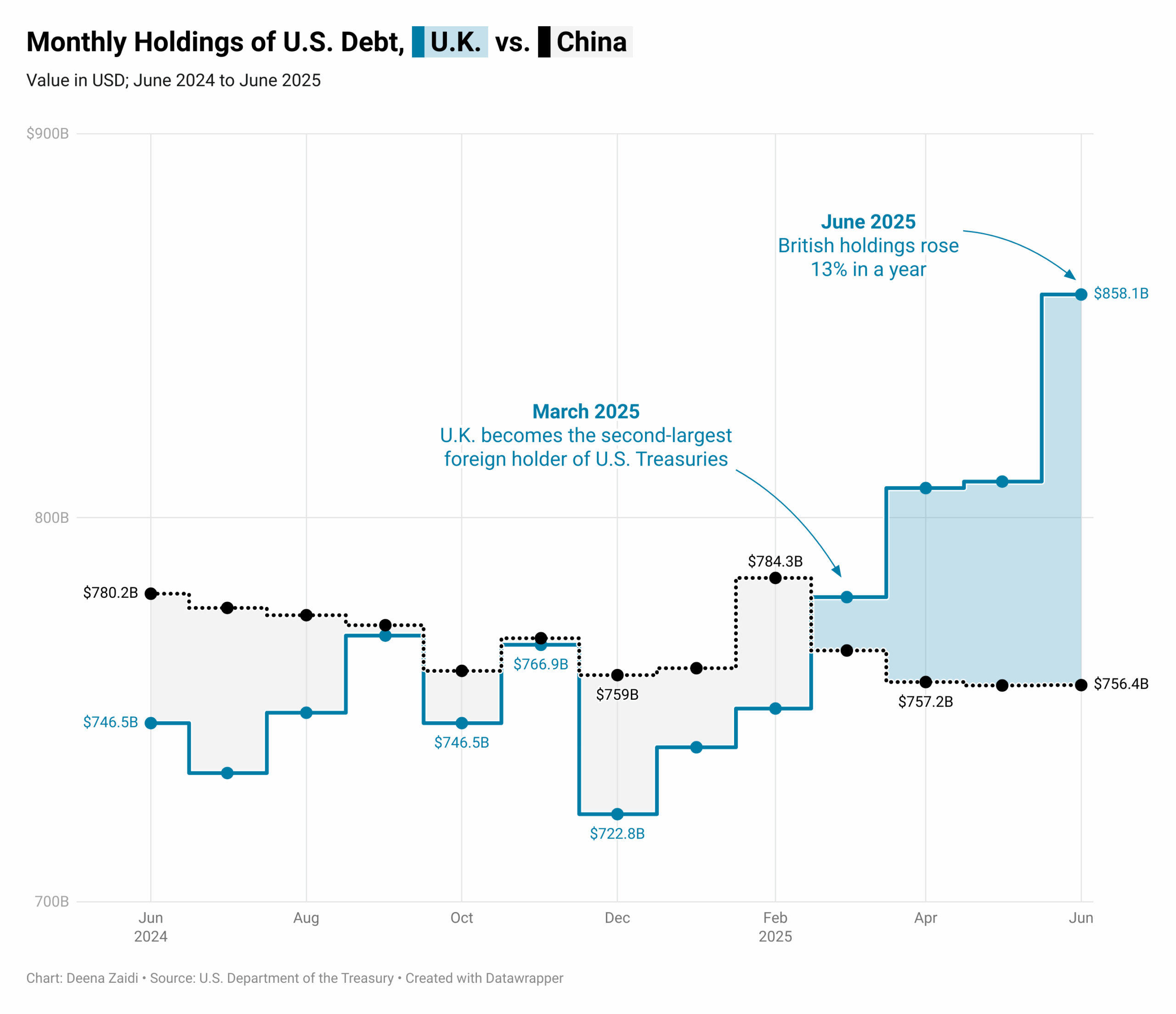

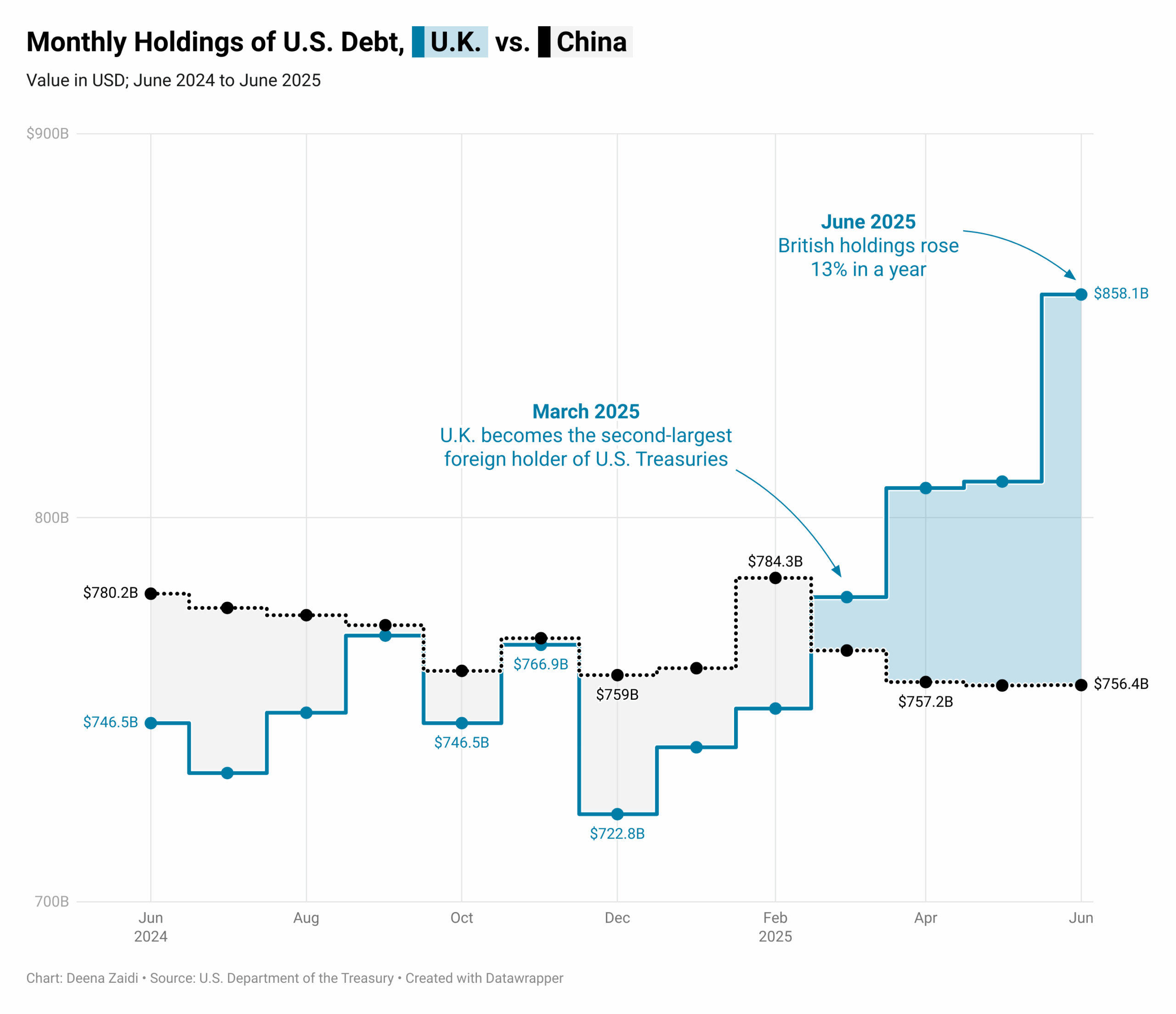

In June 2025, foreign official institutions drove a $80 billion net inflow into U.S. Treasuries, with the U.K. recording the largest one-month increase among major holders.

Data and Financial Journalist

In June 2025, foreign official institutions drove a $80 billion net inflow into U.S. Treasuries, with the U.K. recording the largest one-month increase among major holders.

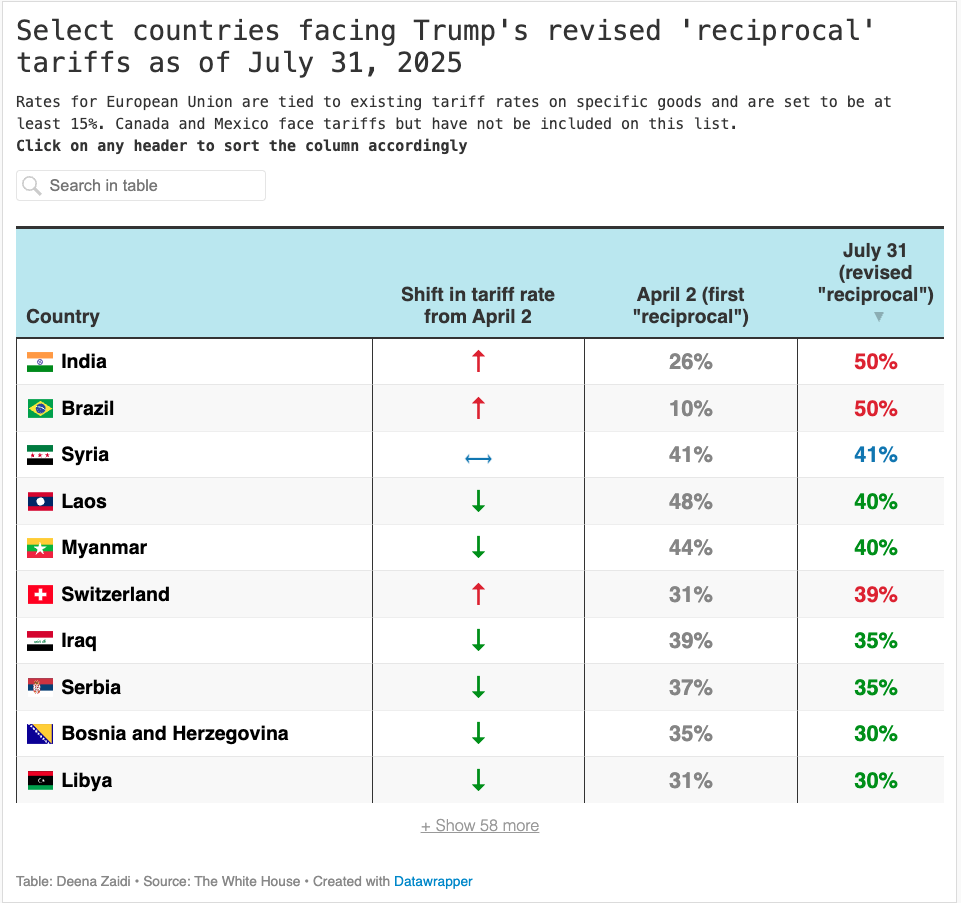

Despite sanctions, Russia’s crude oil exports remain steady. Trade flows have pivoted from Europe to Asia, with China and India now the top buyers. India’s growing imports—and its refusal to join Western sanctions—have triggered steep new U.S. tariffs.

After months of negotiations, pauses, and delays, a sweeping new tariff slate took effect Thursday—marking a new era in U.S. trade policy, with import rates reaching their highest levels since the Great Depression.

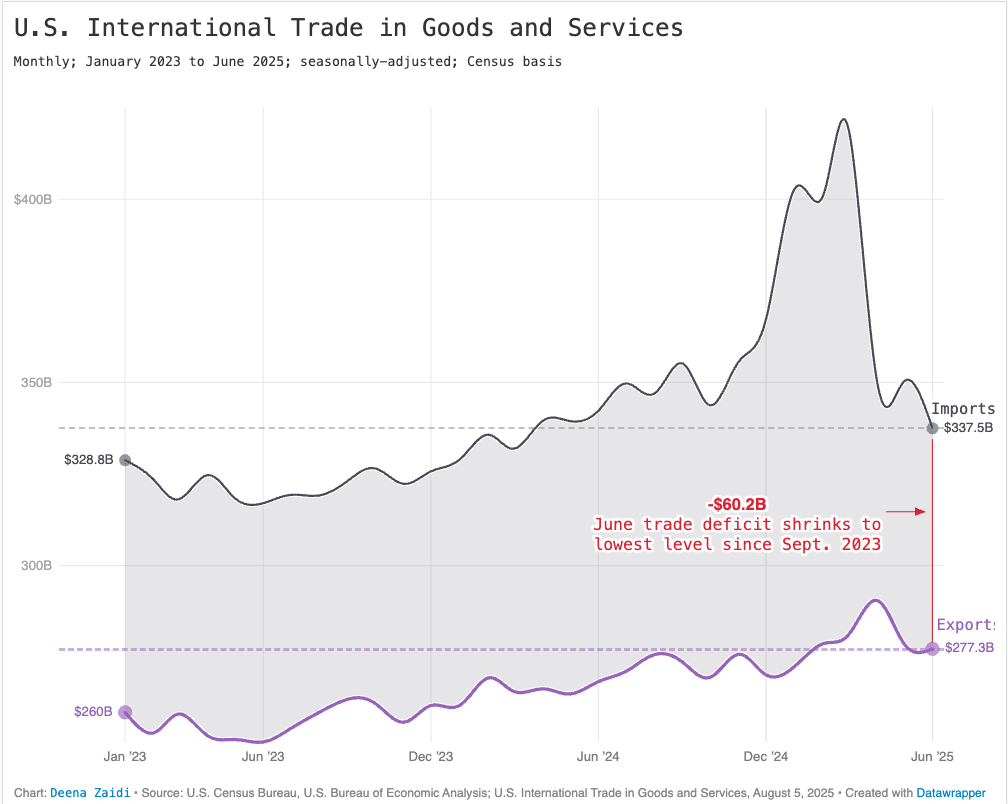

U.S. trade deficit shrank to $60.2B in June 2025, the lowest since Sept. 2023, driven by falling imports and rising tariff uncertainty.