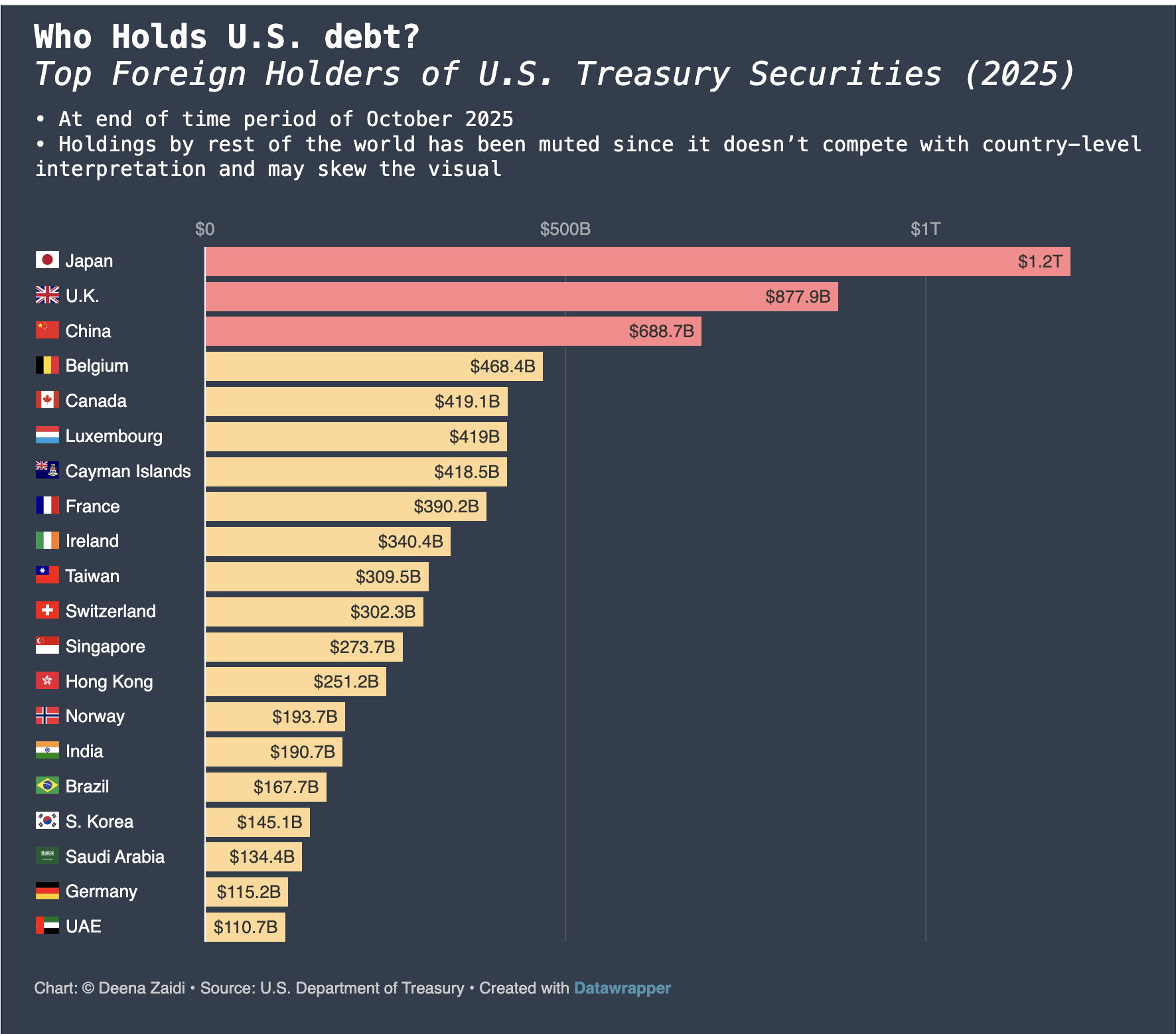

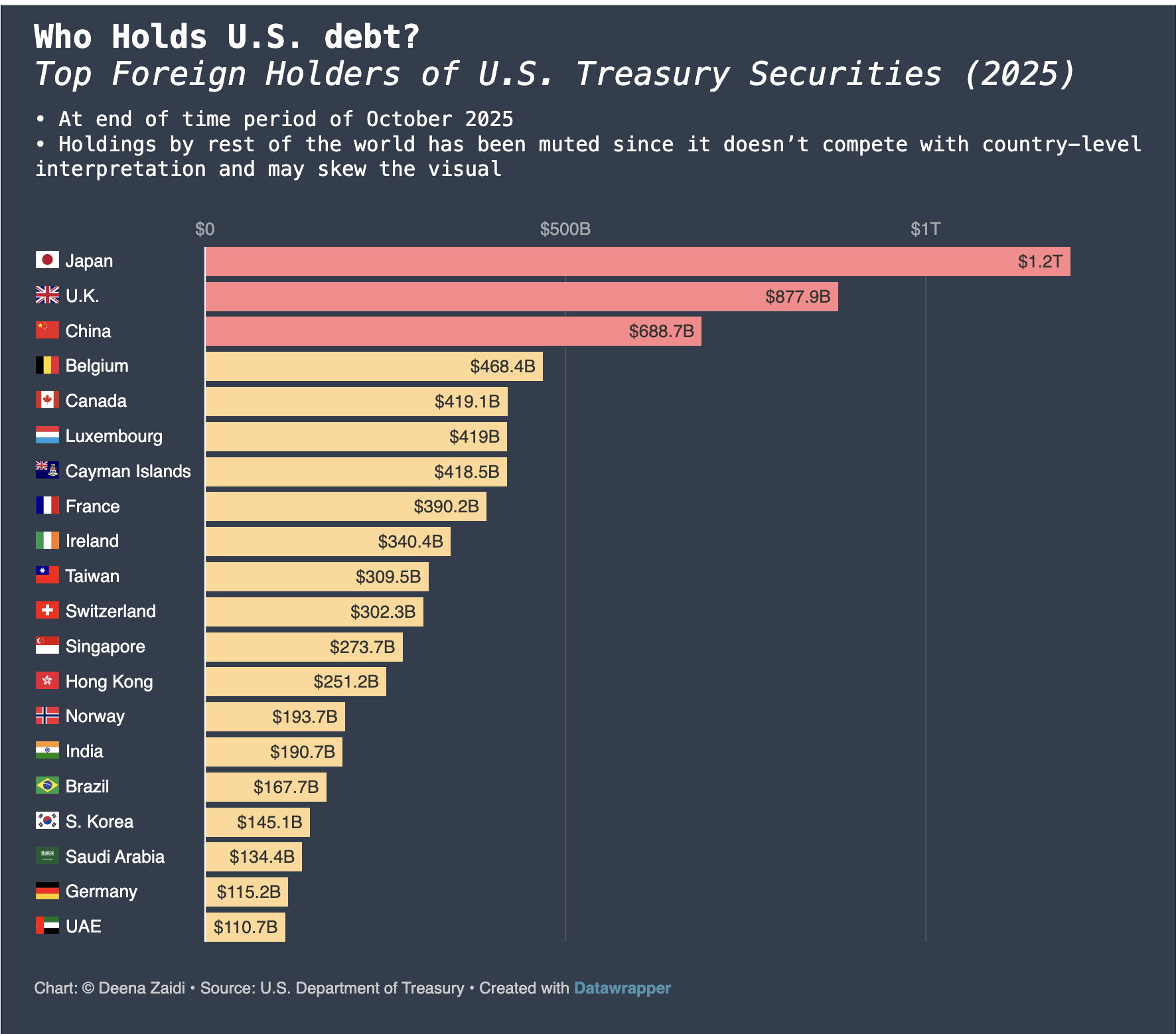

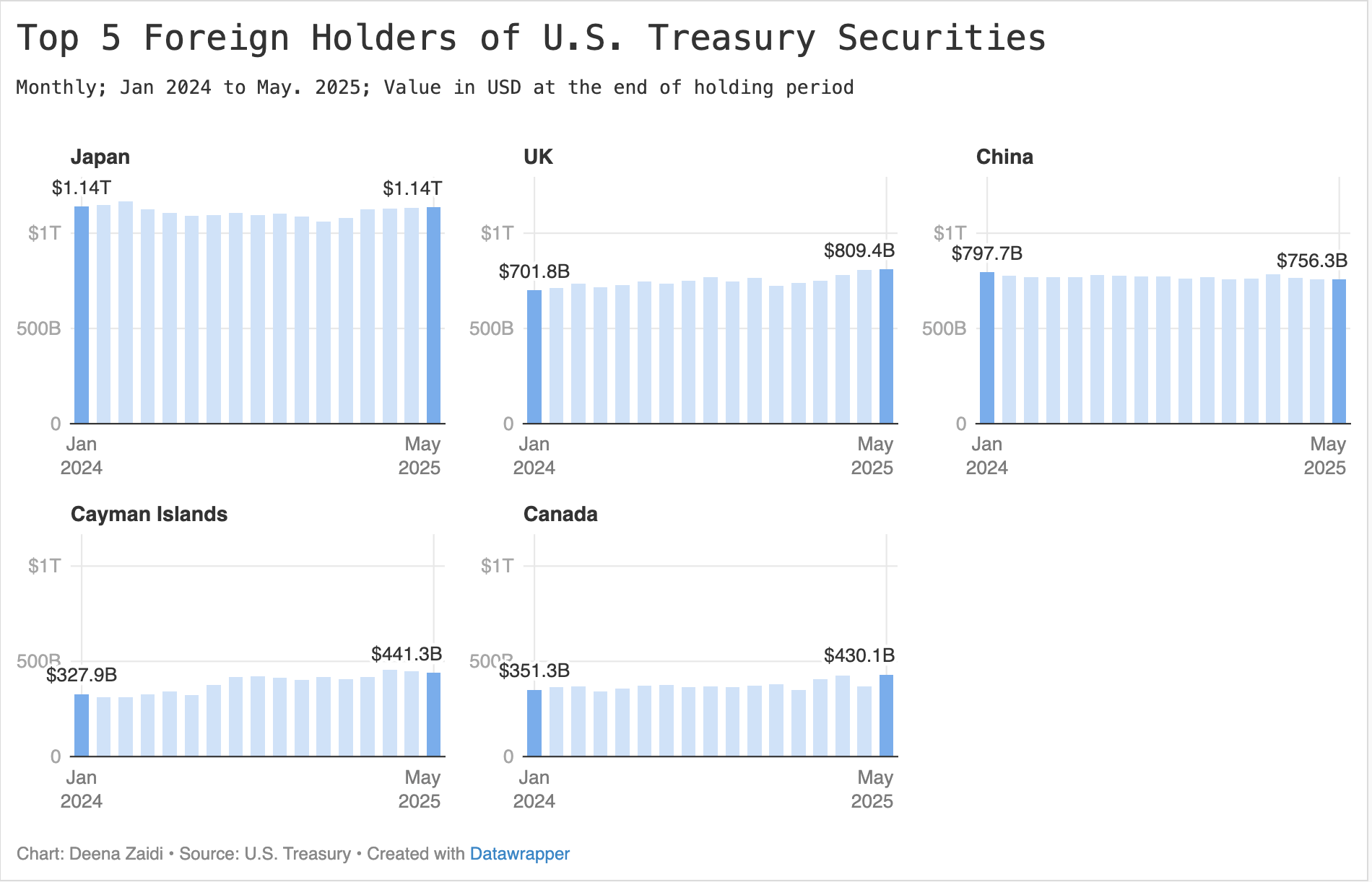

Foreign investors now hold more than $9 trillion in U.S. Treasurys, but growing purchases by advanced economies contrast with pullbacks by China and other emerging markets.

Data & financial journalist covering global economics and policy

Foreign investors now hold more than $9 trillion in U.S. Treasurys, but growing purchases by advanced economies contrast with pullbacks by China and other emerging markets.

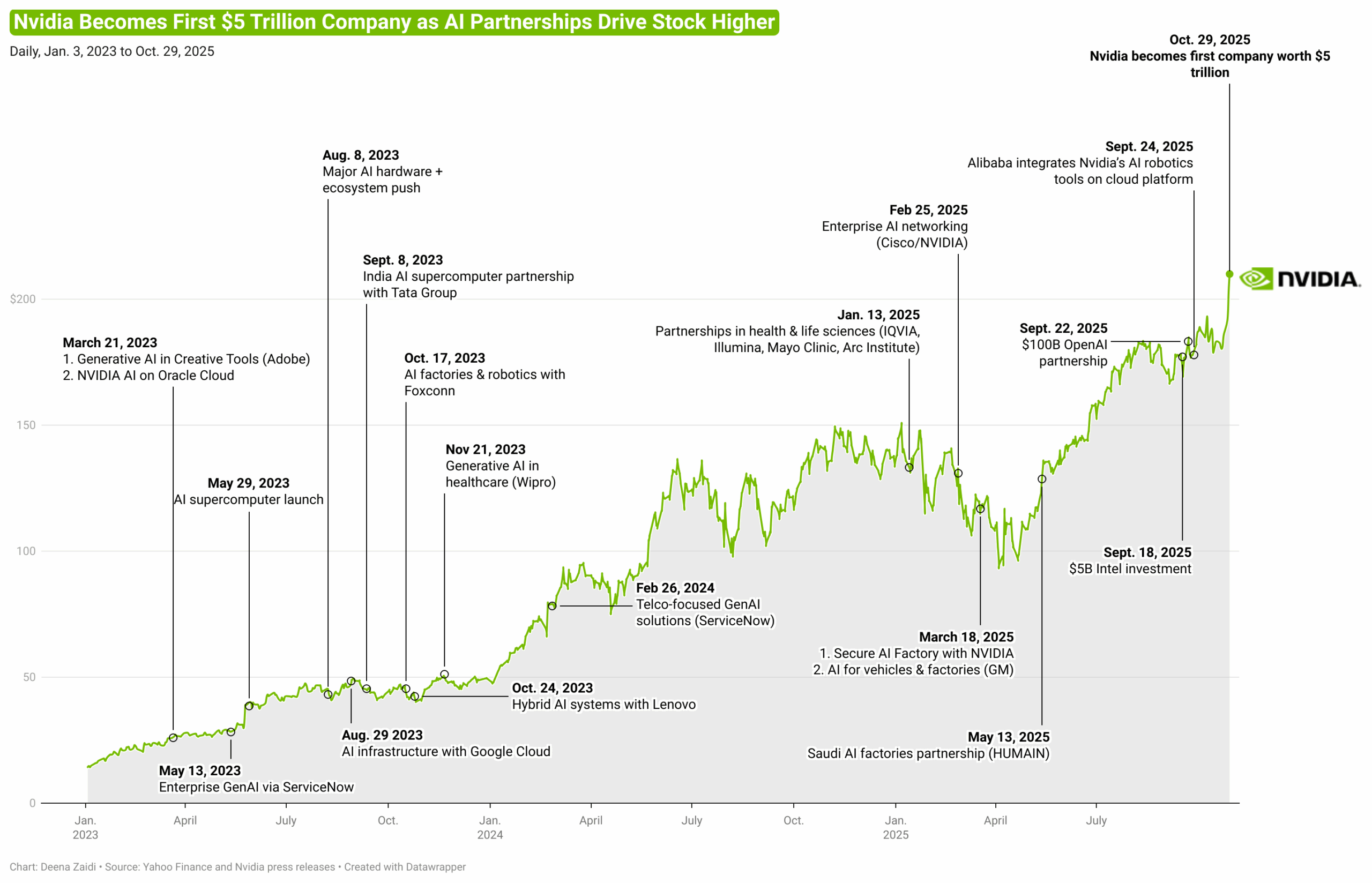

Despite U.S. tariff uncertainty and China’s ban on chips, the AI GPU leader, Nvidia continues to grow – all due to the strong demand for GPUs (graphics processing units) which it aims to fulfill through strategic partnerships. Its recent partnerships with South Korea’s top companies and its earlier $100 billion OpenAI deal are just the latest in NVIDIA’s long history of AI alliances.

Despite sanctions, Russia’s crude oil exports remain steady. Trade flows have pivoted from Europe to Asia, with China and India now the top buyers. India’s growing imports—and its refusal to join Western sanctions—have triggered steep new U.S. tariffs.

Canada’s rapid shift in foreign investment, China’s retreat, and the strong demand from Gulf and European nations capture the shifting alliances and risk appetites. Through 3 charts, I explain who holds America’s IOUs in a time of high deficits and global uncertainty —and how quickly that’s changing.