From graphics chip maker to AI leader, Nvidia is one of the world’s most valuable publicly traded companies after briefly surpassing Microsoft and Apple. We look at the stock’s journey in two charts

Data and Financial Journalist

From graphics chip maker to AI leader, Nvidia is one of the world’s most valuable publicly traded companies after briefly surpassing Microsoft and Apple. We look at the stock’s journey in two charts

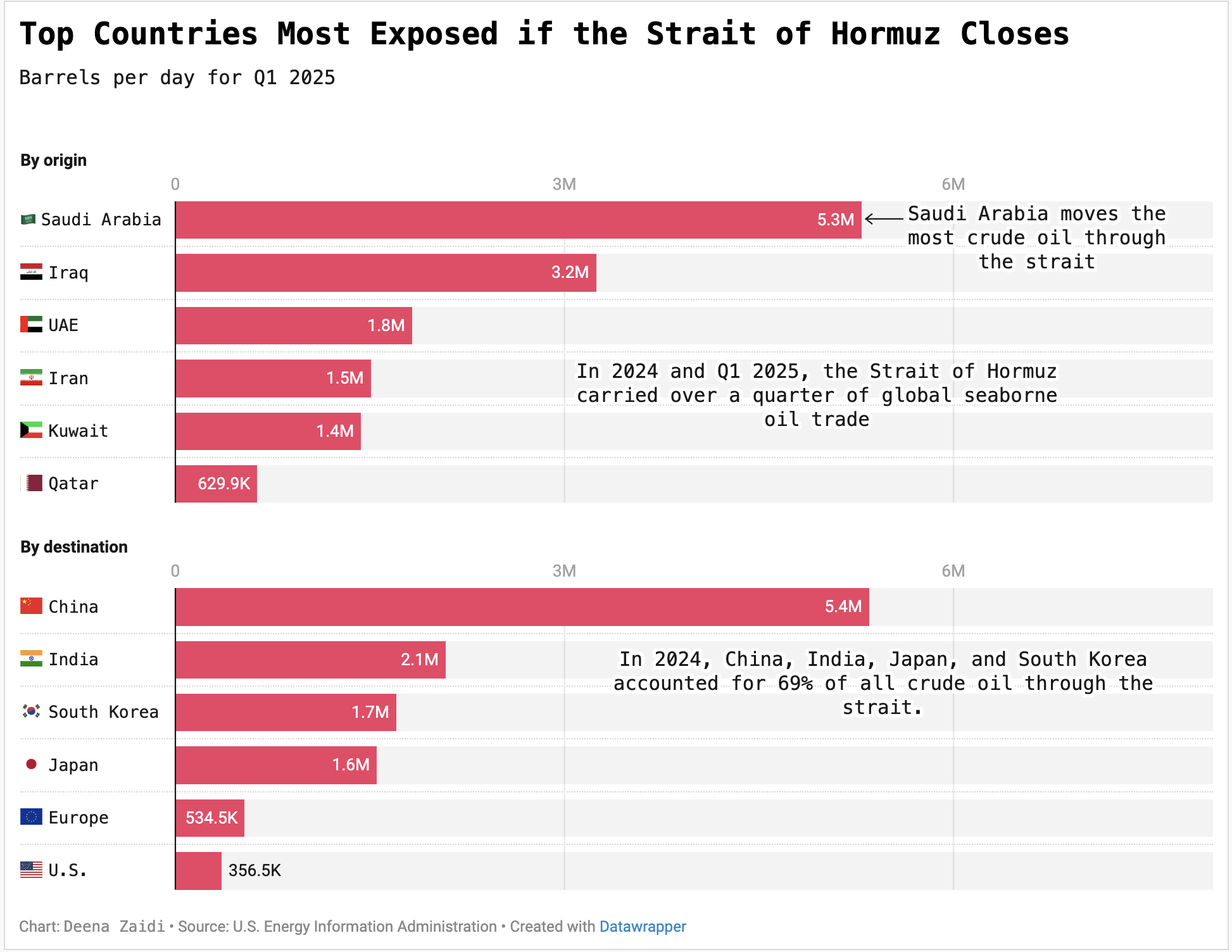

Over a quarter of global seaborne oil flows through the Strait of Hormuz—making Asia’s top economies especially vulnerable to any disruption.

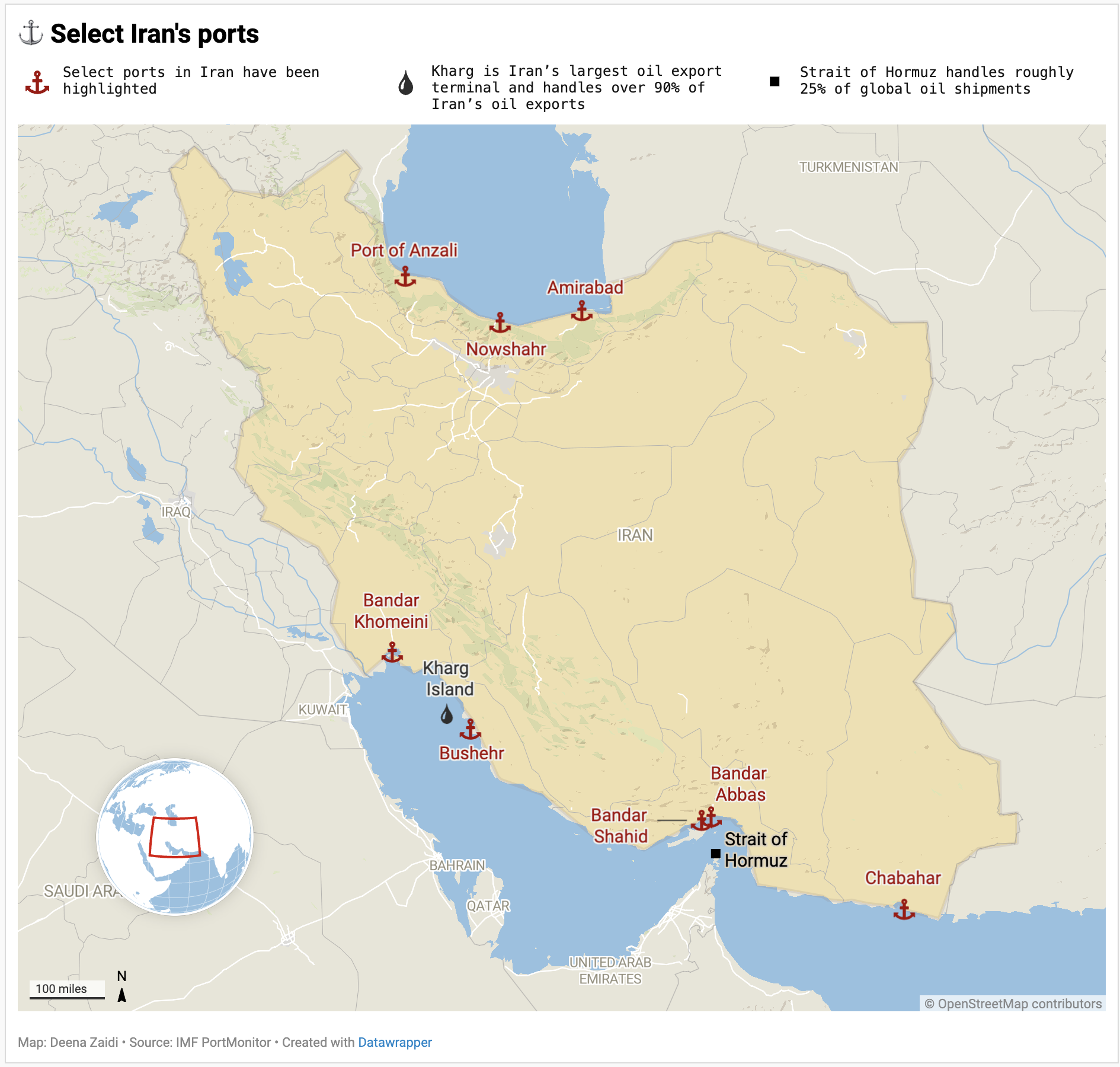

Israel’s strikes on Iran’s strategic sites have sent Brent crude and gold prices sharply higher, while potential threats to Kharg Island and the Strait of Hormuz chokepoints could force shipping reroutes, risking wider global supply-chain disruptions.

The ECB cut its key rates by 25 bps effective June 11 after lowering its 2025 inflation forecast to 2%, with core inflation near target and modest GDP growth expected, but also cautioned against rising tariff uncertainty.