Around 20% of global oil and petroleum product consumption flowed through the Strait of Hormuz in 2024 and early 2025.

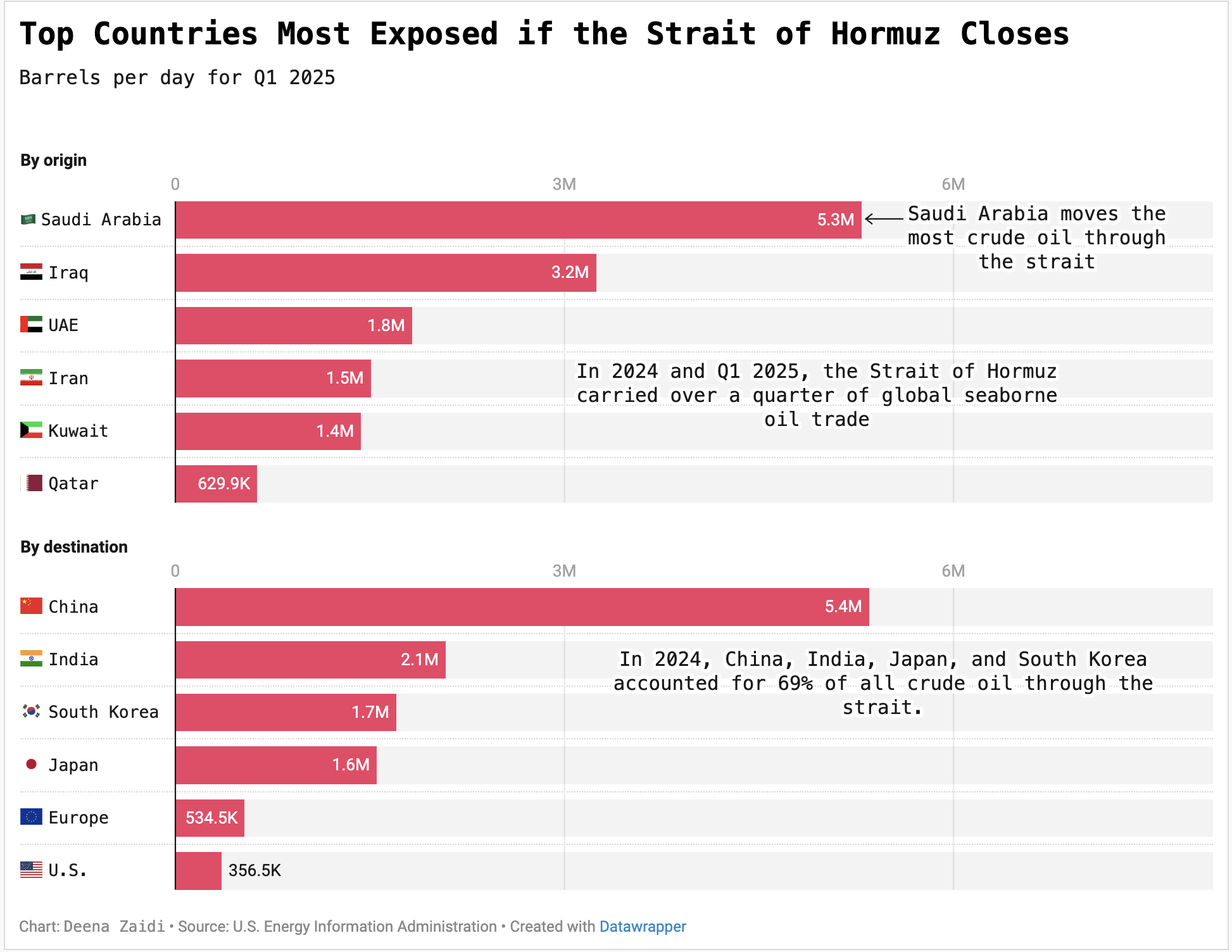

The chart above shows which countries are most exposed if Iran decides on closing the strait.

In first quarter of 2025, Saudi Arabia alone accounted for 38% of crude and condensate exports through the strait—about 5.3 million barrels per day.

Other major exporters included Iraq, the UAE, and Iran.

The biggest potential impact, however, will be felt in Asia.

China, India, Japan, and South Korea together received 69% of all crude moving through Hormuz last year, making them especially vulnerable to any disruption.

While the U.S. has reduced its reliance on imports, touching a a 40-year low, Asian economies remain highly dependent on this vital route.

Any potential blockage or speculation around the closure of the strait could spark oil price shocks and reroute global shipping, inadvertently impacting energy markets.

This story was published on June 23, 2025 and is being republished due to the recent shift in geopolitics around the Strait.