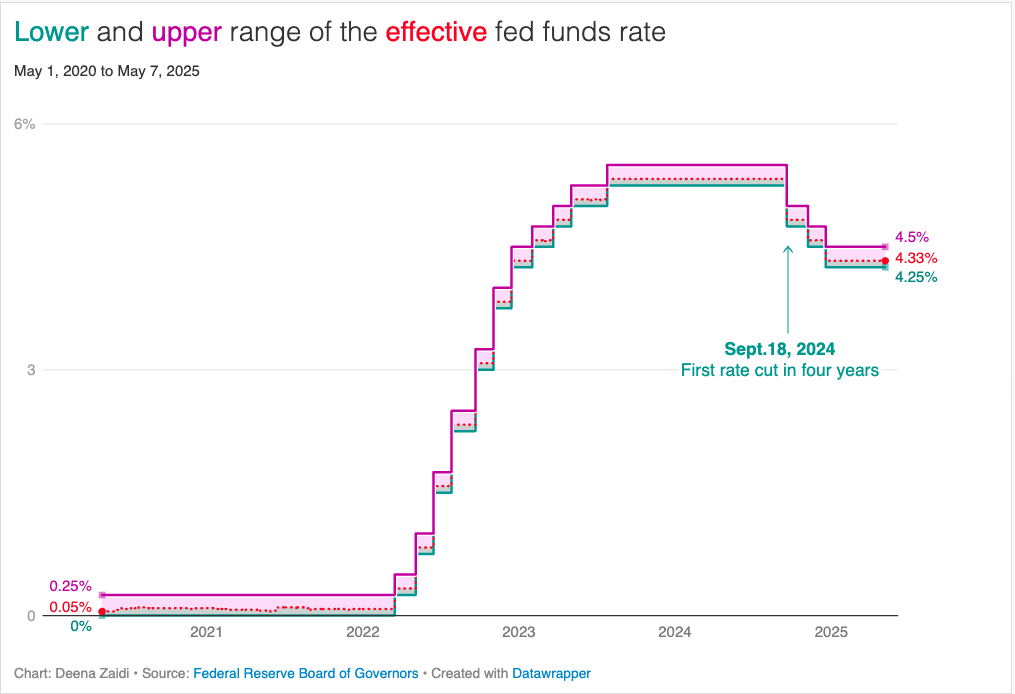

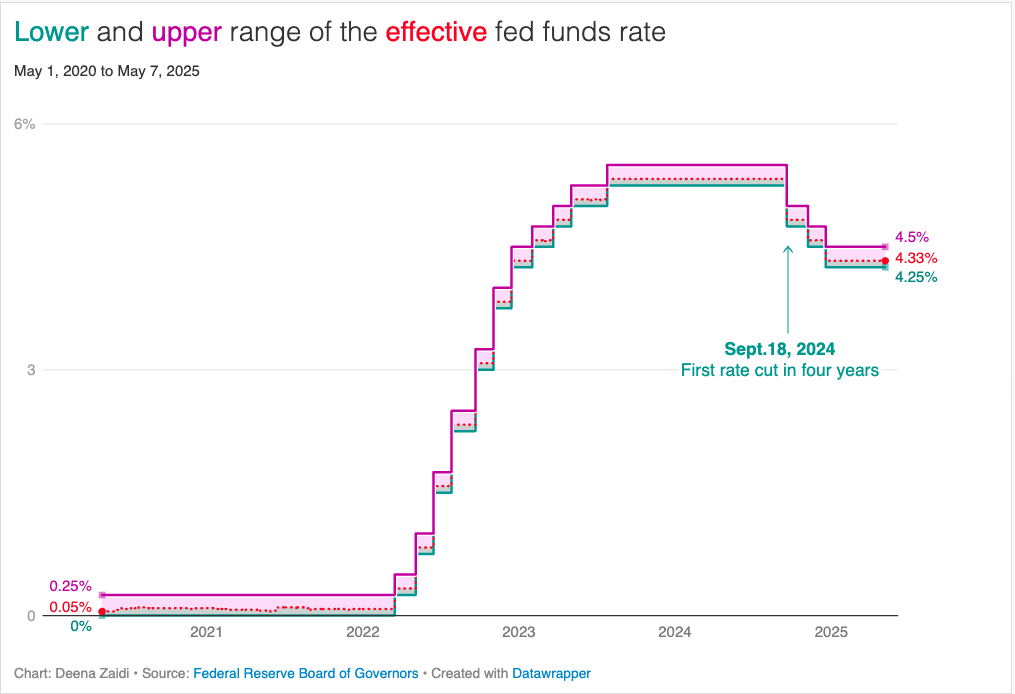

Inflation fell to 2.3% in April. The Fed is keeping rates steady at 4.25%-4.5% as new tariffs fuel inflation risks, prompting a cautious wait-and-see approach.

Data and Financial Journalist

Inflation fell to 2.3% in April. The Fed is keeping rates steady at 4.25%-4.5% as new tariffs fuel inflation risks, prompting a cautious wait-and-see approach.

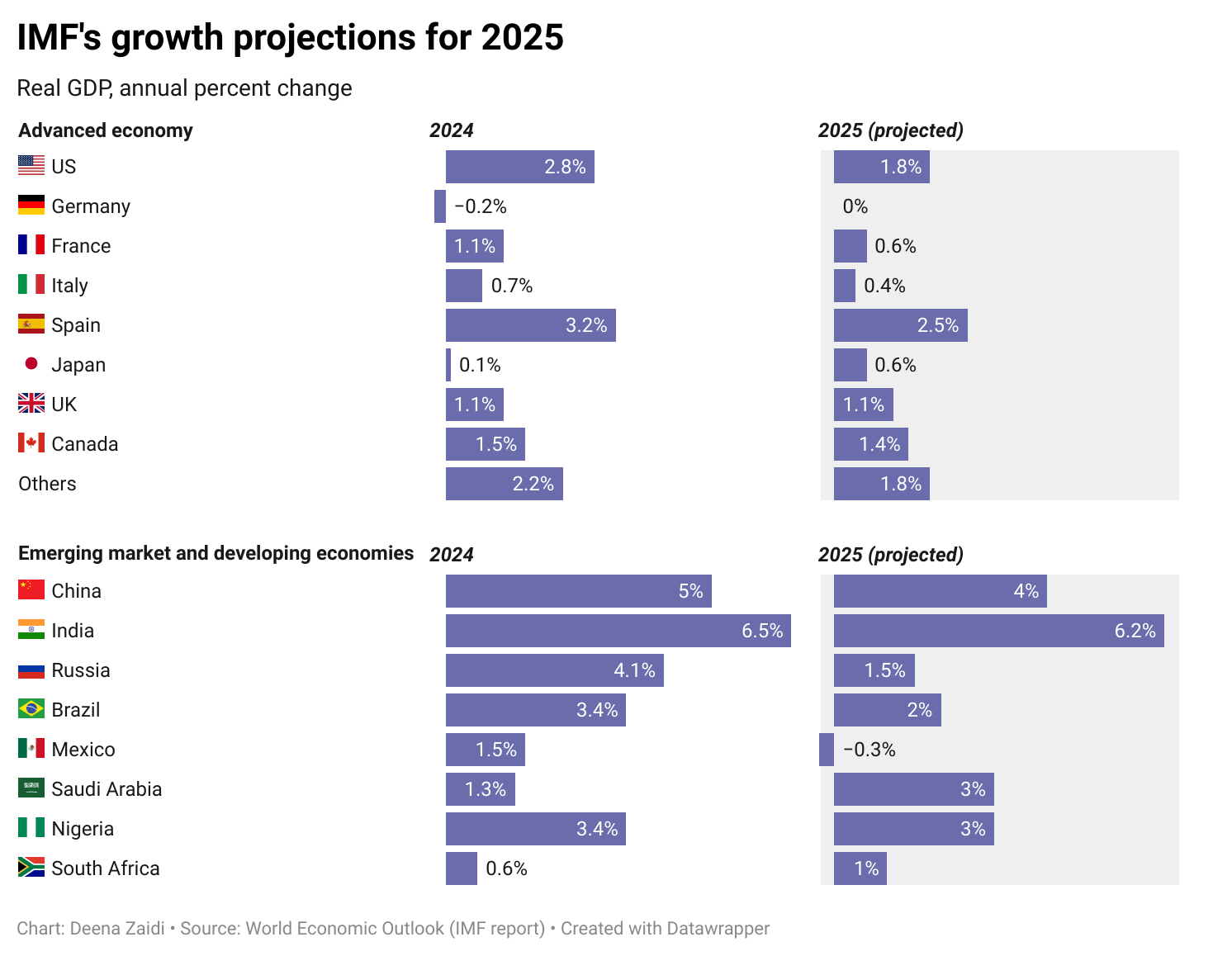

IMF issued its steepest downgrade for the U.S. among advanced economies, citing rising tariff-related uncertainty and a heightened risk of recession. Global economic sentiment has dimmed, with the IMF now projecting a 37% chance of a U.S. downturn—up sharply from 25% just months ago.

Brexit may come at a huge cost to many of the trading nations of Britain. Furthermore,Brexit and its complications can spread to international markets. Britain will vote on June 23 to reach a decision on whether it wants to be a part of European Union or not.

Yuan’s inclusion in IMF currency basket is a relief to China’s economy. China is on its transition path from a more state governed economy to a more market oriented one. The inclusion also marks the entry of the first emerging market in a group of developed ones.