Roughly 20% of global oil and LNG flows through the Strait of Hormuz—making any disruption a potential shock to global energy markets.

Data & financial journalist covering global economics and policy

Roughly 20% of global oil and LNG flows through the Strait of Hormuz—making any disruption a potential shock to global energy markets.

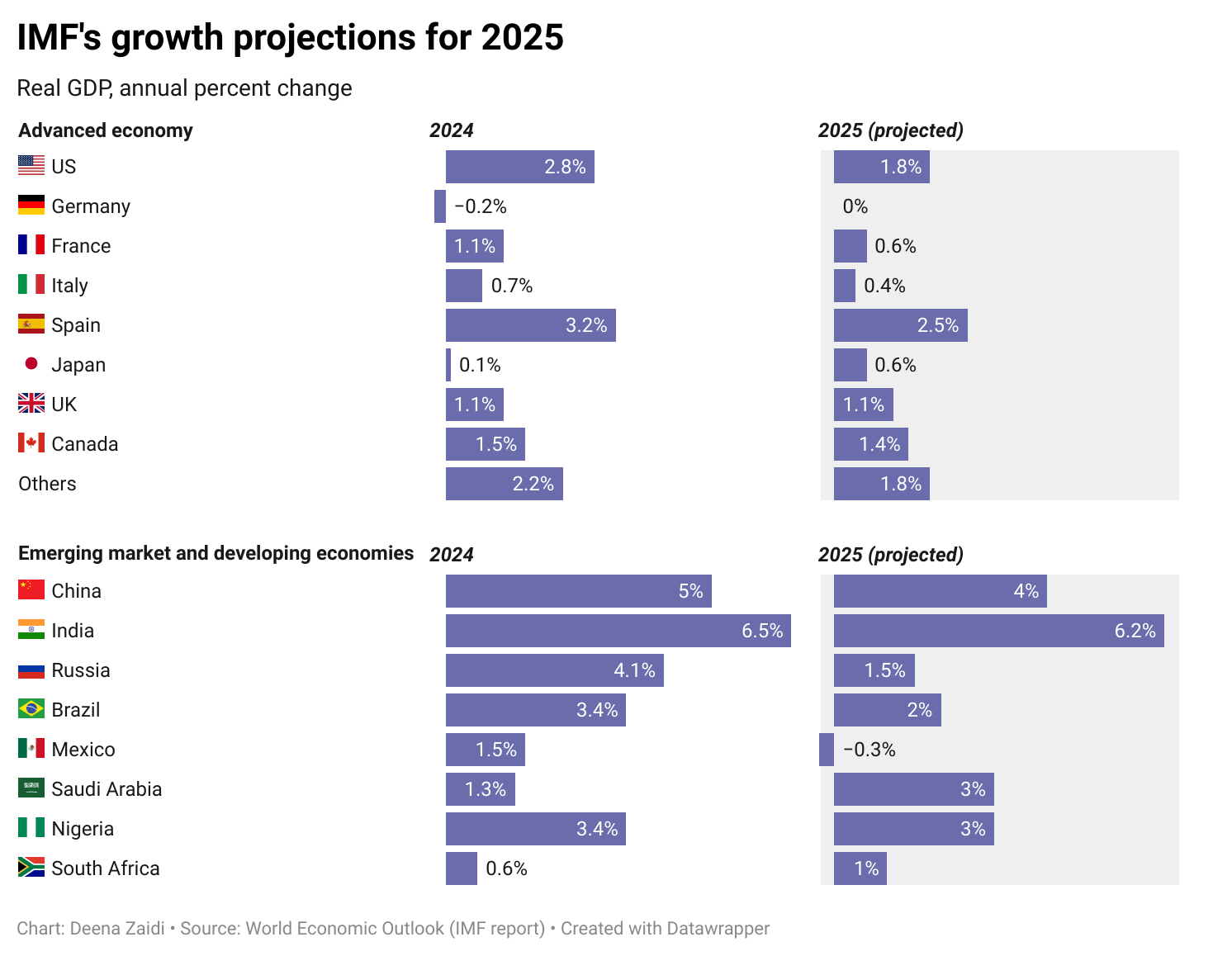

IMF issued its steepest downgrade for the U.S. among advanced economies, citing rising tariff-related uncertainty and a heightened risk of recession. Global economic sentiment has dimmed, with the IMF now projecting a 37% chance of a U.S. downturn—up sharply from 25% just months ago.

In his second presidency, Trump has repeatedly mentioned taking Greenland from Denmark and retaking the Panama Canal.Together, these trade routes underscore the complexities of international cooperation, climate change, and economic interests shaping the future of global commerce. I take a deep dive into the what’s behind these trade routes and why countries like the U.S., China and Russia are interested in them.

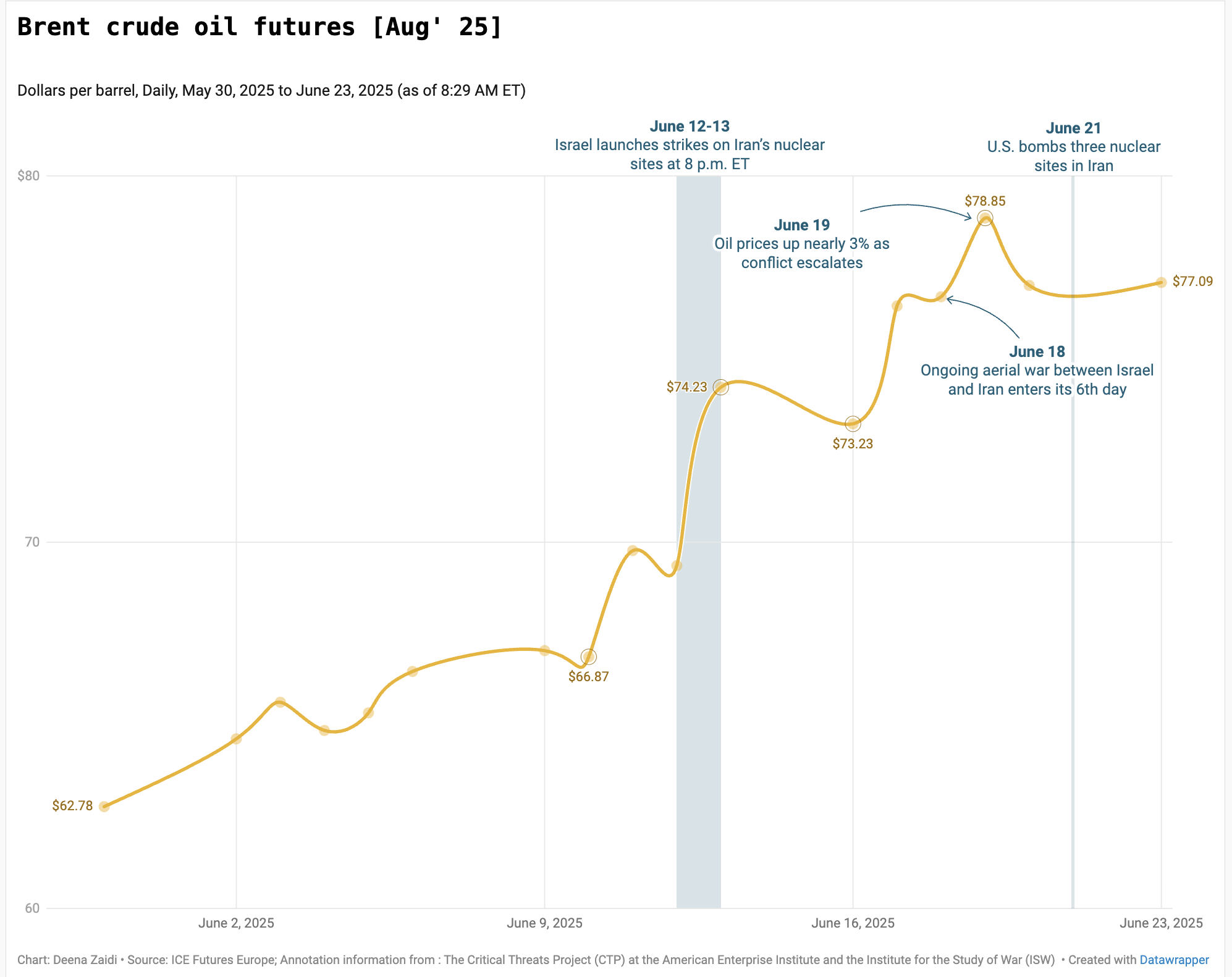

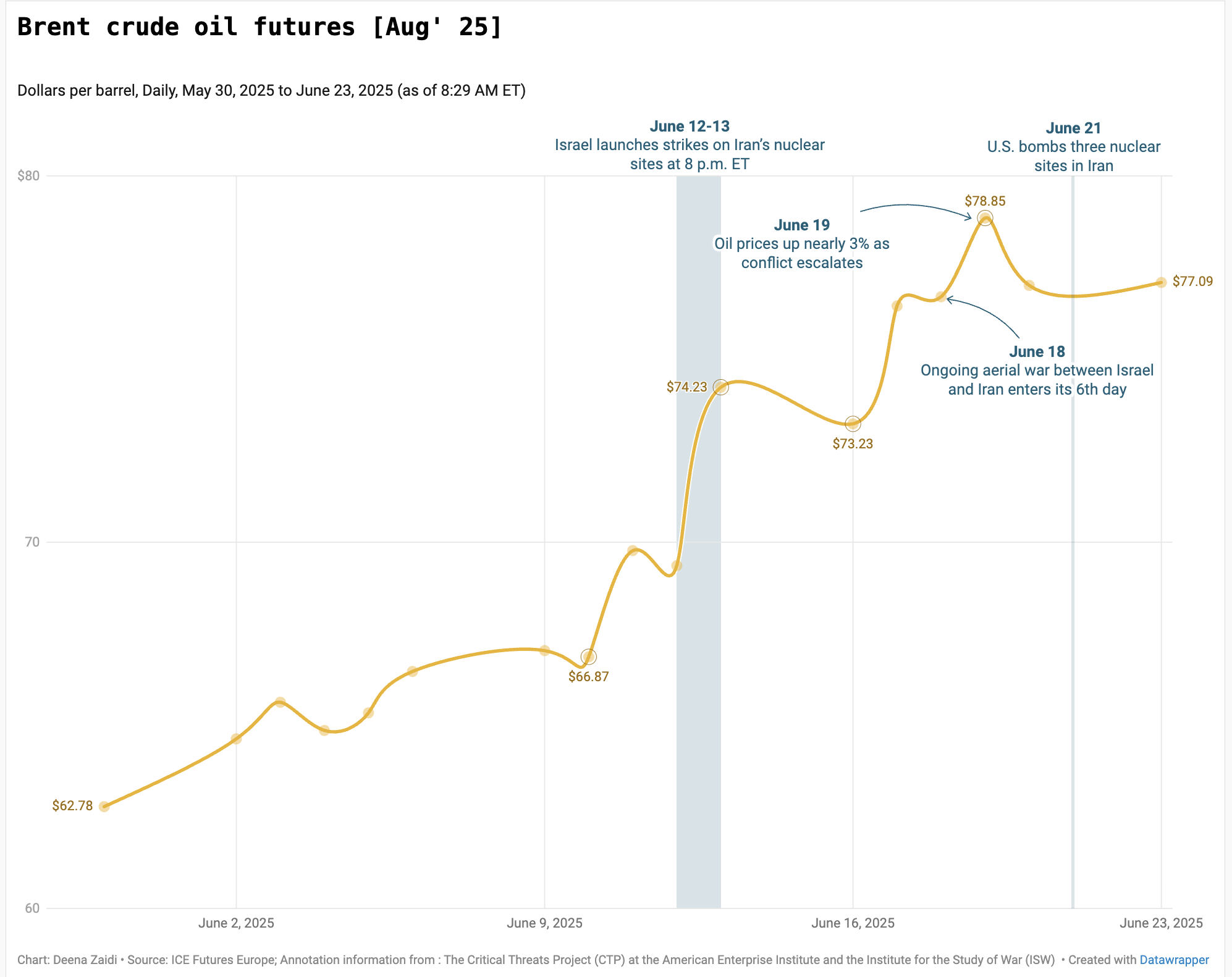

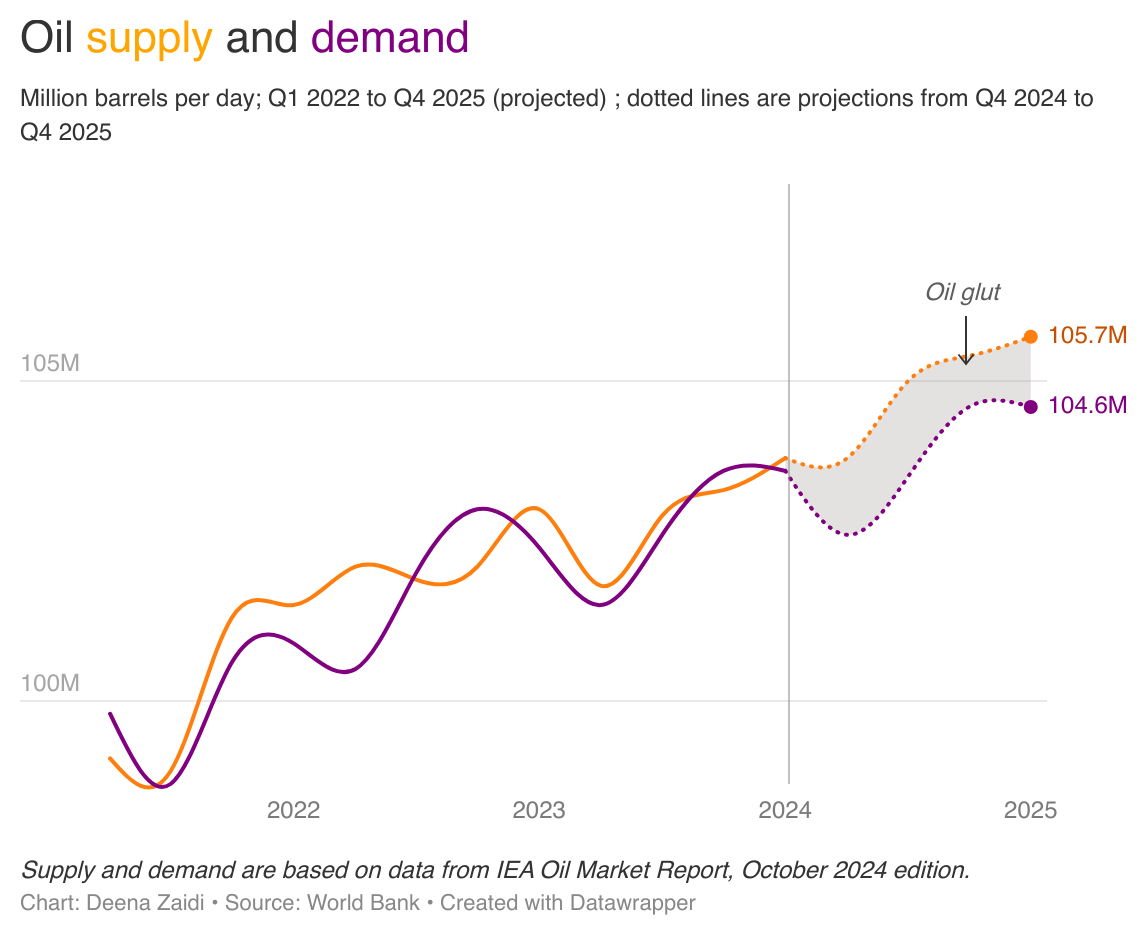

Global commodity prices are set to tumble to a five-year low in 2025 amid an oil glut—so large that it is likely to limit the price effects even of a wider conflict in the Middle East