Foreign investors held $9.2 trillion in U.S. Treasuries as of October, up 6% from $8.7 trillion a year earlier, according to the recent Treasury International Capital (TIC) data from the U.S. Department of the Treasury

That growth comes as the U.S. national debt climbed to roughly $38.3 trillion, underscoring the continued role of overseas buyers in financing U.S. borrowing.

While total foreign holdings of U.S. securities rose 7% from January to October, the gains were unevenly distributed across countries.

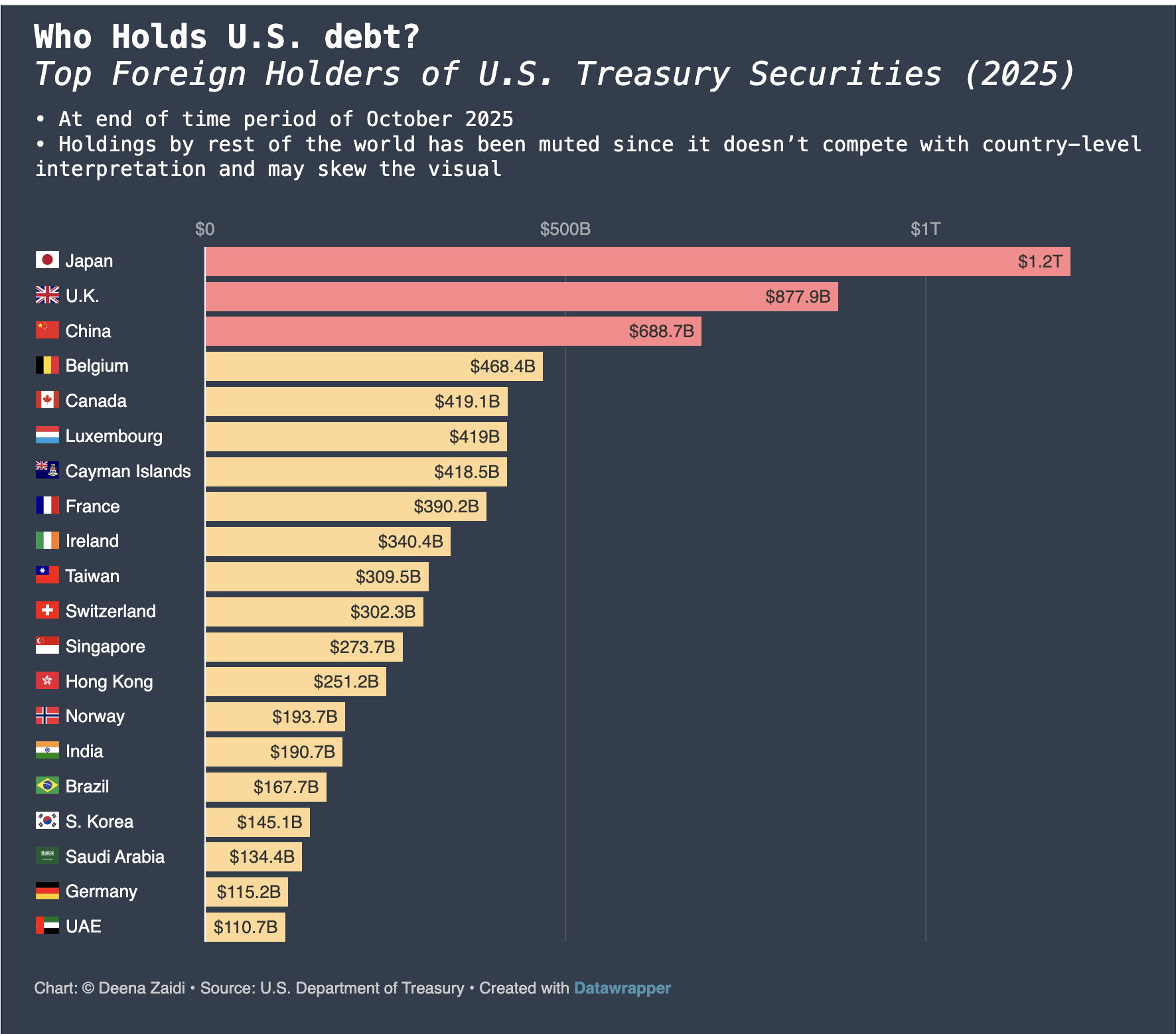

Belgium emerged as one of the most aggressive buyer this year, increasing its holdings by 24% since January —the largest percentage increase among major foreign holders.

As of October 2025, Japan remained the largest foreign holder in October, with holdings of about $1.2 trillion followed closely by the U.K. at roughly $878 billion

Countries that have gradually added to their U.S. Treasury positions over the past one year include the United Arab Emirates (UAE), Canada, South Korea and France

At the same time, several major economies have been moving in the opposite direction such as China , India and Brazil—all members of the BRICS bloc. They have reduced their U.S. Treasury holdings, continuing a longer-term trend away from U.S. government debt.

China’s holdings fell to about $689 billion in October, the lowest level reported since November 2008. The decline accelerated during President Trump’s second term, as Beijing continued to diversify its foreign exchange reserves and reduce exposure to U.S. assets.