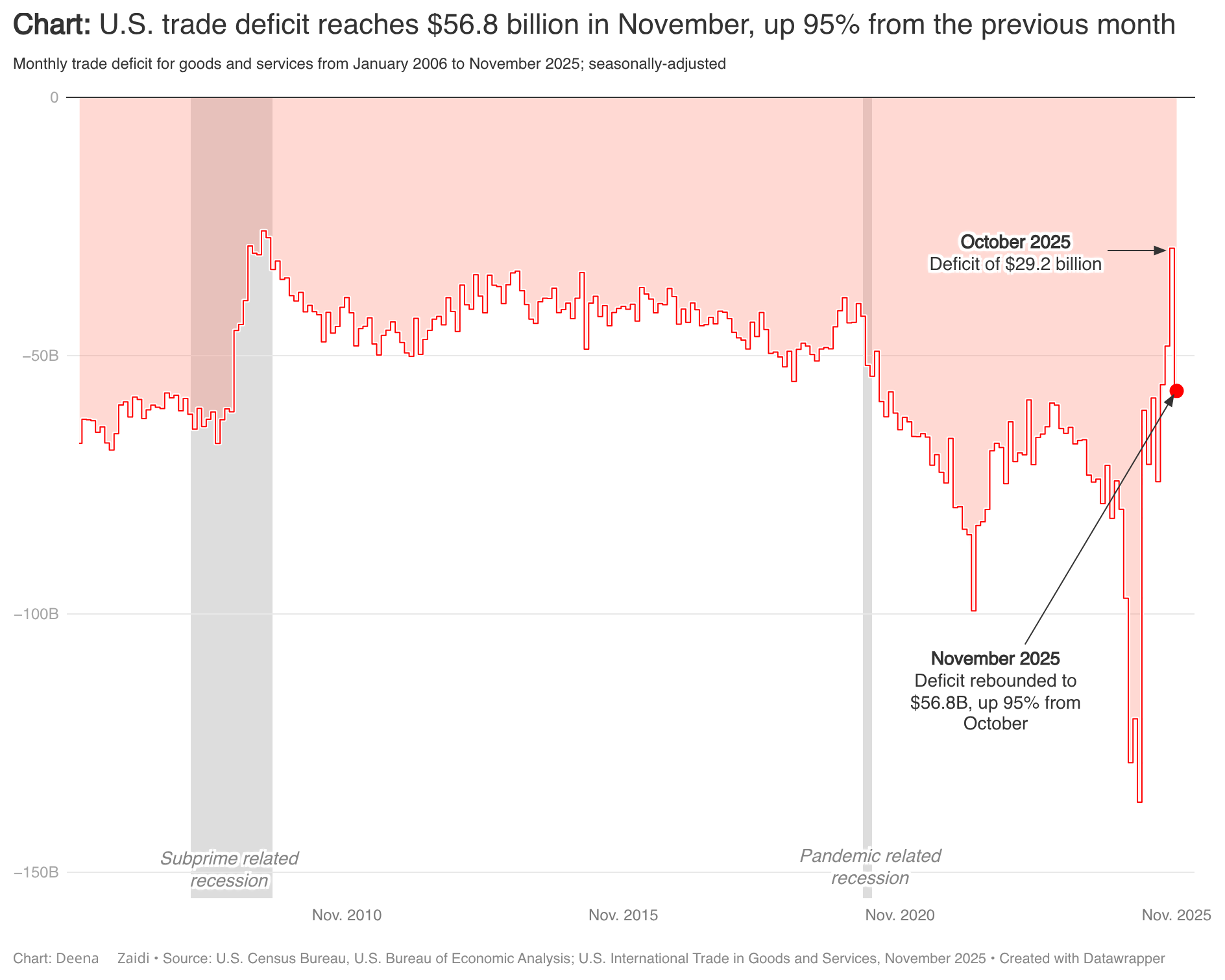

In November 2025, the U.S. goods and services trade deficit nearly doubled compared with October — rising 95% from about $29.2 billion to $56.8 billion.

The tariff volatility is evident in the data released by the Commerce Department on Thursday, where imports to the U.S. rose faster than exports in November.

Early in Mr. Trump’s presidency, firms front-loaded imports to avoid tariffs, driving up imports and the trade deficit. After sweeping global tariffs were announced in April, shipments fell back. Pharmaceuticals and semiconductors also experienced sharp import swings as tariff announcements continued through the year.

Overall, exports of goods and services fell by about $10.9 billion from the previous month, while imports climbed by roughly $16.8 billion.

- A widening trade gap can signal strong domestic demand (since the U.S. bought more foreign goods) but also raises questions about competitiveness and economic balance.

- This jump is especially notable after a much smaller deficit was reported in October — reflecting a quick change in the U.S. trade picture and highlighting the level of volatility after tariff announcement.

- Imports of goods increased $16.8 billion to $272.5 billion in November and for services, imports decreased $0.1 billion to $76.3 billion in November.

- Exports of goods decreased $11.1 billion to $185.6 billion in November, whereas exports of services increased $0.2 billion to $106.4 billion in November.

A widening trade gap can signal strong domestic demand, as the U.S. buys more foreign goods, but it can also raise concerns about competitiveness and external balance.

The November surge is especially notable after October’s unusually small deficit, highlighting how quickly trade dynamics can shift amid tariff-driven uncertainty.