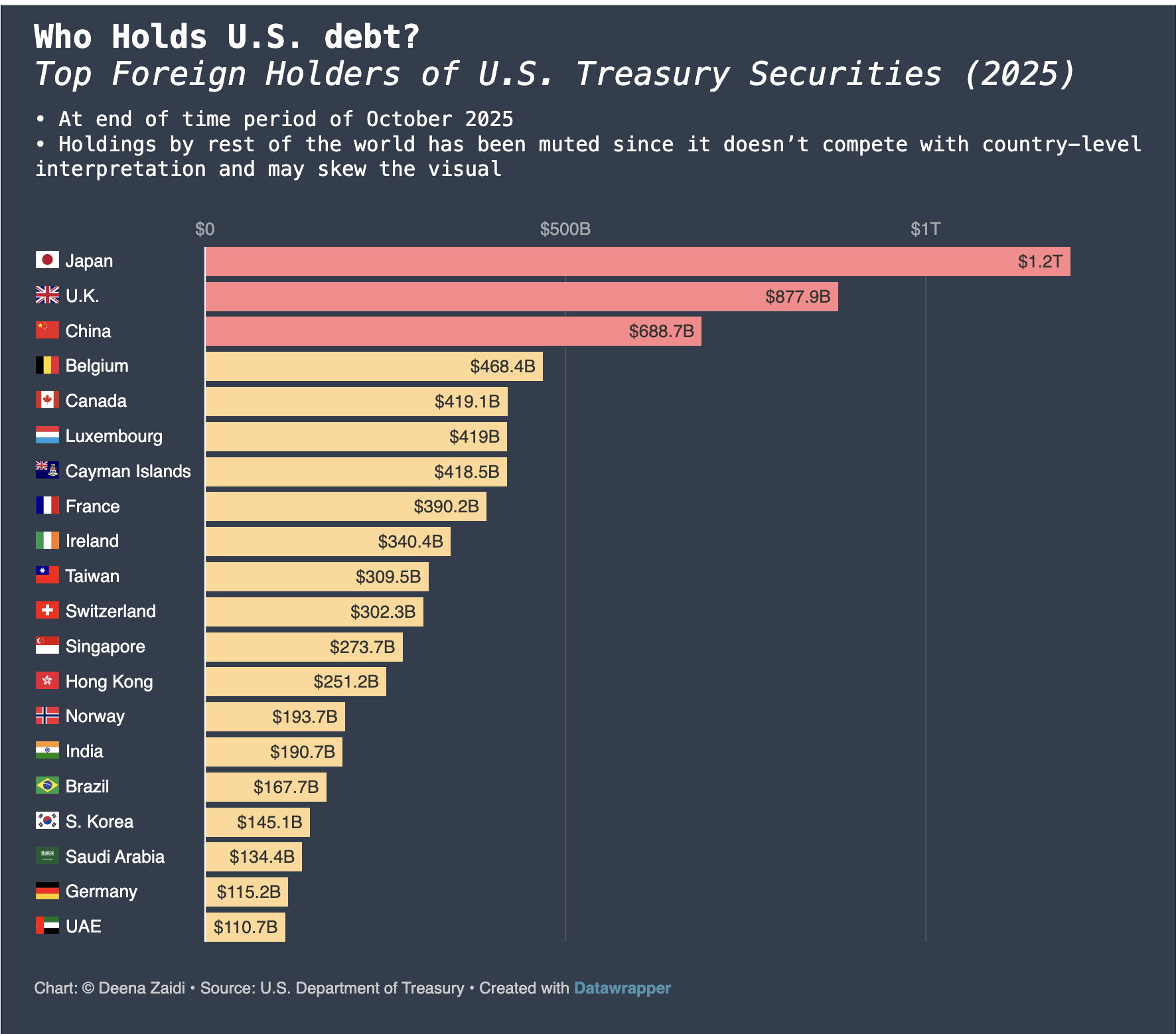

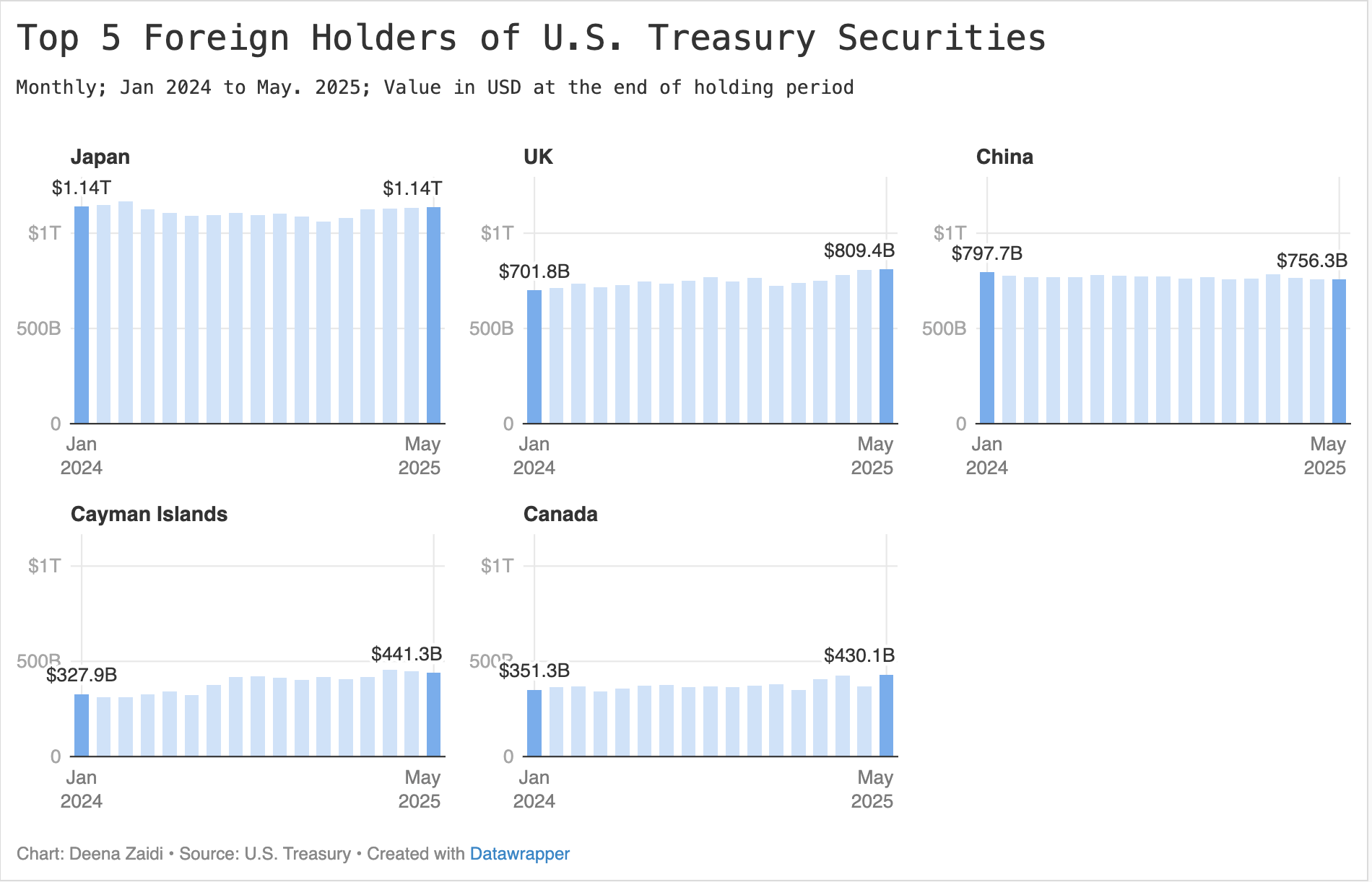

Foreign investors now hold more than $9 trillion in U.S. Treasurys, but growing purchases by advanced economies contrast with pullbacks by China and other emerging markets.

Data & financial journalist covering global economics and policy

Foreign investors now hold more than $9 trillion in U.S. Treasurys, but growing purchases by advanced economies contrast with pullbacks by China and other emerging markets.

Canada’s rapid shift in foreign investment, China’s retreat, and the strong demand from Gulf and European nations capture the shifting alliances and risk appetites. Through 3 charts, I explain who holds America’s IOUs in a time of high deficits and global uncertainty —and how quickly that’s changing.

In Japan, the only Asian economy in G7, core inflation rose at its fastest annual pace in over two years, climbing to 3.5% in April, according to data released Friday. I mapped the inflation (with some caveats) to look at the overall inflation trend in G7 economies.

On April 2, dubbed “Liberation Day” by President Trump, the U.S. will impose new “reciprocal” tariffs on imports, escalating trade tensions with key partners.

While countries like China, Mexico, and Canada are already expected to be hit hardest, many European and Asian economies will likely see a huge impact, prompting global warnings of retaliation, trade wars and a global economic slowdown.