The story has been updated with recent tariff news and new AI partnerships as of Oct. 31, 2025

The Korean government, through the Ministry of Science and ICT, is investing heavily in sovereign AI infrastructure with over 50k of the latest NVIDIA GPUs to be deployed across the National AI Computing Center and Korean cloud service and IT providers NHN Cloud, Kakao Corp. and NAVER Cloud.

Result- major companies now will be stepping up their AI game in partnership with Nvidia and boosting the latter’s market valuation and more dependance.

The story so far: With Chinese firms scaling and a looming U.S. tariff uncertainty, Nvidia is now fighting to keep its foothold in China.

- Nvidia’s stock climbed after President Trump signaled potential relief from U.S. export curbs that have weighed on the company’s China sales.He said he may raise the issue of Nvidia’s Blackwell AI processors during his upcoming meeting with Chinese President Xi on Thursday.

- Nvidia’s graphics processing units (GPUs) have helped push the company’s market capitalization to record highs. Nvidia’s stock has rallied to become the first company to surpass a $4 trillion market value.

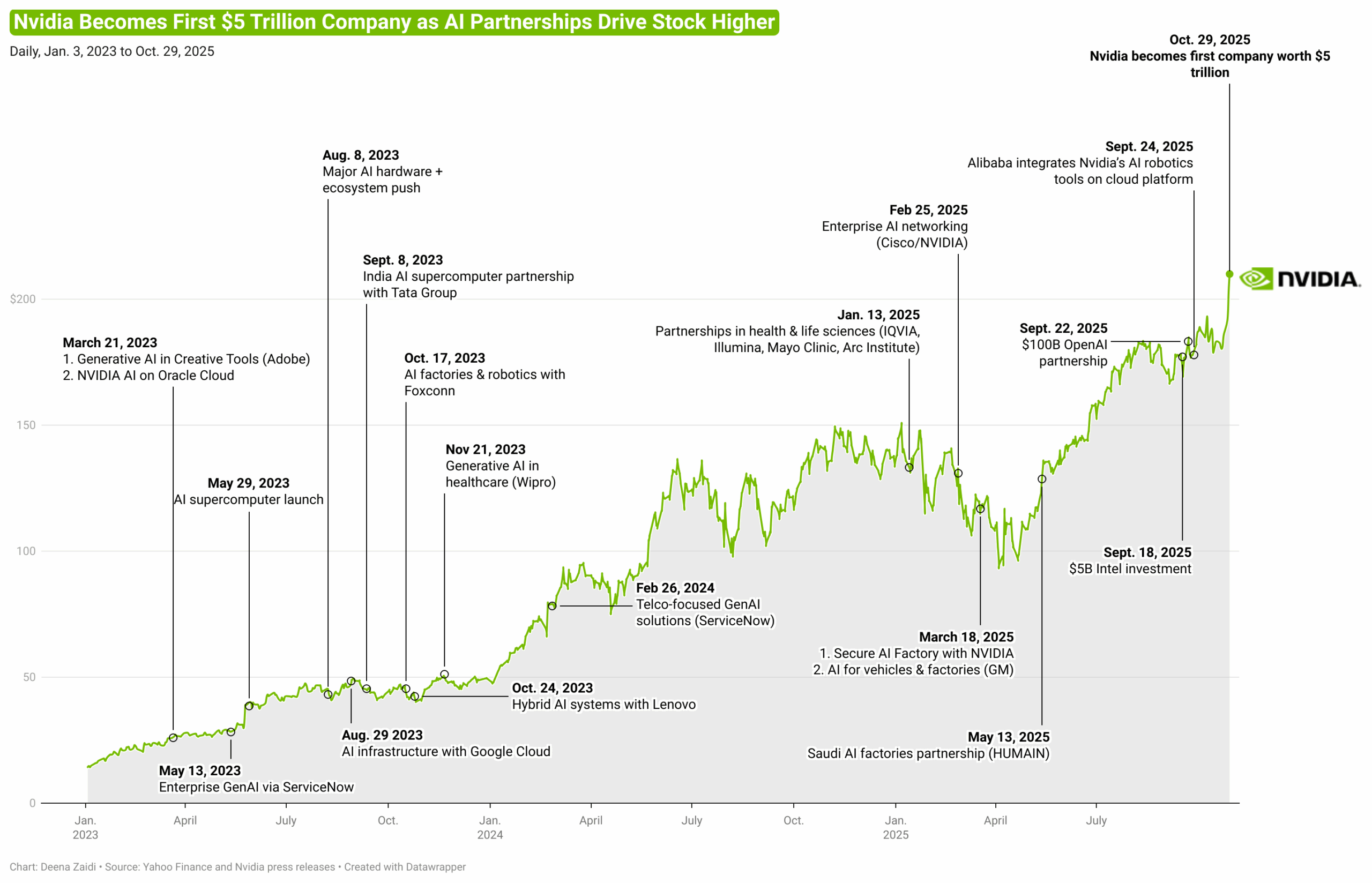

- The gains recently pushed Nvidia’s market valuation to $5 trillion, making it the first company to touch that mark.

- A month ago, speaking on BG2, a podcast hosted by tech investors Brad Gerstner and Bill Gurley, Nvidia CEO Jensen Huang said China is just “nanoseconds behind” the U.S. in chipmaking.

The company has since been developing and deploying AI infrastructure and models through key partnerships- the most recent being with OpenAI.

AI partnerships

Through its AI investments, Nvidia has held the investor confidence.

Recently in the ‘the biggest AI infrastructure deployment in history’, Nvidia partnered with OpenAI to deploy at least 10 gigawatts for OpenAI’s next-gen AI infrastructure.

As a part of the partnership, Nvidia will invest $100 billion to ramp up the computing power of OpenAI.

The companies, in its release, said,

This partnership complements the deep work OpenAI and Nvidia are already doing with a broad network of collaborators, including Microsoft, Oracle, SoftBank and Stargate partners, focused on building the world’s most advanced AI infrastructure.