The interactive chart has been updated to reflect recent changes

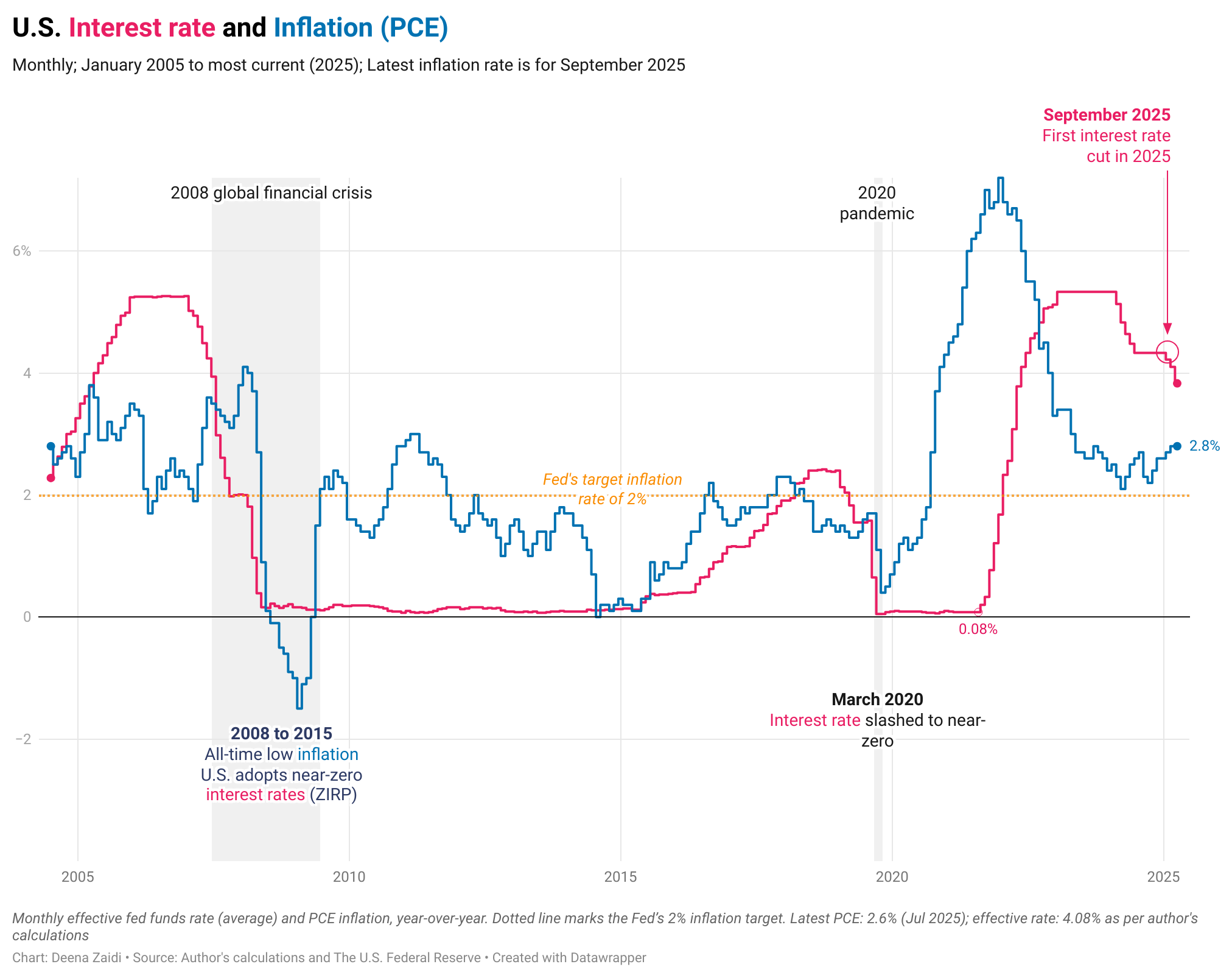

The Federal Reserve slashed its benchmark interest rate for the second time on Wednesday since December 2024 – the second cut during Trump’s second term.

The move lowers the federal funds target range by a quarter percentage point, between 3.75% and 4%.

The Fed has held rates steady in 2025, drawing criticism from the president who vowed to combat inflation in his second term.

Policy makers at the Federal Open Market Committee (FOMC) use interest rates as one of the many monetary policy tools to : stabilize prices around a 2% inflation goal and maximum employment.

While the most recent U.S. personal consumption expenditures (PCE) inflation at 2.8% in September, it still does not meet the 2% inflation target, the cut is largely due to the worrying data around the jobs market. The U.S. economy had added far fewer than expected jobs last month.

But a strong retail sales growth in August, according to data that the Commerce Department released Tuesday. shows that consumer spending had largely held up despite the rise in prices due to tariff risks.

What is the Fed’s 2% inflation target?

- The 2% target inflation is measured by the PCE price index (not CPI)

- Officials also watch core PCE (excludes food and energy) because it is less volatile and a better guide to the price trend.

-

When inflation runs above target, the Fed tends to raise rates; when it runs below or growth weakens, it may lower rates.

What’s next?

- Jobs & wages: A soft payroll or rising unemployment could strengthen the case for further cuts this year.

- Inflation trajectory: If PCE slips closer to 2%, the Fed may maintain an easing bias (but that again that depends on where employment stands in the country)

- Tariffs: Tariff uncertainty could lead to longer periods of price instability, especially in the latter half of 2025 and this could delay cuts

Overall, the net effect depends on scope and timing.

Full Fed transcript