making it the world’s largest data center market by a wide margin

Data centers are the backbone of digital infrastructure, and companies deploy these across the East, Central, and West regions of the country to ensure low latency and reliability.

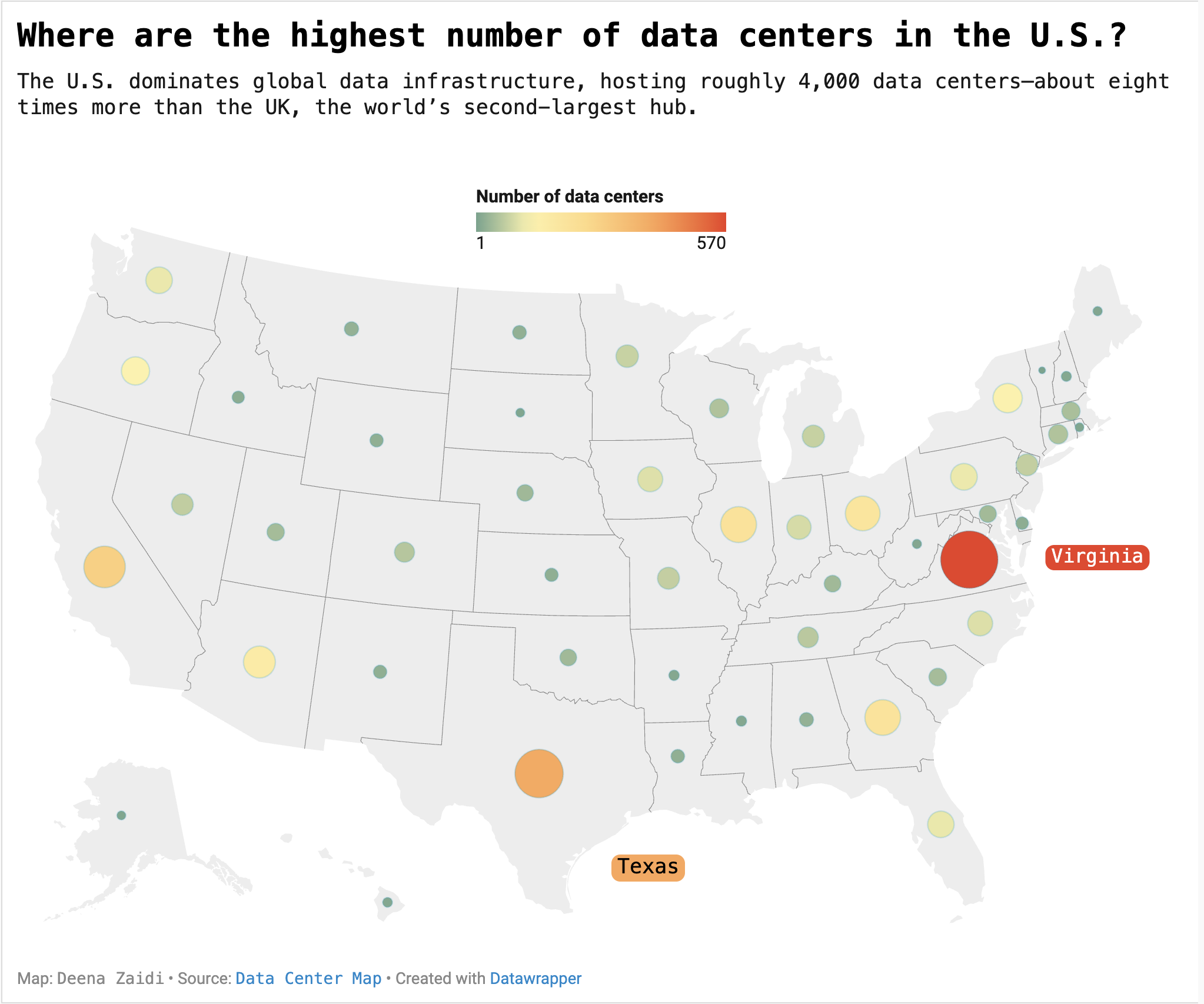

Virginia remains the dominant hub with a total of 570 data centers, including 128 in Ashburn. Northern Virginia has served as the industry’s central hub for more than 15 years, dating back to the early cloud computing days.

But Texas is gaining ground

That’s according to a report from JLL which shows the Lone Star could surpass Virginia by 2030. This year Big Tech which includes Amazon, Microsoft, Google, and Meta announced its plan to spend more than $600 billion on AI infrastructure expansion in 2026.

With power availability, land costs, and incentives driving site selection, Texas — now home to nearly 400 data centers — could emerge as a major growth frontier.

Currently, Dallas alone hosts 177 facilities, more than Ashburn.

Virginia’s dominance in data centers has been a known fact and the state is now planning an elevenfold increase in computing capacity, with nearly 35 gigawatts of projects in development that will help preserve its dominance.

According to JLL’s report, Tennessee, Ohio, Wisconsin, and Texas are now considered the top emerging markets for data centers, and are already capitalizing on abundant energy resources, and ample land availability.

What’s next?

The next wave of data center growth will hinge on power.

In its recent release, the U.S. Energy Information Administration (EIA) forecasts the strongest four-year growth in U.S. electricity demand since 2000, fueled by data centers.

- JLL’s report shows that much of the 35 gigawatts under construction is shifting beyond the traditional hubs as developers chase available electricity, lower costs and faster grid connections.

- With demand still outpacing supply, the race to host AI and cloud infrastructure will increasingly be decided by which regions can deliver reliable energy at scale.